Algorithmic Trading

Algorithmic trading has reshaped the landscape of financial markets, offering a blend of speed, precision, and efficiency that human traders can hardly match. Yet, as fascinating as this technological revolution is, it also raises questions and challenges that every trader must navigate. In this comprehensive guide, we’ll explore the intricacies of algorithmic trading, diving deep into its mechanisms, strategies, and implications. We’ll also share insights, anecdotes, and real-life experiences to make the content engaging and relatable. Whether you’re a seasoned trader or just dipping your toes into the world of finance, this guide will provide you with valuable knowledge and a few thought-provoking questions to ponder.

Contents

- What Is Algorithmic Trading?

- How Algorithmic Trading Works

- The Human Element: Navigating the Challenges

- The Evolution of Trading Strategies

- High-Frequency Trading (HFT)

- Mathematical Model-Based Strategies

- The Regulatory Landscape

- The Future of Algorithmic Trading

- Getting Started with Algorithmic Trading

- Tables and Data Interpretation

- FAQs

- Conclusion: The Journey Ahead

What Is Algorithmic Trading?

Algorithmic trading, often referred to as algo-trading, automated trading, or black-box trading, is a method of executing trades using a computer program that follows a defined set of instructions, or algorithms. These algorithms can be based on various factors such as price, timing, volume, or even complex mathematical models. The ultimate goal is to execute trades that can potentially generate profits at speeds and frequencies that are beyond the reach of human traders.

Why Is Algorithmic Trading So Popular?

It’s not just about speed—though the ability to execute trades in microseconds is certainly part of the appeal. Algorithmic trading eliminates emotional biases that often plague human traders. Have you ever hesitated to buy a stock because it felt “too risky” or held onto a losing position out of stubbornness? Algorithms don’t suffer from these human weaknesses. They follow their programmed instructions without wavering, ensuring a disciplined approach to trading.

Moreover, algorithmic trading allows for the systematic execution of trades across multiple markets and instruments, a feat that would be nearly impossible for an individual trader to manage manually. Imagine trying to track dozens of stocks across multiple exchanges, each with its own opening hours and currency pairs—exhausting, right? But for an algorithm, it’s all in a day’s work.

The Evolution of Algorithmic Trading

Algorithmic trading isn’t a new concept; its roots trace back to the 1970s when computerized trading systems were first introduced. Over the decades, as technology advanced, so did the complexity and capabilities of these trading algorithms. Today, algorithmic trading accounts for a significant portion of trading volumes across major financial markets.

Consider the New York Stock Exchange, which introduced electronic trading in the 1970s. Back then, trades were still largely manual, with brokers shouting orders on the trading floor. Fast forward to today, and more than 60% of all trades on the NYSE are executed by computers. The transition from human to machine has been both gradual and revolutionary, reflecting broader trends in technology and finance.

How Algorithmic Trading Works

At its core, algorithmic trading involves automating the process of analyzing market data and executing trades based on predefined criteria. But how does this actually work in practice? Let’s break it down.

The Building Blocks of an Algorithm

Algorithms are essentially a set of rules or instructions that the computer program follows to make trading decisions. These rules can be as simple as “buy 100 shares of stock XYZ when its price drops below $50” or as complex as “buy 100 shares of stock XYZ when its 50-day moving average crosses above its 200-day moving average, provided the relative strength index (RSI) is below 30.”

The beauty of algorithmic trading lies in its flexibility. You can design an algorithm to fit virtually any trading strategy, from trend-following to arbitrage. Once the algorithm is programmed, it continuously monitors the market, waiting for the conditions specified in its rules to be met. When they are, it automatically executes the trade—no human intervention required.

Real-Life Example: Moving Average Crossover Strategy

Let’s consider a simple yet effective strategy called the moving average crossover. Suppose you decide to use a 50-day moving average (a short-term trend indicator) and a 200-day moving average (a long-term trend indicator). The strategy is straightforward: buy when the 50-day moving average crosses above the 200-day moving average (a bullish signal) and sell when it crosses below (a bearish signal).

Here’s how an algorithm would handle this:

- Monitor Prices: The algorithm continuously tracks the stock’s price data, calculating the 50-day and 200-day moving averages.

