Best Books for Forex Traders

When it comes to navigating the complexities of the forex market, having the right resources is essential. “Best Books for Forex Traders” serves as a comprehensive guide, highlighting the top books that offer valuable insights into currency trading. Whether you’re a beginner looking to grasp the basics or a seasoned trader aiming to refine your strategies, these carefully selected titles provide the knowledge and tools needed to succeed. From foundational texts on technical analysis to advanced guides on trading psychology, this list covers every aspect of forex trading, ensuring you are well-prepared to tackle the dynamic forex market.

Choosing the right book can make a significant difference in your trading journey. This guide not only curates the best books for forex traders but also breaks down each book’s core concepts, making it easier to find the one that suits your needs. By investing time in these top-rated forex trading books, you can build a solid foundation, develop effective trading strategies, and enhance your market analysis skills, ultimately leading to more informed trading decisions and improved financial outcomes.

Contents

- Top 10 Best Forex trading books 2024

- Getting Started: Essential Books for Beginners

- Mastering the Basics: Foundational Knowledge

- Advanced Strategies: For the Seasoned Trader

- Psychology and Emotion: The Mental Game of Forex Trading

- Risk Management: Protecting Your Capital

- Unique Approaches and Techniques

- Historical Perspectives: Learning from the Past

- Comprehensive Learning: The All-in-One Guides

- FAQs

- Conclusion: Your Path to Forex Success

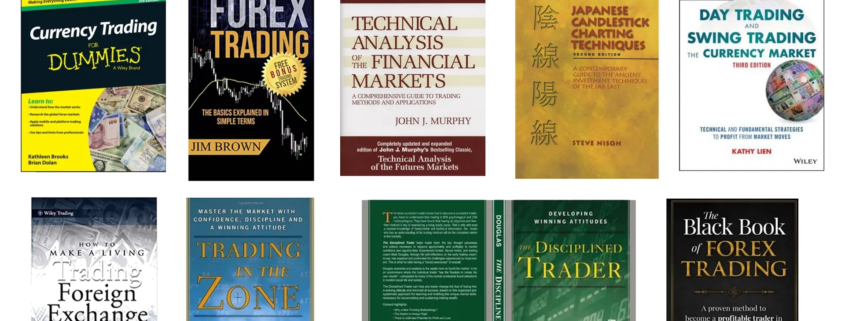

Top 10 Best Forex trading books 2024

Here’s a compaction table that summarizes the key information about some of the best books for forex traders. This table is designed to help you quickly identify which books might be the most relevant for your needs based on their focus areas and key insights.

| Book Title | Author(s) | Focus Area | Key Insights | Best For |

|---|---|---|---|---|

| Currency Trading for Dummies | Paul Mladjenovic, Kathleen Brooks, Brian Dolan | Beginner’s Guide | Easy-to-understand guide covering basics, strategies, and practical tips for new forex traders. | Complete beginners |

| Forex Trading: The Basics Explained in Simple Terms | Jim Brown | Basics of Forex Trading | Simple language explaining forex concepts, trading psychology, and a beginner-friendly strategy. | Beginners needing a clear, concise guide |

| Technical Analysis of the Financial Markets | John J. Murphy | Technical Analysis | Comprehensive coverage of technical analysis, including chart patterns and indicators. | Traders seeking to master technical analysis |

| Japanese Candlestick Charting Techniques | Steve Nison | Candlestick Charting | Detailed exploration of candlestick charting, with practical applications for trading. | Traders wanting to improve charting skills |

| Day Trading and Swing Trading the Currency Market | Kathy Lien | Day and Swing Trading Strategies | In-depth analysis of both short-term and medium-term trading strategies, combining theory with practice. | Intermediate to advanced traders |

| How to Make a Living Trading Foreign Exchange | Courtney D. Smith | Advanced Trading Strategies | Six trading strategies with a focus on risk management and psychological discipline. | Advanced traders aiming for consistent income |

| Trading in the Zone | Mark Douglas | Trading Psychology | Focuses on developing the right mindset for trading success, including managing emotions and discipline. | All traders, especially those struggling with consistency |

| The Black Book of Forex Trading | Paul Langer | Risk Management and Strategies | Practical advice on managing risks and implementing effective trading strategies. | Traders of all levels focused on risk management |

| Trend Following | Michael Covel | Trend Following Strategies | Explores the principles of trend following and how to implement this strategy in various markets. | Traders interested in long-term strategies |

| How to Start a Trading Business with $500 | Heikin Ashi Trader | Starting Small in Forex Trading | Step-by-step guide to starting forex trading with limited capital, using the Heikin Ashi strategy. | Beginners with limited capital |

