What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currencies with the goal of making a profit from changes in exchange rates. The forex market is the largest and most liquid financial market in the world, boasting a daily trading volume that surpasses $6 trillion. Unlike stock markets, which operate within specific hours, the forex market is open 24 hours a day, five days a week, accommodating traders across various time zones. This extensive operation time allows for continuous trading opportunities, making it accessible for both retail and institutional traders globally.

Forex trading is not only a financial activity but also a critical component of the global economy. It facilitates international trade and investments by enabling businesses and investors to convert one currency into another. For example, a company based in the U.S. that imports goods from Europe will need to exchange dollars for euros to pay for the goods. Similarly, forex trading allows for speculation, where traders attempt to profit from currency fluctuations by predicting movements in exchange rates.

Understanding the Basics of Forex Trading

The forex market, also referred to as the FX market or currency market, is a global decentralized platform where currencies are traded. Unlike stock exchanges, which are centralized and operate within specific geographic regions, the forex market functions over-the-counter (OTC). This means that trading occurs directly between parties, usually through electronic platforms, without a centralized exchange.

Key participants in the forex market include central banks, commercial banks, corporations, and individual traders. Central banks, such as the Federal Reserve or the European Central Bank, influence currency values through their monetary policies and interest rate decisions. Commercial banks facilitate large transactions for their clients, which can include other banks and corporations. Corporations engage in forex trading primarily to hedge against the risks associated with currency fluctuations in their international business dealings. Individual traders, also known as retail traders, participate in the market for speculation or to hedge against currency risks.

How Forex Trading Works

In forex trading, currencies are quoted in pairs, such as EUR/USD or GBP/JPY. Each currency pair consists of a base currency and a quote currency. When a trader buys a currency pair, they are purchasing the base currency and selling the quote currency. Conversely, when they sell a currency pair, they are selling the base currency and buying the quote currency. The price of a currency pair represents the amount of quote currency needed to purchase one unit of the base currency.

For instance, if the EUR/USD pair is quoted at 1.2000, it means that 1 euro is equivalent to 1.2000 U.S. dollars. If a trader believes that the euro will strengthen against the dollar, they would buy the EUR/USD pair. If the euro appreciates and the price rises, the trader can sell the pair at a higher price to make a profit. Conversely, if the trader expects the euro to weaken, they would sell the EUR/USD pair, aiming to buy it back at a lower price.

Forex Trading Platforms

Traders use various platforms to execute forex trades, with popular ones including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms provide essential tools for trading, such as charting capabilities, technical analysis tools, and automated trading features.

MetaTrader 4, for example, offers a wide range of charting tools and technical indicators, making it a favorite among many traders. MetaTrader 5, the successor to MT4, includes additional features such as more timeframes and an economic calendar. cTrader is known for its advanced charting tools and ease of use, appealing to both novice and experienced traders. All these platforms support automated trading through Expert Advisors (EAs), which allow traders to set predefined criteria for executing trades automatically.

