In-Depth Understanding of Global Forex Markets

The foreign exchange market, commonly known as Forex or FX, is the largest and most liquid financial market in the world. It facilitates the trading of currencies between various participants, including banks, financial institutions, corporations, and individual traders. Unlike stock markets, Forex operates without a centralized exchange and is open 24 hours a day, five days a week, due to the global nature of its participants.

Forex trading involves the simultaneous buying of one currency and selling of another, which is why currencies are quoted in pairs. The exchange rate between the two currencies in a pair reflects the value of one currency relative to the other. Major currency pairs, such as EUR/USD and USD/JPY, involve the most traded currencies and thus have the highest liquidity.

Contents

The Importance of the Forex Market

The Forex market plays a crucial role in the global economy. It facilitates international trade and investment by enabling currency conversion. For example, a U.S. company importing goods from Europe will need to exchange U.S. dollars for euros to pay the European supplier. This constant flow of currency exchange underpins global commerce and investment.

Moreover, the Forex market offers opportunities for speculation, allowing traders to profit from fluctuations in exchange rates. Central banks and governments also participate in the Forex market to manage their foreign reserves and influence their currency’s value. These interventions can be part of broader monetary policies aimed at controlling inflation, managing economic growth, and achieving financial stability.

Key Participants in the Forex Market

Several key participants drive the Forex market:

- Commercial Banks: These institutions conduct currency transactions on behalf of their clients and for their proprietary accounts. They are the primary drivers of liquidity in the Forex market.

- Central Banks: Central banks manage national reserves and influence currency values through monetary policies. Their actions can significantly impact exchange rates.

- Corporations: Businesses engage in Forex transactions to manage international trade and investment risks. For instance, a company might hedge against currency risk to protect future revenue streams.

- Retail Traders: Individual investors speculate on currency movements through Forex brokers. While retail trading accounts for a smaller share of the market, it has grown significantly with the advent of online trading platforms.

- Hedge Funds and Investment Managers: These entities use the Forex market to hedge against currency risks and enhance portfolio returns. They often employ sophisticated trading strategies to capitalize on market movements.

How Forex Trading Works

Forex trading involves the simultaneous buying of one currency and selling of another. Each currency pair has a base currency and a quote currency. The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency. For example, in the EUR/USD pair, if the exchange rate is 1.20, it means 1 euro is equivalent to 1.20 U.S. dollars.

Trading in the Forex market can be conducted via spot transactions, forwards, futures, options, and swaps. Spot transactions involve the immediate exchange of currencies at the current market rate. Forward contracts allow participants to lock in an exchange rate for a future date, providing a hedge against currency fluctuations. Futures and options offer standardized contracts for trading currencies at future dates, while swaps involve exchanging cash flows between two parties based on different currencies.

The Mechanics of Forex Trading

Currency Pairs and Quotes

In the Forex market, currencies are always traded in pairs. Each pair consists of a base currency and a quote currency. The price of a currency pair is known as the exchange rate, which shows how much of the quote currency is needed to purchase one unit of the base currency.

For example, in the currency pair EUR/USD, EUR is the base currency, and USD is the quote currency. If the exchange rate for EUR/USD is 1.20, it means that one euro can be exchanged for 1.20 U.S. dollars. Understanding currency pairs and quotes is fundamental for traders as it determines the profit or loss of their trades.