Getting Started: Essential Books for Beginners

“Currency Trading for Dummies” by Paul Mladjenovic, Kathleen Brooks, and Brian Dolan

Starting in the forex market can feel overwhelming, like standing at the edge of a vast, swirling ocean. Where do you even begin? That’s where “Currency Trading for Dummies” comes in. This book is designed to guide beginners through the initial stages of forex trading, making complex concepts accessible and easy to understand.

The authors, Paul Mladjenovic, Kathleen Brooks, and Brian Dolan, are all seasoned professionals with years of experience in the financial markets. They break down the essentials of forex trading, from understanding currency pairs to using technical analysis tools. The book is filled with practical tips and strategies to help you get started on the right foot.

But here’s the real beauty of this book: it doesn’t assume any prior knowledge. The authors take you by the hand and lead you through each concept, step by step. They also sprinkle in a bit of humor, making the learning process more enjoyable. If you’re just starting, this book should be at the top of your reading list.

“Forex Trading: The Basics Explained in Simple Terms” by Jim Brown

Jim Brown’s “Forex Trading: The Basics Explained in Simple Terms” is another excellent resource for beginners. Brown is a self-taught forex trader who understands the struggles that newcomers face. His writing style is clear and concise, with no jargon or complicated language to trip you up.

In this book, Brown covers the fundamentals of forex trading, including how to choose a broker, understanding currency pairs, and developing a trading plan. He also shares his personal trading strategy, which is simple enough for beginners to understand and implement.

One of the standout features of this book is its focus on trading psychology. Brown emphasizes the importance of discipline and patience, two qualities that are essential for success in forex trading. He also provides practical advice on managing your emotions and staying calm under pressure.

As you read through Brown’s book, you’ll feel like you’re having a conversation with a mentor. His approachable tone and practical insights make this book a must-read for anyone new to forex trading.

Mastering the Basics: Foundational Knowledge

“Technical Analysis of the Financial Markets” by John J. Murphy

Technical analysis is the backbone of forex trading. It’s the study of past market data, primarily price and volume, to forecast future price movements. If you’re serious about forex trading, you’ll need a solid understanding of technical analysis, and there’s no better place to start than with John J. Murphy’s “Technical Analysis of the Financial Markets.”

First published in 1999, this book has stood the test of time and is considered a bible in the world of technical analysis. Murphy, a former technical analyst for CNBC, covers everything from basic chart patterns to complex indicators. The book is packed with over 400 charts that illustrate the concepts discussed, making it easier for readers to grasp the material.

Murphy’s writing is clear and straightforward, making this book accessible to beginners and valuable for more experienced traders. He explains complex ideas in a way that makes them easy to understand, without oversimplifying the material. Whether you’re just starting or looking to deepen your knowledge, this book is an essential addition to your library.

“Japanese Candlestick Charting Techniques” by Steve Nison

If you’ve ever looked at a forex chart, you’ve probably seen candlestick patterns. These patterns are a powerful tool for technical analysis, and they can provide valuable insights into market trends. Steve Nison’s “Japanese Candlestick Charting Techniques” is the definitive guide to understanding and using these patterns.

Nison is credited with introducing candlestick charting to the Western world, and his book is widely regarded as the go-to resource on the subject. He explains the history of candlestick charting, its key principles, and how to interpret various patterns. The book is filled with real-world examples and practical advice on how to use candlestick patterns in your trading.

One of the things that make this book stand out is its focus on practical application. Nison doesn’t just explain the theory behind candlestick patterns; he also shows you how to apply them in your trading. Whether you’re a beginner or an experienced trader, this book will give you valuable insights into market behavior and help you make more informed trading decisions.

Advanced Strategies: For the Seasoned Trader

“Day Trading and Swing Trading the Currency Market” by Kathy Lien

For traders who have mastered the basics and are looking to take their trading to the next level, Kathy Lien’s “Day Trading and Swing Trading the Currency Market” is an essential read. Lien is a world-renowned currency analyst with years of experience in the financial markets, and her book offers a deep dive into advanced trading strategies.