Fundamental Analysis in Forex Trading

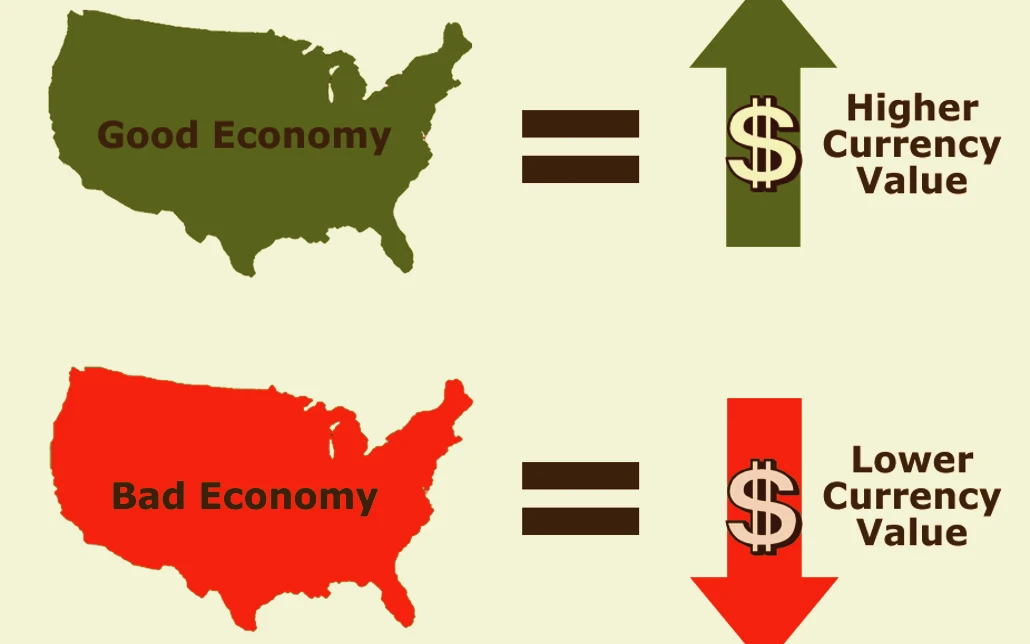

Economic Indicators and Their Impact

Fundamental analysis involves evaluating economic indicators to predict currency movements. Key indicators include:

- Gross Domestic Product (GDP): Measures the economic output of a country.

- Unemployment Rates: High rates can weaken a currency.

- Inflation Rates: High inflation often leads to currency depreciation.

- Interest Rates: Central banks use interest rates to control inflation and stabilize the currency.

Central Bank Policies

Central banks play a crucial role in the forex market. Their policies on interest rates, inflation, and money supply can significantly impact currency values.

Examples of Central Bank Actions:

- Federal Reserve (Fed): Decisions on interest rates impact the USD.

- European Central Bank (ECB): Influences the euro through monetary policy.

- Bank of Japan (BoJ): Affects the yen through interventions and policy adjustments.

Geopolitical Events

Geopolitical events, such as elections, wars, and trade disputes, can cause significant volatility in the forex market. Traders must stay informed about global news and understand its potential impact on currency movements.

Notable Geopolitical Events:

- Brexit: Caused significant fluctuations in the value of the British pound (GBP).

- US-China Trade War: Affected the value of the USD and the Chinese yuan (CNY).

- Elections: Political instability can lead to currency depreciation.

Technical Analysis in Forex Trading

Chart Patterns

Technical analysis involves studying price charts to identify patterns and predict future movements. Common chart patterns include:

- Head and Shoulders: Indicates a trend reversal.

- Double Top and Double Bottom: Signals potential reversal points.

- Triangles: Continuation patterns that indicate the direction of the trend.

Example of a Head and Shoulders Pattern:

| Left Shoulder | Head | Right Shoulder |

|---|---|---|

| Higher High | Peak | Lower High |

Technical Indicators

Technical indicators help traders analyze price data and make informed trading decisions. Popular indicators include:

- Moving Averages: Show the average price over a specific period.

- Relative Strength Index (RSI): Measures the strength and speed of price movements.

- Bollinger Bands: Indicate volatility and potential reversal points.

Example of RSI Calculation:

| Time Period | Closing Price | Gain | Loss | Average Gain | Average Loss | RSI |

|---|---|---|---|---|---|---|

| 1 | 100 | – | – | – | – | – |

| 2 | 102 | 2 | 0 | 2 | 0 | 100 |

| 3 | 101 | 0 | 1 | 1 | 0.5 | 66.67 |

Support and Resistance Levels

Support and resistance levels are critical in technical analysis. These levels indicate where a currency pair may find support as it falls or face resistance as it rises.

- Support Level: A price level where a currency tends to find buying interest.

- Resistance Level: A price level where a currency tends to find selling interest.

Example of Support and Resistance:

| Level Type | Price Level |

|---|---|

| Support | 1.2000 |

| Resistance | 1.2500 |

Forex Trading Strategies

Scalping

Scalping is a short-term trading strategy aimed at making small profits from minor price movements. Scalpers execute numerous trades throughout the day, often holding positions for just a few seconds or minutes.

Characteristics of Scalping:

- High Frequency: Multiple trades in a short time.

- Small Profits: Aiming for small gains per trade.

- Quick Decision Making: Requires fast execution and analysis.

Day Trading

Day trading involves opening and closing positions within the same trading day. Day traders capitalize on intraday price movements and avoid overnight exposure to risk.

Key Aspects of Day Trading:

- Intraday Focus: All positions are closed before the market closes.

- Technical Analysis: Heavy reliance on charts and indicators.

- Risk Management: Use of stop-loss and take-profit orders.

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term market movements. Swing traders aim to profit from price swings in the market.

Features of Swing Trading:

- Longer Holding Period: Positions held for days or weeks.

- Combines Analysis: Uses both technical and fundamental analysis.

- Less Intensive: Requires less time compared to day trading.

Position Trading

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This approach is based on thorough fundamental analysis and aims to profit from long-term trends.

Attributes of Position Trading:

- Long-Term Perspective: Focus on major trends.