Major, Minor, and Exotic Pairs

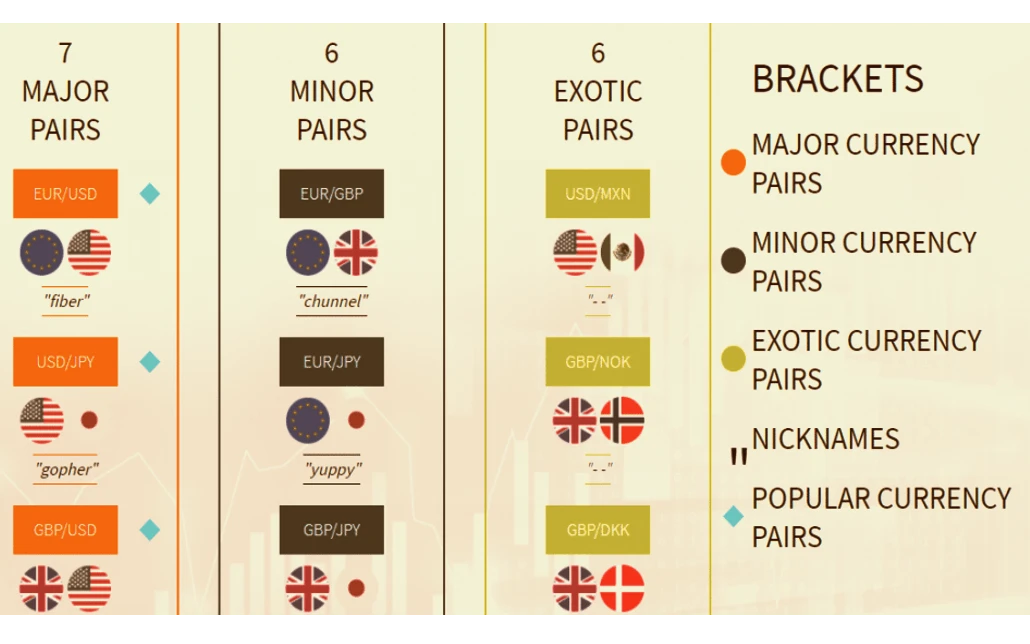

Currency pairs are categorized into three groups: major, minor, and exotic pairs.

- Major Pairs: These involve the most traded currencies and include pairs like EUR/USD, USD/JPY, GBP/USD, and USD/CHF. Major pairs are characterized by high liquidity and lower volatility, making them popular among traders.

- Minor Pairs: Also known as cross-currency pairs, minor pairs do not include the U.S. dollar. Examples include EUR/GBP, EUR/JPY, and GBP/JPY. These pairs have slightly lower liquidity and higher volatility compared to major pairs.

- Exotic Pairs: These involve one major currency and one currency from a developing or smaller economy, such as USD/TRY (U.S. dollar/Turkish lira) or EUR/SGD (euro/Singapore dollar). Exotic pairs tend to have lower liquidity and higher volatility, presenting more risk and opportunity for traders.

| Pair | Base Currency | Quote Currency | Description |

|---|---|---|---|

| EUR/USD | Euro | U.S. Dollar | Most traded currency pair |

| USD/JPY | U.S. Dollar | Japanese Yen | High liquidity and volatility |

| GBP/USD | British Pound | U.S. Dollar | Known as “Cable” |

| USD/CHF | U.S. Dollar | Swiss Franc | Safe-haven pair |

Bid and Ask Prices

Every currency pair in the Forex market has a bid price and an ask price. The bid price is the highest price a buyer is willing to pay for a currency pair, while the ask price is the lowest price a seller is willing to accept. The difference between the bid and ask price is known as the spread.

The spread is a crucial factor for traders as it represents the cost of trading. For highly liquid pairs, the spread is typically lower, while for less liquid pairs, the spread can be wider. Traders must consider the spread when calculating their potential profits and losses.

Leverage and Margin

Leverage allows traders to control a large position with a relatively small amount of capital. It is expressed as a ratio, such as 50:1 or 100:1, indicating how much the trader can borrow against their own capital. For example, with 100:1 leverage, a trader can control a $100,000 position with just $1,000 of their own money.

Margin is the amount of money required to open and maintain a leveraged position. It acts as a security deposit to cover potential losses. While leverage can amplify profits, it also increases the risk of significant losses. Therefore, traders must use leverage cautiously and manage their risk effectively.

Fundamental Analysis in Forex Trading

Economic Indicators

Fundamental analysis in Forex trading involves examining economic indicators to forecast currency movements. Key indicators include:

- Gross Domestic Product (GDP): Measures a country’s economic output and growth.

- Employment Data: Includes unemployment rates and non-farm payrolls, indicating labor market health.

- Inflation Rates: Monitored through Consumer Price Index (CPI) and Producer Price Index (PPI).

- Interest Rates: Set by central banks, influencing currency value through monetary policy.

- Trade Balances: Reflects the difference between a country’s exports and imports.

These indicators provide insights into a country’s economic health and influence currency demand and supply.

| Indicator | Description | Impact on Forex Market |

|---|---|---|

| GDP | Measures economic output and growth | Strong GDP boosts currency value |

| Employment Data | Indicates labor market health | High employment strengthens currency |

| Inflation Rates | Monitors price stability | High inflation can weaken currency |

| Interest Rates | Set by central banks | Higher rates attract foreign investment |

| Trade Balances | Difference between exports and imports | Trade surpluses boost currency value |

Central Bank Policies

Central banks play a pivotal role in the Forex market through their monetary policies. By adjusting interest rates and engaging in open market operations, central banks can influence currency values. For example, a rate hike by the Federal Reserve can strengthen the U.S. dollar by attracting foreign investment seeking higher returns.