The book is divided into two main sections: day trading and swing trading. Lien covers the key principles of each approach, including how to identify trading opportunities, manage risk, and maximize profits. She also delves into the fundamental and technical factors that influence currency pairs, providing readers with a comprehensive understanding of the forex market.

What sets this book apart is Lien’s ability to combine theory with practical insights. She doesn’t just tell you what to do; she shows you how to do it, with step-by-step instructions and real-world examples. If you’re looking to refine your trading strategies and improve your results, this book is a valuable resource.

“How to Make a Living Trading Foreign Exchange” by Courtney D. Smith

Courtney D. Smith’s “How to Make a Living Trading Foreign Exchange” is another must-read for advanced traders. Smith, a seasoned trader with over 30 years of experience, shares his insights and strategies for building a successful forex trading career.

The book is structured around six trading strategies, each designed to help traders earn a steady income from forex trading. Smith also covers risk management techniques and the psychology of trading, providing readers with a holistic approach to trading success.

One of the standout features of this book is Smith’s unique “rejection rule,” a strategy designed to double the profit generated from basic channel breakout systems. This strategy is just one example of the practical, actionable advice that Smith offers throughout the book.

If you’re serious about making a living from forex trading, this book is a valuable resource that will help you achieve your goals.

Psychology and Emotion: The Mental Game of Forex Trading

“Trading in the Zone” by Mark Douglas

Trading is as much a mental game as it is a technical one. You can have the best strategy in the world, but if you can’t control your emotions, you’re unlikely to succeed. That’s where Mark Douglas’s “Trading in the Zone” comes in. This book is a deep dive into the psychology of trading, and it’s a must-read for anyone serious about forex trading.

Douglas, a trader and psychologist, explores the mental barriers that prevent traders from achieving consistent success. He explains how fear, greed, and overconfidence can lead to poor decision-making and offers practical techniques for overcoming these emotional obstacles.

One of the key takeaways from this book is the importance of developing a “trader’s mindset.” Douglas argues that successful traders think differently from the rest of us. They understand the inherent uncertainty of the markets and are comfortable taking calculated risks. By adopting this mindset, you can improve your trading performance and achieve more consistent results.

“The Disciplined Trader” by Mark Douglas

Another classic from Mark Douglas, “The Disciplined Trader,” complements “Trading in the Zone” by focusing on the discipline required to succeed in trading. While “Trading in the Zone” deals more with the psychological aspects of trading, “The Disciplined Trader” offers a more structured approach to developing the discipline needed to stick to your trading plan.

Douglas delves into the psychological challenges that traders face, such as the fear of losing money and the temptation to deviate from their trading strategy. He provides practical advice on how to develop self-discipline and maintain a positive attitude, even when things aren’t going your way.

If you’re struggling with discipline in your trading, this book will help you understand the root causes of your behavior and give you the tools to overcome them. It’s an essential read for anyone looking to develop the mental toughness needed to succeed in forex trading.

Risk Management: Protecting Your Capital

“The Black Book of Forex Trading” by Paul Langer

Risk management is one of the most critical aspects of forex trading. Without a solid risk management plan, even the best trading strategy can lead to significant losses. Paul Langer’s “The Black Book of Forex Trading” is a valuable resource for traders looking to protect their capital and minimize risk.

In this book, Langer shares his personal experiences as a trader and offers practical advice on managing risk. He covers a range of topics, including position sizing, stop-loss orders, and the importance of having a trading plan. Langer also discusses the psychological aspects of risk management, emphasizing the importance of staying calm and disciplined under pressure.

One of the standout features of this book is its focus on practical application. Langer provides real-world examples and step-by-step instructions on how to implement effective risk management strategies. Whether you’re a beginner or an experienced trader, this book will help you protect your capital and improve your trading results.

“Come Into My Trading Room” by Dr. Alexander Elder

Dr. Alexander Elder’s “Come Into My Trading Room” is another excellent resource for traders looking to improve their risk management skills. Elder, a professional trader and psychiatrist, combines his expertise in both fields to offer a comprehensive guide to trading psychology and risk management.