- Detect Crossover: When the 50-day moving average rises above the 200-day moving average, the algorithm identifies a crossover.

- Execute Trade: The algorithm automatically places a buy order for the stock. If the crossover is downward, it triggers a sell order.

This strategy doesn’t require any predictive analytics—it’s purely reactive. The algorithm waits for the market to show its hand before making a move. And because it’s automated, the trade is executed instantly, capitalizing on the opportunity without delay.

Advantages of Algorithmic Trading

- Speed: Algorithms can execute trades in milliseconds, capitalizing on fleeting opportunities.

- Precision: They follow predefined rules to the letter, eliminating the risk of human error.

- Backtesting: Before going live, algorithms can be tested on historical data to gauge their effectiveness.

- Reduced Costs: Automation reduces the need for human intervention, potentially lowering transaction costs.

- Emotion-Free Trading: Algorithms operate without fear or greed, ensuring disciplined execution.

Disadvantages of Algorithmic Trading

- Technology Dependence: If the system fails, trades may not be executed as planned, leading to potential losses.

- Latency Issues: Delays in trade execution can result in missed opportunities.

- Over-Optimization: There’s a risk of creating an algorithm that performs well on historical data but fails in live markets.

- Market Impact: Large algorithmic trades can influence market prices, sometimes causing unintended consequences.

Despite the many advantages of algorithmic trading, it’s not without its challenges. And this is where the human element comes in. As much as we’d like to believe that algorithms are infallible, the reality is that they are only as good as the humans who design and manage them.

Anecdote: The Flash Crash of 2010

One of the most famous examples of algorithmic trading gone awry is the Flash Crash of May 6, 2010. On that day, the Dow Jones Industrial Average plunged nearly 1,000 points in just minutes, only to recover most of the losses within the hour. The cause? A single large sell order executed by an algorithm, which triggered a cascade of automated selling across the market.

This incident highlights a critical point: while algorithms can process information at lightning speed, they can also amplify market movements in unpredictable ways. In the case of the Flash Crash, the algorithms didn’t have the human ability to pause and assess the situation—they just followed their programmed instructions to sell, sell, sell.

The Importance of Human Oversight

So, does this mean that algorithmic trading is inherently risky? Not necessarily. But it does underscore the importance of human oversight. Algorithms are powerful tools, but they require careful monitoring and adjustment. Traders need to be vigilant, ready to intervene if an algorithm starts behaving unexpectedly.

It’s also important to remember that markets are dynamic and complex. No algorithm can account for every possible variable, which is why experienced traders often combine algorithmic strategies with their own market intuition and expertise.

The Evolution of Trading Strategies

The strategies used in algorithmic trading have evolved significantly over the years. From simple trend-following to complex arbitrage, there’s a strategy for almost every market condition. Let’s explore some of the most popular ones.

Trend-Following Strategies

Trend-following is one of the most straightforward algorithmic trading strategies. It involves buying assets that are trending upwards and selling those that are trending downwards. The key indicators used in these strategies are moving averages, channel breakouts, and price level movements.

Moving Average Strategies

The moving average is a popular technical indicator that smooths out price data to create a single flowing line. This line represents the average price of an asset over a specified period. Traders often use moving averages to identify trends and potential entry or exit points.

For example, a common trend-following strategy is to use the 50-day and 200-day moving averages. When the 50-day moving average crosses above the 200-day moving average, it’s seen as a bullish signal, indicating that the asset is likely to continue rising. Conversely, when the 50-day moving average crosses below the 200-day moving average, it’s considered a bearish signal.