Traders closely monitor central bank announcements, meeting minutes, and speeches by key officials to anticipate policy changes. Understanding the relationship between central bank actions and currency movements is essential for successful Forex trading.

Political and Geopolitical Events

Political stability and geopolitical events significantly impact the Forex market. Elections, government policies, trade agreements, and conflicts can cause volatility and shift market sentiment. For instance, Brexit negotiations led to significant fluctuations in the value of the British pound.

Traders need to stay informed about global news and political developments that could affect currency values. Geopolitical risks can create opportunities for profit but also increase uncertainty and risk.

Market Sentiment

Market sentiment refers to the overall mood or attitude of investors towards a particular currency or the market as a whole. It is influenced by economic data, central bank policies, and political events. Positive sentiment can drive currency appreciation, while negative sentiment can lead to depreciation.

Sentiment analysis involves gauging the market’s reaction to news and events. Tools such as the Commitment of Traders (COT) report and sentiment indicators help traders understand the market’s positioning and potential future movements.

Technical Analysis in Forex Trading

Chart Types

Technical analysis involves studying price charts to predict future market movements. The main types of charts used in Forex trading are:

- Line Charts: Simple charts that display the closing prices over a period, providing a clear overview of the trend.

- Bar Charts: Show the open, high, low, and close prices for each period, offering more detail than line charts.

- Candlestick Charts: Similar to bar charts but with a visual representation of bullish (rising) and bearish (falling) periods, making it easier to identify patterns.

Each chart type has its advantages, and traders often use multiple charts to gain a comprehensive view of the market.

Technical Indicators

Technical indicators are mathematical calculations based on price, volume, or open interest data. They help traders identify trends, momentum, volatility, and other market conditions. Common technical indicators include:

- Moving Averages: Smooth out price data to identify the direction of the trend. Examples include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: Consist of a moving average and two standard deviations, indicating volatility and potential reversal points.

- MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages to identify trend changes and momentum.

Traders use a combination of indicators to develop trading strategies and confirm signals.

| Indicator | Description | Use in Trading |

|---|---|---|

| Moving Averages | Smooth out price data to identify trend direction | Identify trend direction and strength |

| Relative Strength Index (RSI) | Measures speed and change of price movements | Identify overbought/oversold conditions |

| Bollinger Bands | Consist of a moving average and two standard deviations | Indicate volatility and reversal points |

| MACD | Shows the relationship between two moving averages | Identify trend changes and momentum |

Support and Resistance Levels

Support and resistance levels are key concepts in technical analysis. Support is a price level where buying interest is strong enough to prevent the price from falling further, while resistance is a level where selling interest is strong enough to prevent the price from rising further.

Identifying these levels helps traders make decisions about entry and exit points. When the price approaches a support level, traders might look for buying opportunities. Conversely, when the price nears a resistance level, traders might consider selling or shorting.

Chart Patterns

Chart patterns are formations created by the price movements on a chart. They provide visual cues about future price direction. Common chart patterns include:

- Head and Shoulders: Indicates a potential reversal of the current trend.

- Double Tops and Bottoms: Suggests a reversal when the price fails to break through previous highs or lows.

- Triangles (Ascending, Descending, Symmetrical): Indicate a continuation or breakout in the direction of the trend.

- Flags and Pennants: Short-term continuation patterns that follow a sharp price movement.

Recognizing and interpreting chart patterns is crucial for making informed trading decisions.

Risk Management in Forex Trading

Importance of Risk Management

Risk management is a critical aspect of Forex trading. It involves identifying, assessing, and prioritizing risks, followed by applying resources to minimize, control, and monitor the impact of unfavorable events. Effective risk management helps traders protect their capital and improve their chances of long-term success.

Without proper risk management, traders can suffer significant losses, even if they have a profitable trading strategy. By managing risk, traders can withstand market volatility and avoid emotional decision-making.

Setting Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for managing risk in Forex trading.

- Stop-Loss Order: This order automatically closes a trade when the price reaches a predetermined level, limiting the trader’s loss. Setting a stop-loss order helps traders protect their capital and avoid emotional trading decisions.

- Take-Profit Order: This order automatically closes a trade when the price reaches a predetermined profit level. It ensures that traders lock in their profits and do not get greedy, which can lead to unnecessary risks.

By using these orders, traders can set predefined risk-reward ratios for their trades and maintain discipline in their trading strategies.

Position Sizing

Position sizing refers to determining the amount of capital to risk on a single trade. It is a crucial aspect of risk management as it directly impacts the potential gain or loss on a trade. Traders should base their position size on their risk tolerance, account size, and the specific trade setup.