The book is structured around the “Three M’s” of trading: Mind, Method, and Money. Elder argues that successful trading requires mastery of all three. In the “Money” section, he focuses on risk management, providing practical advice on how to protect your capital and maximize your profits.

Elder’s writing is clear and engaging, and he uses real-world examples to illustrate his points. He also includes exercises and checklists to help readers apply the concepts discussed in the book. If you’re looking to improve your risk management skills and develop a more disciplined approach to trading, this book is a valuable resource.

Unique Approaches and Techniques

“Trend Following” by Michael Covel

“Trend Following” by Michael Covel offers a unique approach to forex trading that focuses on following market trends. Covel argues that by identifying and following trends, traders can achieve consistent profits, even in unpredictable markets.

The book is based on the principles of trend following, a trading strategy that has been used by some of the most successful traders in history. Covel provides a comprehensive overview of the strategy, including its historical performance, key principles, and practical application.

One of the things that make this book stand out is its focus on mindset. Covel emphasizes the importance of maintaining discipline and patience when following trends, even when the market seems to be moving against you. He also provides practical advice on how to develop a trend-following system and stick to it.

If you’re looking for a unique approach to forex trading, this book is a valuable resource that will help you understand the power of trends and how to profit from them.

“How to Start a Trading Business with $500” by Heikin Ashi Trader

For traders with limited capital, Heikin Ashi Trader’s “How to Start a Trading Business with $500” offers a practical guide to building a successful trading business on a shoestring budget. The book is designed for beginners who want to start trading forex without risking a large amount of money.

The author, a seasoned trader, provides a step-by-step guide to starting a trading business, including how to choose a broker, develop a trading plan, and manage your capital. He also covers the Heikin Ashi trading strategy, a unique approach that uses candlestick patterns to identify trading opportunities.

One of the standout features of this book is its focus on practicality. The author provides detailed instructions on how to implement the strategies discussed in the book, with real-world examples and case studies. If you’re looking to start trading forex with a small amount of capital, this book is a valuable resource that will help you get started on the right foot.

By Heikin Ashi Trader

Historical Perspectives: Learning from the Past

“Reminiscences of a Stock Operator” by Edwin Lefèvre

“Reminiscences of a Stock Operator” by Edwin Lefèvre is a classic book that offers valuable insights into the world of trading. Although it’s not specifically about forex trading, the lessons in this book are timeless and applicable to any market.

The book is a fictionalized account of the life of Jesse Livermore, one of the most successful traders in history. It provides a fascinating glimpse into the world of trading in the early 20th century, with valuable lessons on risk management, psychology, and market analysis.

One of the things that make this book stand out is its storytelling. Lefèvre’s writing is engaging and entertaining, making the book a pleasure to read. But beyond the entertainment value, the book is filled with practical insights and lessons that are still relevant today.

Whether you’re a beginner or an experienced trader, “Reminiscences of a Stock Operator” is a must-read that will give you a deeper understanding of the markets and the psychology of trading.

“Market Wizards” by Jack D. Schwager

“Market Wizards” by Jack D. Schwager is another classic book that offers valuable insights into the world of trading. The book is a collection of interviews with some of the most successful traders of all time, including Paul Tudor Jones, Bruce Kovner, and Richard Dennis.

Each interview provides a unique perspective on trading, with valuable lessons on risk management, psychology, and trading strategies. Schwager’s interviews are insightful and thought-provoking, offering readers a rare glimpse into the minds of the world’s best traders.

One of the standout features of this book is its focus on mindset. Many of the traders interviewed in the book emphasize the importance of discipline, patience, and perseverance in trading. They also share their personal experiences and challenges, making the book relatable and inspiring.

If you’re looking for inspiration and insights from some of the best traders in the world, “Market Wizards” is a must-read that will help you develop the mindset and skills needed to succeed in forex trading.

Comprehensive Learning: The All-in-One Guides

“Forex for Beginners” by Anna Coulling

“Forex for Beginners” by Anna Coulling is a comprehensive guide designed to take novice traders from zero knowledge to a solid understanding of forex trading. Coulling, a trader and educator with years of experience, breaks down complex concepts into easy-to-understand language.

The book covers a wide range of topics, including the basics of forex trading, technical and fundamental analysis, and trading psychology. Coulling also provides practical tips on how to develop a trading plan, choose a broker, and manage your risk.