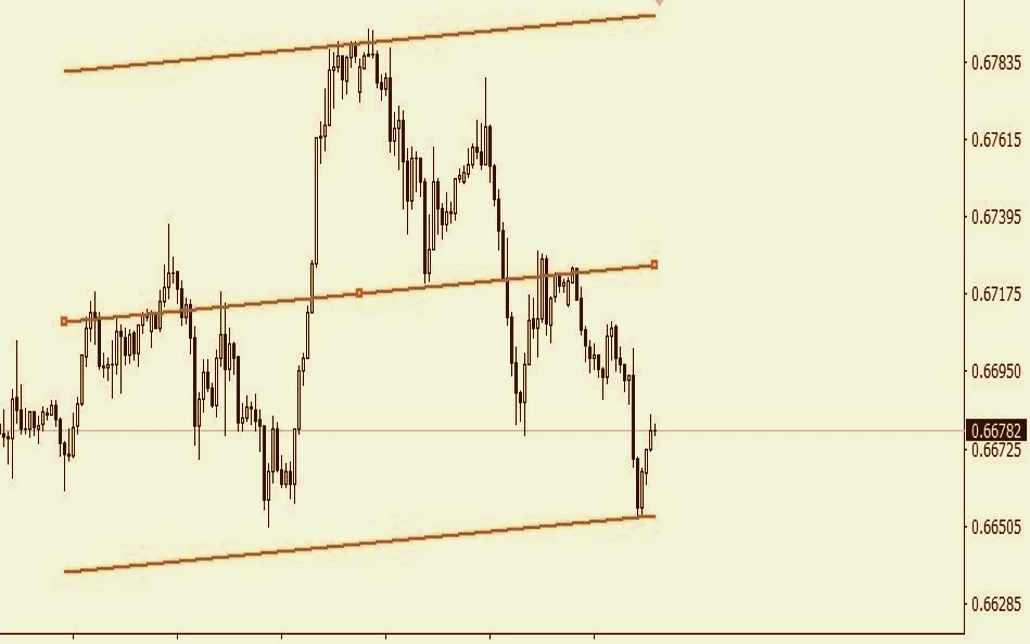

Channel Breakout Strategies

Channel breakout strategies involve identifying the upper and lower boundaries of a trading range. When the price breaks out of this channel, it signals a potential trend. Algorithms can be programmed to buy when the price breaks above the upper boundary and sell when it breaks below the lower boundary.

Arbitrage Opportunities

Arbitrage is a strategy that involves exploiting price differences between markets or instruments. In its simplest form, arbitrage involves buying an asset in one market where the price is lower and simultaneously selling it in another market where the price is higher.

Real-Life Example: Currency Arbitrage

Let’s say you notice that the exchange rate for EUR/USD is 1.2000 on one platform and 1.2010 on another. An algorithm could be designed to buy euros on the cheaper platform and sell them on the more expensive one, locking in a risk-free profit.

However, arbitrage opportunities are usually fleeting and require lightning-fast execution. This is where algorithmic trading truly shines. By automating the process, traders can capitalize on these opportunities before they disappear.

Index Fund Rebalancing

Index funds periodically rebalance their portfolios to align with their benchmark indices. This rebalancing creates opportunities for algorithmic traders, who can anticipate the trades that the index funds will make and position themselves accordingly.

Exploiting Rebalancing Opportunities

For example, if an index fund needs to buy a large quantity of a particular stock to match its benchmark, this buying pressure is likely to drive the stock’s price up. An algorithm could be designed to buy the stock in anticipation of this move, and then sell it after the price has risen.

This strategy requires a deep understanding of the timing and methodology of index fund rebalancing, but it can be highly profitable if executed correctly.

High-Frequency Trading (HFT)

High-frequency trading (HFT) is a subset of algorithmic trading that focuses on executing a large number of orders at extremely high speeds. HFT algorithms are designed to capitalize on small price discrepancies that exist for only fractions of a second.

How HFT Works

HFT firms use sophisticated algorithms and powerful computer systems to execute trades at lightning speed. These firms often colocate their servers near the exchanges to minimize latency—the time it takes for data to travel between the server and the exchange.

The goal of HFT is to capture small profits on each trade, but do so at such high volumes that the profits add up. For example, an HFT algorithm might buy a stock for $50.01 and sell it for $50.02, making a profit of just one cent per share. But if it can do this millions of times a day, the profits quickly accumulate.

The Controversy Around HFT

HFT is a highly controversial topic in the world of finance. Proponents argue that HFT provides liquidity to the markets and reduces trading costs for all participants. Critics, on the other hand, argue that HFT can increase market volatility and create an uneven playing field where only the fastest traders can succeed.

There’s also the question of fairness. Is it fair that HFT firms can profit from tiny price discrepancies that last only microseconds, while slower traders are left in the dust? It’s a debate that has yet to be fully resolved.