A common method for position sizing is the fixed percentage risk model, where traders risk a fixed percentage of their trading capital on each trade. For example, if a trader has a $10,000 account and uses a 2% risk model, they would risk $200 per trade. This approach ensures that no single trade can significantly impact the overall account balance.

Diversification

Diversification involves spreading investments across different assets or markets to reduce risk. In Forex trading, diversification can be achieved by trading multiple currency pairs rather than focusing on a single pair. By doing so, traders can mitigate the impact of adverse movements in any one currency pair.

Additionally, traders can diversify by incorporating different trading strategies, such as trend following, range trading, and scalping. Diversification helps in smoothing out returns and reducing the overall risk of the trading portfolio.

Forex Trading Strategies

Trend Following

Trend following is a popular trading strategy that aims to capitalize on the momentum of an existing trend. Traders using this strategy identify and follow the direction of the prevailing trend, whether it is upward (bullish) or downward (bearish).

Key components of trend following include:

- Moving Averages: Traders use moving averages to identify the direction and strength of a trend. When the price is above the moving average, it indicates an uptrend, and when below, it suggests a downtrend.

- Trendlines: Drawing trendlines on price charts helps traders visualize the trend and identify potential entry and exit points.

- Indicators: Indicators such as the Average Directional Index (ADX) measure the strength of a trend, helping traders confirm their analysis.

Trend following can be highly effective in trending markets but may lead to losses in ranging or choppy markets.

Range Trading

Range trading involves identifying and trading within price ranges, where the currency pair moves between defined support and resistance levels. Traders using this strategy buy at the support level and sell at the resistance level, aiming to profit from price oscillations within the range.

Key elements of range trading include:

- Support and Resistance: Identifying key support and resistance levels is crucial for range trading. These levels act as boundaries for the price range.

- Oscillators: Indicators like the Relative Strength Index (RSI) and Stochastic Oscillator help traders identify overbought and oversold conditions within the range.

- Entry and Exit Points: Traders set buy orders near support levels and sell orders near resistance levels, with stop-loss and take-profit orders to manage risk.

Range trading is effective in markets with low volatility but may lead to losses during strong trends or breakouts.

Breakout Trading

Breakout trading involves identifying key levels of support and resistance and entering trades when the price breaks through these levels. This strategy aims to capture significant price movements following a breakout, which often signals the start of a new trend.

Key components of breakout trading include:

- Identifying Breakout Levels: Traders look for key support and resistance levels where breakouts are likely to occur.

- Volume: Increased trading volume during a breakout confirms the strength of the move.

- Entry and Exit Points: Traders enter trades when the price breaks through a key level and set stop-loss orders to manage risk. Take-profit orders are placed to lock in gains.

Breakout trading can be highly profitable but also involves higher risk, as false breakouts can lead to losses.

Scalping

Scalping is a short-term trading strategy that involves making numerous small trades to capture minor price movements. Scalpers aim to profit from small price changes, often holding positions for just a few seconds to minutes.

Key elements of scalping include:

- High-Frequency Trading: Scalpers make multiple trades throughout the day, seeking small profits from each trade.

- Low Time Frames: Scalping is done on very short time frames, such as 1-minute or 5-minute charts.

- Liquidity: Scalpers prefer highly liquid currency pairs to ensure quick execution of trades.

- Risk Management: Due to the high number of trades, effective risk management is crucial to avoid significant losses.

Scalping requires discipline, quick decision-making, and a robust trading platform to execute trades efficiently.

Psychological Aspects of Forex Trading

The Role of Psychology in Trading

Psychology plays a vital role in Forex trading, as emotional responses can significantly impact trading decisions. Successful traders understand the importance of maintaining a disciplined and rational approach to trading, avoiding emotional pitfalls such as fear, greed, and overconfidence.

- Fear: Fear of losing money can lead to hesitation, missed opportunities, or closing trades prematurely.

- Greed: Greed can cause traders to over-leverage, take unnecessary risks, or hold onto winning trades for too long, hoping for larger profits.

- Overconfidence: Overconfidence can lead to complacency, neglecting risk management, or making impulsive trades.

Recognizing and managing these emotions is crucial for maintaining a consistent and effective trading strategy.

Developing a Trading Plan

A trading plan is a comprehensive guide that outlines a trader’s strategy, risk management rules, and goals. Developing and adhering to a trading plan helps traders stay focused and disciplined, reducing the impact of emotional decision-making.

Key components of a trading plan include:

- Trading Strategy: Define the specific trading strategies and techniques to be used.

- Risk Management: Establish rules for position sizing, stop-loss orders, and take-profit levels.