One of the things that make this book stand out is its focus on education. Coulling is a natural teacher, and her writing is clear and engaging. She provides plenty of examples and exercises to help readers apply the concepts discussed in the book.

Whether you’re a complete beginner or looking to brush up on your knowledge, “Forex for Beginners” is an excellent resource that will give you a solid foundation in forex trading.

“The Little Book of Currency Trading” by Kathy Lien

Kathy Lien’s “The Little Book of Currency Trading” is another comprehensive guide that offers a wealth of information on forex trading. Lien, a seasoned currency analyst, provides a step-by-step guide to getting started in the forex market, with plenty of practical tips and strategies.

The book covers a wide range of topics, including the basics of forex trading, how to choose a broker, and how to develop a trading plan. Lien also delves into more advanced topics, such as technical and fundamental analysis, and provides practical advice on how to manage your risk.

One of the things that make this book stand out is its focus on simplicity. Lien’s writing is clear and concise, making the book accessible to beginners. But despite its simplicity, the book is packed with valuable insights and strategies that will benefit traders at all levels.

If you’re looking for a comprehensive guide to forex trading, “The Little Book of Currency Trading” is a valuable resource that will help you develop the knowledge and skills needed to succeed in the forex market.

FAQs

For beginners, “Currency Trading for Dummies” by Paul Mladjenovic, Kathleen Brooks, and Brian Dolan is highly recommended. It offers a comprehensive introduction to the basics of forex trading in an easy-to-understand format. Another great choice is “Forex Trading: The Basics Explained in Simple Terms” by Jim Brown, which breaks down complex concepts into clear, simple language ideal for newcomers.

“Technical Analysis of the Financial Markets” by John J. Murphy is widely regarded as a cornerstone text for anyone serious about technical analysis. This book covers a broad range of topics, including chart patterns, indicators, and the underlying theory behind technical analysis, making it suitable for both beginners and advanced traders.

“Trading in the Zone” by Mark Douglas is a must-read for understanding the psychological aspects of trading. This book delves into the mindset needed to trade successfully, focusing on managing emotions, developing discipline, and achieving consistency in trading performance.

Yes, “The Black Book of Forex Trading” by Paul Langer provides valuable insights into risk management strategies, helping traders protect their capital while seeking profits. “Come Into My Trading Room” by Dr. Alexander Elder also covers risk management extensively, along with other critical trading concepts.

“Japanese Candlestick Charting Techniques” by Steve Nison is the definitive guide on the subject. This book introduces readers to the world of candlestick charting, explaining its principles and how to apply them effectively in trading.

“How to Start a Trading Business with $500” by Heikin Ashi Trader is an excellent resource for traders with limited capital. It provides practical guidance on building a trading business from the ground up, even with a small budget.

Books like “Day Trading and Swing Trading the Currency Market” by Kathy Lien and “How to Make a Living Trading Foreign Exchange” by Courtney D. Smith offer advanced strategies and insights that can help experienced traders refine their skills and improve their trading outcomes.

“Forex for Beginners” by Anna Coulling and “The Little Book of Currency Trading” by Kathy Lien are both excellent all-in-one guides. They cover a wide range of topics, from the basics to more advanced concepts, making them suitable for traders at various stages of their journey.

These books offer a wealth of knowledge, from foundational concepts to advanced strategies, helping traders understand the market better, develop effective trading plans, and manage their emotions and risks. By applying the lessons learned, traders can make more informed decisions and enhance their overall trading performance.

These books are widely available online through major retailers like Amazon, Barnes & Noble, and other bookshops. Many of them are also available in digital formats for e-readers and audiobooks.

Conclusion: Your Path to Forex Success

Navigating the forex market can be a daunting task, but with the right knowledge and resources, you can develop the skills needed to succeed. The books discussed in this guide offer a wealth of information, from the basics of forex trading to advanced strategies and risk management techniques.

Whether you’re a beginner looking to learn the ropes or an experienced trader looking to refine your strategies, these books provide valuable insights and practical advice that will help you achieve your trading goals. Remember, success in forex trading requires a combination of knowledge, discipline, and patience. By investing in your education and continuously learning, you can develop the skills needed to navigate the complexities of the forex market and achieve long-term success.

Leave a Reply

Want to join the discussion?Feel free to contribute!