Anecdote: The Rise of Flash Boys

In his book Flash Boys, author Michael Lewis chronicles the rise of HFT and the traders who built the infrastructure that makes it possible. One of the key takeaways from the book is the lengths to which HFT firms will go to gain even the slightest speed advantage, including laying fiber-optic cables through mountains to shave milliseconds off their trade times.

The book sparked a public outcry and led to calls for greater regulation of HFT. It also highlighted the often unseen impact that these ultra-fast trades can have on the broader market.

Mathematical Model-Based Strategies

Mathematical models are the backbone of many algorithmic trading strategies. These models use statistical methods and historical data to predict future price movements and optimize trading decisions.

Delta-Neutral Trading

One popular mathematical model-based strategy is delta-neutral trading. This strategy involves creating a portfolio of positions that offset each other’s price movements, resulting in a net delta of zero. Delta is a measure of how much the price of an option is expected to move in relation to the price of the underlying asset.

By maintaining a delta-neutral portfolio, traders can profit from changes in the volatility or time decay of the options, without being exposed to the directional risk of the underlying asset.

Mean Reversion

Mean reversion is another mathematical model-based strategy that assumes that prices will revert to their historical mean over time. The idea is that if an asset’s price deviates significantly from its historical average, it’s likely to move back towards the mean.

Algorithms can be programmed to buy when prices are below the mean and sell when they are above, capitalizing on these reversionary movements.

The Role of Quants in Algorithmic Trading

The development of these mathematical models is often the domain of quantitative analysts, or quants. Quants have backgrounds in mathematics, physics, or computer science, and they use their expertise to develop complex models that can identify trading opportunities.

Anecdote: From Academia to Wall Street

Many quants started their careers in academia, conducting research on topics like fluid dynamics or statistical mechanics. But the allure of Wall Street, with its high salaries and the challenge of solving real-world problems, drew them into the world of finance.

One such story is that of Emanuel Derman, a physicist who became a quant at Goldman Sachs and co-developed the famous Black-Derman-Toy interest rate model. Derman’s transition from the theoretical world of physics to the fast-paced world of finance is a testament to the interdisciplinary nature of algorithmic trading.

The Regulatory Landscape

Algorithmic trading operates in a complex regulatory environment, with rules varying by country and market. These regulations are designed to ensure market stability, protect investors, and prevent market manipulation.

Key Regulations

In the United States, algorithmic trading is regulated by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). These agencies have implemented various rules to oversee the activities of algorithmic traders, including requirements for registration, reporting, and risk management.

One of the most significant regulations is the SEC’s Regulation NMS (National Market System), which was introduced in 2007 to promote fairness and transparency in the markets. Regulation NMS includes the Order Protection Rule, which ensures that trades are executed at the best available price across all exchanges.

The Role of FINRA

The Financial Industry Regulatory Authority (FINRA) also plays a crucial role in overseeing algorithmic trading. FINRA monitors trading activity to detect potential manipulative practices, such as spoofing (placing orders with the intent to cancel them) or layering (placing a series of fake orders to create the illusion of market activity).

FINRA’s regulatory framework requires algorithmic traders to implement risk controls and supervisory procedures to prevent unintended market disruptions.

The Impact of Regulation on Traders

Regulation can be a double-edged sword for algorithmic traders. On one hand, it provides a level of protection and ensures a fair playing field. On the other hand, compliance can be costly and time-consuming, particularly for smaller firms.

Traders must stay abreast of regulatory changes and ensure that their algorithms are compliant. Failure to do so can result in hefty fines or even the suspension of trading activities.

Anecdote: The Collapse of Knight Capital

In 2012, Knight Capital Group, a major market maker, suffered a catastrophic loss of $440 million in just 45 minutes due to a glitch in its trading algorithm. The incident was caused by the deployment of faulty software that executed erroneous trades at a rapid pace, flooding the market with orders.

Knight Capital’s collapse was a stark reminder of the importance of proper risk management and regulatory compliance in algorithmic trading. The incident led to increased scrutiny from regulators and highlighted the need for robust safeguards to prevent similar occurrences in the future.

The Future of Algorithmic Trading

As technology continues to evolve, so too does the landscape of algorithmic trading. From advancements in artificial intelligence to the rise of decentralized finance, the future of trading promises to be even more dynamic and innovative.