- Fundamental Analysis: Strong emphasis on economic indicators and news.

- Lower Frequency: Fewer trades, but larger positions.

Managing Risks in Forex Trading

Leverage and Margin

Leverage allows traders to control large positions with a small amount of capital. While leverage can amplify profits, it also increases the risk of significant losses. Margin is the collateral required to open a leveraged position.

Example of Leverage:

| Leverage Ratio | Control Amount | Required Margin |

|---|---|---|

| 50:1 | $50,000 | $1,000 |

| 100:1 | $100,000 | $1,000 |

Stop-Loss and Take-Profit Orders

Stop-loss orders automatically close a position at a predetermined price to limit losses. Take-profit orders close a position at a predetermined price to secure profits.

Example of Stop-Loss and Take-Profit:

| Order Type | Entry Price | Stop-Loss Price | Take-Profit Price |

|---|---|---|---|

| Buy | 1.2500 | 1.2400 | 1.2600 |

| Sell | 1.2500 | 1.2600 | 1.2400 |

Risk Management Techniques

Effective risk management is crucial in forex trading. Techniques include:

- Position Sizing: Determining the appropriate amount of capital to risk on a trade.

- Diversification: Spreading investments across different currency pairs.

- Risk-Reward Ratio: Evaluating the potential reward against the potential risk.

Example of Risk-Reward Ratio:

Example of Risk-Reward Ratio:

| Trade | Potential Risk | Potential Reward | Risk-Reward Ratio |

|---|---|---|---|

| Trade A | $100 | $300 | 1:3 |

| Trade B | $200 | $400 | 1:2 |

Forex Trading Psychology

Emotional Discipline

Emotional discipline is vital for successful trading. Traders must control their emotions, such as fear and greed, to make rational decisions.

Common Emotions in Trading:

- Fear: Can lead to premature exits or missed opportunities.

- Greed: Can result in overtrading and excessive risk-taking.

Developing a Trading Plan

A trading plan outlines a trader’s strategy, risk management rules, and goals. It serves as a roadmap to guide trading decisions and maintain consistency.

Components of a Trading Plan:

- Strategy: Defines the approach and methods used.

- Risk Management: Sets rules for managing risk.

- Goals: Establishes short-term and long-term objectives.

Staying Informed

Successful traders stay informed about market news, economic data, and geopolitical events. Continuous learning and adapting to market conditions are essential.

Resources for Staying Informed:

- News Websites: For real-time updates and analysis.

- Economic Calendars: Track upcoming economic events.

- Trading Forums: Engage with other traders and share insights.

Forex Trading Tools and Resources

Economic Calendars

Economic calendars provide a schedule of important economic events, such as interest rate decisions, employment reports, and GDP releases. Traders use these calendars to anticipate market movements and plan their trades.

Example of an Economic Calendar:

Example of an Economic Calendar:

| Date | Time (GMT) | Event | Currency | Importance |

|---|---|---|---|---|

| 2024-07-15 | 12:30 | US Retail Sales | USD | High |

| 2024-07-16 | 09:00 | German ZEW Economic Sentiment | EUR | Medium |

| 2024-07-17 | 14:00 | Bank of Canada Interest Rate | CAD | High |

Forex News Sites

Staying updated with the latest forex news is crucial for informed trading decisions. Top forex news sites provide real-time updates, analysis, and expert opinions.

Popular Forex News Sites:

- Forex Factory: Comprehensive economic calendar and news updates.

- DailyFX: Market analysis, news, and trading strategies.

- Investing.com: Financial news, analysis, and tools.

Trading Journals

Maintaining a trading journal helps traders track their performance, analyze their trades, and identify areas for improvement. A detailed journal includes entry and exit points, trade rationale, and outcomes.

Example of a Trading Journal Entry:

| Date | Currency Pair | Trade Type | Entry Price | Exit Price | Profit/Loss | Notes |

|---|---|---|---|---|---|---|

| 2024-07-10 | EUR/USD | Buy | 1.1200 | 1.1300 | +100 pips | Followed technical analysis. |

| 2024-07-12 | GBP/USD | Sell | 1.3000 | 1.2950 | +50 pips | Positive economic data. |

The Future of Forex Trading

Technological Advancements

The forex market is continuously evolving with advancements in technology. Automated trading systems, artificial intelligence, and blockchain technology are transforming the way traders interact with the market.

Key Technological Trends:

- Automated Trading: Algorithms execute trades based on predefined criteria.

- AI and Machine Learning: Enhance market analysis and prediction accuracy.

