How Exchange Rates are Determined

Exchange rates are crucial for understanding international finance and global trade. They represent the value of one currency in relation to another, indicating how much of one currency can be exchanged for a unit of another. For example, if the exchange rate between the U.S. dollar (USD) and the euro (EUR) is 1.07, it means that one euro can be exchanged for $1.07. This simple relationship between currencies influences everything from consumer purchasing power to national economic health.

Understanding how exchange rates are determined requires knowledge of various economic factors and market forces. Exchange rates can fluctuate significantly based on changes in demand and supply for currencies, influenced by interest rates, inflation, political stability, and overall economic performance. In this article, we will explore the different types of exchange rates, the factors affecting them, and the mechanisms through which they are determined and adjusted in the global marketplace.

Contents

What Are Exchange Rates?

An exchange rate is defined as the price at which one currency can be exchanged for another. It serves as an indicator of a country’s economic health and can impact inflation, interest rates, and overall trade dynamics. Exchange rates can be classified into two primary categories: floating exchange rates and fixed exchange rates.

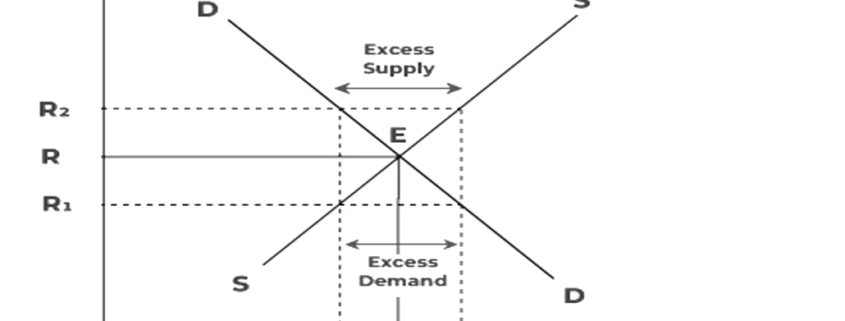

Floating Exchange Rates: Floating exchange rates are determined by market forces without direct government or central bank intervention. In this system, the value of a currency rises and falls based on supply and demand in the foreign exchange market. For instance, if the demand for euros increases relative to the U.S. dollar, the euro’s value will rise against the dollar.

Fixed Exchange Rates: In contrast, fixed exchange rates are pegged to the value of another currency or a basket of currencies. Governments or central banks maintain the exchange rate within a narrow band by buying and selling their currency in the foreign exchange market. A prime example is the Hong Kong dollar, which is pegged to the U.S. dollar within a specified range, thus stabilizing its value against the dollar.

The Role of Exchange Rates in International Trade

Exchange rates play a vital role in international trade by influencing the price of goods and services across borders. When a country’s currency appreciates, its exports become more expensive for foreign buyers, potentially leading to a decrease in demand. Conversely, when a currency depreciates, exports become cheaper, making them more attractive to foreign markets.

This dynamic also affects imports. If a country’s currency weakens, the cost of imported goods rises, potentially leading to higher inflation as consumers pay more for foreign products. On the other hand, a stronger currency reduces the cost of imports, which can benefit consumers but may harm domestic producers who face increased competition from cheaper foreign goods.

Importance of Understanding Exchange Rates

For businesses engaged in international trade, understanding exchange rates is crucial for pricing strategies, cost management, and profit margins. Fluctuations in exchange rates can lead to significant changes in revenues and expenses. Therefore, businesses often employ financial instruments such as hedging to mitigate risks associated with currency fluctuations.

Consumers also need to be aware of exchange rates, especially when traveling abroad or making purchases from foreign websites. Exchange rates directly impact how much consumers pay for foreign goods and services. Thus, awareness of current exchange rates can lead to better financial decisions, whether for personal or business-related purposes.

Factors Influencing Exchange Rates

Several key economic indicators play a significant role in determining exchange rates. Among them are:

- Interest Rates: Central banks influence currency values through interest rate policies. Higher interest rates offer lenders a higher return relative to other countries, attracting foreign capital and causing the currency to appreciate. Conversely, lower interest rates can lead to depreciation as investors seek higher returns elsewhere.

- Inflation Rates: Inflation affects the purchasing power of a currency. Countries with lower inflation rates typically experience an appreciation in currency value, as their purchasing power increases relative to other currencies. High inflation can lead to depreciation, as consumers lose confidence in the currency’s stability.

- Economic Growth: The overall economic performance of a country, as measured by GDP growth, affects its currency value. Strong economic growth typically leads to increased investment from foreign entities, driving up demand for the country’s currency and resulting in appreciation. Conversely, weak economic performance can lead to depreciation.

Political Stability and Economic Performance

Political stability is another critical factor influencing exchange rates. Countries with stable governments and robust economic policies are more likely to attract foreign investment, boosting demand for their currency. Conversely, political turmoil or uncertainty can lead to currency depreciation, as investors seek safer havens for their capital.

The performance of the domestic economy relative to other economies also impacts currency values. For instance, if the U.S. economy is performing better than the Eurozone, the demand for the U.S. dollar may increase, leading to appreciation against the euro. Economic indicators such as employment rates, consumer confidence, and trade balances can signal the health of an economy and influence investor sentiment.

Speculation and Market Sentiment

Speculative activity in the forex market can also lead to fluctuations in exchange rates. Traders often buy and sell currencies based on expectations of future movements, influenced by news events, economic data releases, and geopolitical developments. For example, if traders anticipate that a country’s central bank will raise interest rates, they may buy that currency in anticipation of its appreciation.

Market sentiment, which reflects the overall attitude of investors toward a particular currency or economy, can also drive exchange rate movements. Positive news, such as strong economic data or political stability, can bolster investor confidence, leading to increased demand for a currency. Conversely, negative news can prompt sell-offs, resulting in depreciation.