The Role of Artificial Intelligence

Artificial intelligence (AI) is poised to play a significant role in the future of algorithmic trading. AI algorithms can analyze vast amounts of data at unprecedented speeds, identifying patterns and trends that would be impossible for humans to detect.

Machine learning, a subset of AI, allows algorithms to learn from historical data and improve their performance over time. This self-improving capability could lead to more accurate predictions and better trading outcomes.

The Rise of Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is another emerging trend that could reshape algorithmic trading. DeFi platforms operate on blockchain technology, enabling peer-to-peer trading without the need for traditional financial intermediaries.

Algorithms could be designed to interact with DeFi protocols, executing trades and managing portfolios in a fully decentralized environment. This opens up new possibilities for trading strategies and could democratize access to sophisticated trading tools.

Ethical Considerations and the Human Touch

As algorithmic trading becomes more prevalent, it raises important ethical questions. For example, is it ethical to use high-frequency trading algorithms that can outpace human traders? What about the potential for algorithms to be used in manipulative practices?

Moreover, as trading becomes increasingly automated, there’s a risk of losing the human touch. While algorithms can process data and execute trades with incredible efficiency, they lack the intuition, judgment, and empathy that human traders bring to the table.

A Call for Balance

The future of algorithmic trading lies in finding a balance between automation and human oversight. Traders and firms will need to blend the strengths of algorithms—speed, precision, and discipline—with the insights and ethical considerations that only humans can provide.

Anecdote: The Trader’s Gut Instinct

There’s a story of a veteran trader who, despite having access to some of the most sophisticated algorithms in the business, always relied on his gut instinct before making a big trade. He would review the algorithm’s recommendations, but before pulling the trigger, he’d take a moment to consider the broader market context, the economic landscape, and even his own emotions.

One day, his algorithm signaled a strong buy on a particular stock, but something didn’t feel right. The trader hesitated, and instead of buying, he decided to sell. The next day, the stock plummeted on news that the algorithm hadn’t picked up—a classic case of human intuition outsmarting the machine.

Getting Started with Algorithmic Trading

If you’re intrigued by the possibilities of algorithmic trading and want to get started, there are a few key steps to follow.

Learning the Basics

Before diving into algorithmic trading, it’s important to have a solid understanding of financial markets and trading principles. You don’t need to be an expert, but you should be familiar with concepts like order types, technical indicators, and risk management.

There are plenty of resources available to help you get started, from online courses to books and webinars. Take the time to build a strong foundation before moving on to more advanced topics.

Choosing a Programming Language

One of the first technical decisions you’ll need to make is which programming language to use. Python is a popular choice for beginners due to its simplicity and the wealth of libraries available for financial analysis. C++ is another common choice, particularly for high-frequency trading, due to its speed and efficiency.

Building Your First Algorithm

Once you’ve chosen a programming language, it’s time to start building your first algorithm. Start with a simple strategy, such as a moving average crossover, and gradually add complexity as you gain confidence.

Backtesting and Optimization

Before deploying your algorithm in live markets, it’s crucial to backtest it on historical data. This allows you to see how your strategy would have performed in the past and make any necessary adjustments.

Keep in mind that past performance is not always indicative of future results. It’s important to optimize your algorithm for current market conditions, but avoid overfitting it to historical data.

Choosing a Broker

Not all brokers support algorithmic trading, so you’ll need to choose one that does. Look for a broker that offers robust API access, low latency, and competitive fees. Some popular brokers for algorithmic trading include Interactive Brokers, TD Ameritrade, and Alpaca.

Managing Risk

Algorithmic trading can be highly profitable, but it also carries risks. Make sure to implement risk management measures, such as setting stop-loss orders and position size limits. Regularly monitor your algorithm’s performance and be prepared to make adjustments as needed.

Anecdote: The Learning Curve

Every algorithmic trader has a learning curve. One trader recalls the excitement of building his first algorithm—a simple moving average crossover strategy. He backtested it on historical data and was thrilled to see that it would have made significant profits. Confident, he deployed the algorithm in live markets.

But within days, the algorithm started losing money. The trader realized that the market conditions had changed, and his algorithm wasn’t adapting. It was a valuable lesson in the importance of flexibility and continuous learning.

