What is a Pip in Forex Trading?

Contents

What is a Pip?

In forex trading, a “pip” is a unit of measurement that represents the smallest price movement that a given exchange rate can make based on market convention. Typically, it is the last decimal place of a price quote. For example, in the currency pair EUR/USD, if the price moves from 1.1050 to 1.1051, this change of 0.0001 USD signifies a movement of one pip. Understanding pips is crucial for forex traders, as they are essential for calculating profit and loss, assessing risk, and making informed trading decisions.

Pips play a fundamental role in forex trading, serving as a universal language for traders around the world. By using pips, traders can communicate price changes succinctly and effectively, regardless of the currency pairs they are dealing with. This standardization makes it easier to discuss market movements, compare strategies, and understand trading outcomes.

The Importance of Pips in Forex Trading

Pips are significant for several reasons. First, they provide a way to measure price fluctuations and determine the value of currency pairs. Traders use pips to quantify gains or losses, making it easier to track performance over time. This precision allows traders to evaluate their strategies and adjust them accordingly, optimizing their trading activities for better results.

Secondly, understanding pips is essential for effective risk management. By knowing how much each pip is worth in their account’s base currency, traders can set stop-loss orders and take-profit targets more accurately. This ability to calculate risk in pips ensures that traders are not exposed to unexpected losses, maintaining their capital while participating in the forex market.

Lastly, the concept of pips supports the development of trading strategies. Traders can backtest their methods using historical price movements expressed in pips, allowing them to refine their approaches based on quantifiable data. This analytical perspective is crucial for successful trading, as it promotes a disciplined and data-driven approach.

The Mechanics of Pips

Understanding how pips are calculated is vital for forex traders. Most currency pairs are quoted to four decimal places, with a pip representing the fourth decimal point (0.0001). However, there are exceptions, particularly with Japanese yen pairs, which are quoted to two decimal places, making the pip size 0.01. This distinction is essential for traders, as it affects the way they interpret price movements and calculate potential profits or losses.

To illustrate, consider the following table, which outlines the pip value for various currency pairs:

| Currency Pair | Standard Pip Size | Example Movement | Pip Movement |

|---|---|---|---|

| EUR/USD | 0.0001 | 1.1050 to 1.1051 | 1 pip |

| USD/JPY | 0.01 | 110.00 to 110.01 | 1 pip |

| GBP/USD | 0.0001 | 1.3050 to 1.3051 | 1 pip |

| AUD/CAD | 0.0001 | 0.9500 to 0.9501 | 1 pip |

In this table, the pip values demonstrate how different currency pairs operate within the framework of pips, reinforcing the concept that pip size can vary depending on the pair being traded. For traders, knowing how to read these movements is crucial for their trading strategies.

What is a Pipette?

In addition to pips, many forex brokers quote currency pairs using “pipettes,” which are fractional pips representing a tenth of a pip. For instance, if GBP/USD moves from 1.30542 to 1.30543, that change of 0.00001 USD reflects one pipette. This increased precision can be valuable for traders who require finer granularity in their trading activities.

Pipettes can enhance trading strategies by providing more detailed information about price movements. This added precision allows traders to refine their entry and exit points, which can significantly impact the overall performance of their trades. In highly liquid markets, where price movements can be minimal, pipettes provide traders with the ability to act on smaller price changes, giving them a competitive edge.

Understanding pipettes is also important for newer traders, as they represent an additional layer of complexity in forex trading. By recognizing that a pipette is essentially a fractional movement within the larger framework of pips, traders can better appreciate the nuances of price action and the factors that influence it.

Calculating Pip Value

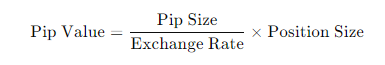

Calculating the monetary value of a pip is essential for managing risk and determining position sizes in forex trading. The value of a pip varies depending on the currency pair being traded, the exchange rate, and the size of the trade. To calculate pip value, traders typically use the following formula:

For instance, if a trader is trading one standard lot (100,000 units) of EUR/USD, and the current exchange rate is 1.1050, the pip value would be calculated as follows:

This calculation shows that for a one-pip movement in the EUR/USD pair, the trader would gain or lose approximately 9.05 USD. Understanding how to calculate pip value helps traders make informed decisions about their risk exposure and overall trading strategy.

Risk Management with Pips

Effective risk management is a cornerstone of successful trading. Using pips as a measurement allows traders to quantify their potential losses and set appropriate stop-loss orders. By defining risk in terms of pips, traders can adhere to their risk tolerance levels and ensure that their trading strategies remain sustainable over time.