- Goals: Set realistic and measurable trading goals, such as daily or monthly profit targets.

- Record Keeping: Maintain a trading journal to track performance, analyze trades, and identify areas for improvement.

A well-structured trading plan provides a roadmap for consistent and disciplined trading.

Maintaining Discipline and Patience

Discipline and patience are essential qualities for successful Forex trading. Traders must adhere to their trading plan, even in the face of market volatility or emotional stress. This involves:

- Sticking to the Plan: Follow the rules and guidelines outlined in the trading plan without deviation.

- Avoiding Overtrading: Resist the temptation to make impulsive trades or chase losses.

- Waiting for Setups: Be patient and wait for high-probability trading setups that align with the strategy.

Maintaining discipline and patience helps traders avoid common pitfalls and achieve long-term success.

Learning from Mistakes

Mistakes are an inevitable part of trading, but successful traders view them as learning opportunities. Analyzing and understanding mistakes can help traders improve their strategies and avoid repeating the same errors.

- Reviewing Trades: Regularly review and analyze past trades to identify mistakes and areas for improvement.

- Adjusting Strategies: Make necessary adjustments to the trading plan or strategy based on lessons learned.

- Continuous Learning: Stay informed about market developments, new strategies, and trading techniques.

By learning from mistakes and continuously improving, traders can enhance their performance and increase their chances of success.

Conclusion

The Dynamic Nature of the Forex Market

The Forex market is a dynamic and complex environment that offers numerous opportunities for traders and investors. Understanding the mechanics of Forex trading, fundamental and technical analysis, risk management, and trading psychology is essential for navigating this market effectively. The interplay between economic indicators, central bank policies, political events, and market sentiment creates a constantly evolving landscape that requires traders to stay informed and adaptable.

The Importance of Continuous Learning

Success in the Forex market requires continuous learning and adaptation. Markets evolve, new trading strategies emerge, and global events shape currency movements. Traders who commit to ongoing education, staying updated on market developments, and refining their strategies are better positioned to capitalize on opportunities and manage risks. Resources such as trading courses, webinars, books, and market analysis can provide valuable insights and enhance trading skills.

Developing a Comprehensive Trading Approach

A comprehensive trading approach combines technical and fundamental analysis, effective risk management, and a disciplined mindset. Traders should develop a well-structured trading plan that outlines their strategies, risk tolerance, and goals. Regularly reviewing and adjusting the plan based on performance and market conditions ensures continuous improvement and long-term success. By integrating these elements, traders can navigate the Forex market with confidence and achieve their financial objectives.

FAQs

Forex trading, also known as foreign exchange trading or FX trading, involves the buying and selling of currencies on the global market. Traders aim to profit from changes in currency values, typically by buying one currency while simultaneously selling another. The Forex market is the largest and most liquid financial market in the world, operating 24 hours a day, five days a week.

The Forex market operates through a network of banks, brokers, financial institutions, and individual traders. It is decentralized, meaning there is no central exchange; instead, trading is conducted electronically over-the-counter (OTC). The market is divided into major trading sessions based on global financial centers: the Sydney, Tokyo, London, and New York sessions.

Currency pairs are the cornerstone of Forex trading, representing the value of one currency against another. They are quoted in pairs, such as EUR/USD (Euro/US Dollar). The first currency in the pair is the base currency, and the second is the quote currency. The price of the pair indicates how much of the quote currency is needed to purchase one unit of the base currency.

Major currency pairs: These involve the most traded currencies, such as EUR/USD, USD/JPY, GBP/USD, and USD/CHF. They typically have high liquidity and lower spreads.

Minor currency pairs: These do not include the US Dollar but involve other major currencies like EUR/GBP, GBP/JPY, and EUR/AUD. They have moderate liquidity and spreads.

Exotic currency pairs: These include one major currency and one currency from a smaller or emerging economy, like USD/TRY (US Dollar/Turkish Lira). They generally have lower liquidity and higher spreads.

To start Forex trading, follow these steps:

Education: Learn the basics of Forex trading, including market mechanics, analysis methods, and trading strategies.

Choose a broker: Select a reputable Forex broker that offers a trading platform, educational resources, and good customer support.

Open a trading account: Register for a trading account with your chosen broker.

Fund your account: Deposit funds into your trading account to start trading.

Develop a trading plan: Create a detailed plan outlining your trading strategy, risk management rules, and goals.

Practice with a demo account: Use a demo account to practice trading without risking real money.

Start trading: Begin trading with real money once you feel confident in your strategy and skills.

Leave a Reply

Want to join the discussion?Feel free to contribute!