Tables and Data Interpretation

To provide a clearer understanding of algorithmic trading, let’s look at some data and how it relates to overall trading strategies.

| Trading Strategy | Timeframe | Risk Level | Potential Returns | Market Conditions |

|---|---|---|---|---|

| Moving Average Crossover | Medium | Moderate | Moderate | Trending markets |

| Arbitrage | Short | Low | Low to Moderate | Volatile markets |

| Index Fund Rebalancing | Medium | Low | Low to Moderate | Predictable, rebalancing periods |

| High-Frequency Trading (HFT) | Microseconds | High | High | Highly liquid markets |

| Delta-Neutral Trading | Medium to Long | Moderate | Moderate | Stable or slightly volatile markets |

| Mean Reversion | Medium | Moderate | Moderate | Mean-reverting markets |

Interpreting the Data

This table presents a snapshot of various algorithmic trading strategies, their risk levels, potential returns, and suitable market conditions. Understanding this data helps traders choose the right strategy based on their risk tolerance and market outlook.

For instance, if you’re looking for a low-risk strategy, arbitrage might be a good choice, especially in volatile markets where price discrepancies are more likely to occur. On the other hand, if you’re willing to take on more risk for potentially higher returns, high-frequency trading could be appealing, provided you’re operating in highly liquid markets.

FAQs

Algorithmic trading works by programming a set of rules or criteria into a computer algorithm. The algorithm then monitors the market and executes trades when the specified conditions are met. For example, a trader might program an algorithm to buy a stock when its 50-day moving average crosses above its 200-day moving average, and to sell when it crosses below.

While algorithmic trading offers many advantages, it also comes with risks such as:

Technology Dependence: System failures or connectivity issues can lead to significant losses.

Market Impact: Large algorithmic trades can influence market prices, potentially causing volatility.

Over-Optimization: Algorithms that are too finely tuned to historical data may underperform in live markets.

Regulatory Compliance: Algorithms must comply with financial regulations, and failing to do so can result in penalties.

Some popular algorithmic trading strategies include:

Trend-Following: Buying assets that are trending upward and selling those that are trending downward.

Arbitrage: Exploiting price differences between markets or instruments.

Index Fund Rebalancing: Anticipating trades made by index funds during their rebalancing periods.

High-Frequency Trading (HFT): Executing a large number of orders at extremely high speeds to capture small price discrepancies.

Yes, algorithmic trading is legal, but it is subject to regulation. Different countries and markets have specific rules governing algorithmic trading to ensure fairness, market stability, and investor protection. Traders must ensure that their algorithms comply with all relevant regulations.

Yes, programming skills are often necessary for algorithmic trading, especially if you plan to develop your own algorithms. Python is a popular language for beginners due to its simplicity and the availability of financial libraries. However, some trading platforms offer pre-built algorithms or “drag-and-drop” interfaces that require minimal coding knowledge.

Yes, algorithmic trading can be applied to various asset classes, including stocks, forex, commodities, and cryptocurrencies. However, the strategies and algorithms used may vary depending on the characteristics of the asset class.

The future of algorithmic trading is likely to be shaped by advancements in artificial intelligence and machine learning. These technologies will enable more sophisticated algorithms that can adapt to changing market conditions and learn from past trades. Additionally, the rise of decentralized finance (DeFi) and blockchain technology may open new avenues for algorithmic trading in peer-to-peer markets.

Conclusion: The Journey Ahead

Algorithmic trading is a powerful tool in the modern trader’s arsenal, offering speed, precision, and the ability to capitalize on opportunities that human traders might miss. But it’s not without its challenges. From the technical complexities of building and optimizing algorithms to the ethical and regulatory considerations, algorithmic trading requires a blend of technical skill, market knowledge, and human judgment.

As you embark on your algorithmic trading journey, remember that it’s not just about writing code—it’s about understanding markets, managing risk, and continuously learning and adapting. Whether you’re a seasoned trader looking to automate your strategies or a newcomer eager to explore the world of finance, algorithmic trading offers endless possibilities.

So, what’s next for you? Are you ready to start building your first algorithm? Or perhaps you’re inspired to delve deeper into the world of high-frequency trading or AI-driven strategies? Whatever path you choose, the journey will be as rewarding as the destination.

Leave a Reply

Want to join the discussion?Feel free to contribute!