For example, if a trader enters a position with a stop-loss set at 50 pips from their entry point, they can calculate their potential loss based on the pip value. If the pip value for the trade is 10 USD, then a 50-pip loss would equate to a potential loss of 500 USD. This clear understanding of risk allows traders to make decisions that align with their financial goals and risk appetite.

Furthermore, managing risk using pips can help traders maintain psychological discipline. Knowing the specific number of pips at risk helps to remove emotional decision-making from the equation, allowing traders to follow their plans without second-guessing themselves during periods of volatility. This disciplined approach is crucial for long-term success in forex trading.

The Role of Pips in Trading Strategies

Pips play a pivotal role in the formulation and execution of trading strategies. Traders often use technical analysis to identify potential entry and exit points based on pip movements. By analyzing historical price data, traders can discern patterns and trends, using these insights to inform their trading decisions.

Many traders employ a pip-based approach when setting their target profit levels. For instance, a trader may aim to achieve a profit of 30 pips for a particular trade. By setting clear targets, traders can remain focused and disciplined, reducing the likelihood of emotional trading decisions that could jeopardize their capital.

Additionally, the use of pips in trading strategies enables traders to implement risk-reward ratios effectively. A common practice is to aim for a risk-reward ratio of at least 1:2, meaning that for every pip risked, the trader seeks to gain at least two pips. This structured approach helps traders manage their risk while maximizing potential profits, reinforcing the importance of pips in their overall trading strategy.

Common Misconceptions About Pips

Despite their significance, pips can often be misunderstood, especially by new traders. One common misconception is that all currency pairs have the same pip value, which is not true. As previously discussed, the pip size varies between different currency pairs, and understanding these differences is crucial for effective trading.

Another misconception is that pips only matter in terms of profit and loss calculations. While they are essential for quantifying gains and losses, pips also serve as a fundamental component of risk management, strategy formulation, and overall market analysis. By recognizing the multifaceted role of pips, traders can gain a deeper understanding of how they function within the forex market.

Finally, some traders may overlook the importance of pipettes and their potential impact on trading strategies. By ignoring pipettes, traders might miss out on opportunities for enhanced precision and better decision-making, particularly in highly liquid markets. Emphasizing the significance of both pips and pipettes can empower traders to make more informed choices.

FAQs

A pip is calculated based on the decimal place of the currency pair being traded. For example, if the EUR/USD moves from 1.1050 to 1.1051, that 0.0001 change represents one pip. To determine the monetary value of a pip, traders consider the lot size of their trade and the currency pair involved.

Pips are essential for measuring price movements, calculating profits and losses, and managing risk. They help traders communicate price changes clearly and standardize the evaluation of trading performance across different currency pairs.

A pipette is a fractional pip, which is a smaller price increment that some brokers use in their quotes. It is typically one-tenth of a pip. For example, if the GBP/USD moves from 1.30542 to 1.30543, that change of 0.00001 is one pipette.

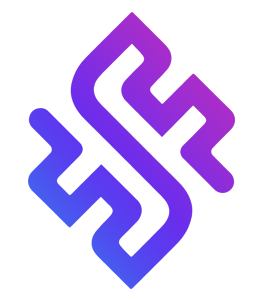

To calculate the monetary value of a pip, you need to know the lot size of your trade. For standard lots (100,000 units), a pip is worth approximately $10. For mini lots (10,000 units), it’s about $1, and for micro lots (1,000 units), it’s about $0.10. The formula varies slightly depending on the currency pair being traded.

Yes, while the definition of a pip remains constant, the monetary value can vary based on factors such as the currency pair and the size of the trade. Additionally, market conditions can influence how much a pip is worth in your trading account.

Yes, most currency pairs follow the standard pip definition, but there are exceptions. For example, currency pairs involving the Japanese yen are quoted to two decimal places, meaning a pip for these pairs is 0.01.

Forex trading platforms typically display currency pairs in a format that highlights pips, making it easier for traders to identify price changes. Many platforms also include tools for calculating pip values based on your account settings, enhancing your trading experience.

Conclusion

In summary, pips are a fundamental aspect of forex trading, serving as a crucial measurement for price movements and risk management. By understanding the concept of pips, traders can enhance their trading strategies, manage their risks effectively, and make informed decisions in the dynamic forex market. Whether you’re a novice trader or an experienced professional, mastering the intricacies of pips is essential for achieving success in forex trading.

By recognizing the importance of pips and employing them strategically, traders can navigate the complexities of the forex market with confidence, ultimately leading to more successful trading outcomes.

Leave a Reply

Want to join the discussion?Feel free to contribute!