- Blockchain: Ensures secure and transparent transactions.

Regulatory Changes

Regulatory bodies worldwide are implementing new rules to protect traders and ensure market integrity. Understanding these regulations is crucial for compliance and effective trading.

Examples of Regulatory Bodies:

- Commodity Futures Trading Commission (CFTC): Regulates forex trading in the US.

- Financial Conduct Authority (FCA): Oversees forex brokers in the UK.

- Australian Securities and Investments Commission (ASIC): Regulates the Australian forex market.

Global Economic Trends

Global economic trends, such as the rise of emerging markets and changes in international trade policies, will continue to influence the forex market. Traders must adapt to these trends to stay competitive.

Influential Economic Trends:

- Emerging Markets: Increasing influence on global currency flows.

- Trade Agreements: Impact currency values through trade dynamics.

- Globalization: Affects capital flows and currency demand.

Conclusion

Forex trading is a complex but rewarding endeavor that requires a deep understanding of market dynamics, thorough analysis, and disciplined execution. Whether you’re a beginner or an experienced trader, continuously learning and adapting to market conditions is key to success. By leveraging the insights and strategies discussed in this guide, traders can navigate the forex market with confidence and achieve their financial goals.

FAQs

Forex trading, or foreign exchange trading, is the act of buying and selling currencies with the aim of making a profit from changes in exchange rates. It is one of the largest and most liquid financial markets globally, with a daily trading volume of over $6 trillion. The forex market operates 24 hours a day, five days a week, making it accessible to traders from all over the world.

Forex trading involves the simultaneous buying of one currency and selling of another. Currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is called the base currency, and the second is the quote currency. The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency. Traders make a profit by correctly predicting movements in these exchange rates and executing trades accordingly.

Key participants in the forex market include:

Central Banks: Influence currency values through monetary policy and interest rate decisions.

Commercial Banks: Facilitate large-volume transactions and currency exchange for clients.

Corporations: Engage in forex trading to hedge against risks from international business operations.

Individual Traders: Retail traders who speculate on currency movements or hedge against currency risks.

Forex trading platforms are software applications that allow traders to execute trades, analyze markets, and manage their accounts. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms offer various tools for technical analysis, charting, and automated trading through Expert Advisors (EAs).

Fundamental Analysis: Focuses on evaluating economic indicators, central bank policies, and geopolitical events to predict currency movements. Key indicators include GDP, unemployment rates, inflation rates, and interest rates.

Technical Analysis: Involves analyzing price charts and using technical indicators to forecast future market movements. Common techniques include studying chart patterns, moving averages, and oscillators like the Relative Strength Index (RSI).

Leverage allows traders to control a large position with a relatively small amount of capital. For instance, with a leverage ratio of 100:1, you can control $100,000 with only $1,000. Margin is the collateral required to open and maintain leveraged positions. While leverage can amplify profits, it also increases the risk of significant losses.

Stop-Loss Order: Automatically closes a position at a specified price to limit potential losses. For example, if you buy a currency pair at 1.2500 with a stop-loss at 1.2400, the position will be closed if the price drops to 1.2400.

Take-Profit Order: Automatically closes a position at a predetermined price to lock in profits. For example, if you set a take-profit order at 1.2600 for a pair bought at 1.2500, the position will be closed when the price reaches 1.2600.

Common forex trading strategies include:

Scalping: Making small profits from minor price movements by executing many trades throughout the day.

Day Trading: Opening and closing positions within the same trading day to capitalize on intraday price movements.

Swing Trading: Holding positions for several days or weeks to profit from short- to medium-term market swings.

Position Trading: Taking a long-term approach by holding positions for weeks, months, or even years based on fundamental analysis.

Effective risk management techniques include:

Position Sizing: Determining the amount of capital to risk on each trade.

Diversification: Spreading investments across different currency pairs to reduce risk.

Risk-Reward Ratio: Evaluating the potential reward against the potential risk of a trade.

Forex trading psychology is crucial for maintaining emotional discipline. Traders must manage emotions such as fear and greed to make rational decisions and stick to their trading plans. Developing a well-defined trading plan, including strategies and risk management rules, helps in maintaining consistency and avoiding impulsive decisions.

Global economic trends, such as the rise of emerging markets and changes in international trade policies, affect currency values. Emerging markets increasingly influence global currency flows, while trade agreements and globalization impact capital flows and currency demand. Adapting to these trends is crucial for staying competitive in the forex market.

Leave a Reply

Want to join the discussion?Feel free to contribute!