Types of Exchange Rate Systems

A free-floating exchange rate system is characterized by minimal government intervention. In this system, the value of a currency fluctuates based on market forces of supply and demand. Countries that employ a free-floating exchange rate system allow their currencies to rise and fall based on market conditions, leading to more volatility but also a more accurate reflection of economic fundamentals.

This system enables countries to respond quickly to changes in economic conditions. For instance, if a country faces economic challenges, its currency may depreciate, making exports cheaper and stimulating demand for goods abroad. However, the volatility inherent in a free-floating system can create uncertainty for businesses and investors, requiring them to adopt risk management strategies.

Pegged Exchange Rate System

A pegged exchange rate system involves a country’s currency being tied to another currency or a basket of currencies. In this system, the government or central bank intervenes in the foreign exchange market to maintain the currency’s value within a specific range. This approach provides stability for international trade and investment but can limit a country’s ability to respond to economic shocks.

For example, if a country’s economy is struggling, maintaining a pegged exchange rate may require significant intervention, such as depleting foreign reserves to support the currency’s value. Countries that adopt this system must have strong fiscal and monetary policies to maintain the peg effectively.

Managed Float Exchange Rate System

A managed float exchange rate system, also known as a dirty float, combines elements of both free-floating and pegged systems. In this system, the currency’s value is primarily determined by market forces, but the government or central bank intervenes periodically to stabilize the currency when necessary.

This approach allows for some flexibility while still providing a level of control to manage extreme volatility. Countries using a managed float system can respond to economic conditions by allowing their currencies to float freely most of the time but stepping in to intervene when market fluctuations threaten economic stability.

How Exchange Rates Are Calculated

Exchange rates can be expressed in two primary ways: direct and indirect quotation.

- Direct Quotation: In a direct quotation, the domestic currency is the base currency, and the exchange rate indicates how much of the foreign currency can be purchased with one unit of the domestic currency. For example, if the USD/EUR exchange rate is 1.07, it means one U.S. dollar can buy 1.07 euros.

- Indirect Quotation: In an indirect quotation, the foreign currency is the base currency, and the exchange rate shows how much of the domestic currency is needed to purchase one unit of the foreign currency. Using the previous example, if the EUR/USD exchange rate is 0.93, it indicates that one euro is equivalent to $0.93.

Understanding direct and indirect quotations is essential for businesses engaged in international transactions, as it affects pricing strategies and profit margins.

Cross Rates

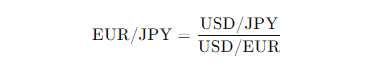

Cross rates are exchange rates between two currencies derived from their common relationship with a third currency. For instance, if you want to know the exchange rate between the euro and the Japanese yen, but only have the USD to EUR and USD to JPY exchange rates, you can calculate the cross rate.

To find the EUR/JPY exchange rate, you would use the following formula:

This method allows businesses to evaluate multiple currency relationships and make informed decisions regarding currency conversions and international transactions.

Exchange Rate Mechanisms

Several mechanisms can influence how exchange rates are calculated and adjusted, including:

- Central Bank Interventions: Central banks can influence exchange rates through monetary policy and direct market interventions. By buying or selling currencies, central banks can stabilize their currency’s value and control inflation.

- Interest Rate Differentials: The difference in interest rates between two countries can impact exchange rates. Higher interest rates in one country can attract foreign investment, leading to appreciation of that currency against others.

- Economic Indicators: Key economic indicators, such as GDP growth, inflation rates, and employment data, provide insights into a country’s economic health, influencing investor perceptions and, subsequently, exchange rates.

The Role of the Forex Market

The foreign exchange market, or forex market, is a decentralized global marketplace for trading currencies. It is one of the largest and most liquid financial markets in the world, with daily trading volumes exceeding $6 trillion. Participants include central banks, financial institutions, corporations, and individual traders.

Trading in the forex market occurs 24 hours a day, five days a week, allowing for constant price fluctuations and immediate responses to economic news and events. The lack of a central exchange allows for a wide range of participants and trading strategies, leading to diverse opportunities and risks.

Major Currency Pairs

In the forex market, currencies are traded in pairs. The most commonly traded currency pairs include:

- Major Pairs: These include the USD paired with other major currencies, such as the EUR/USD, USD/JPY, and GBP/USD. Major pairs are characterized by high liquidity and tight spreads.

- Minor Pairs: Minor pairs consist of currencies that are less frequently traded, such as EUR/GBP or AUD/NZD. While they can offer trading opportunities, they may have wider spreads and lower liquidity.

- Exotic Pairs: Exotic pairs involve a major currency paired with a currency from a developing or emerging economy, such as USD/THB (Thai baht) or EUR/TRY (Turkish lira). Exotic pairs can be more volatile and carry higher risks.

Trading Strategies in the Forex Market

Traders in the forex market utilize various strategies to profit from currency fluctuations. Common strategies include:

- Scalping: This short-term strategy involves making numerous small trades throughout the day to capitalize on minor price movements. Scalpers rely on high liquidity and quick execution to maximize profits.

- Day Trading: Day traders buy and sell currencies within the same trading day, closing all positions before the market closes. This strategy aims to profit from intraday price movements while avoiding overnight risk.

- Swing Trading: Swing traders hold positions for several days or weeks, seeking to profit from larger price swings. This strategy relies on technical analysis and market trends to identify potential entry and exit points.

The Impact of Exchange Rates on the Economy

Exchange rates directly impact inflation and purchasing power. When a country’s currency depreciates, the cost of imported goods rises, leading to higher inflation. Conversely, a stronger currency reduces the cost of imports, which can help keep inflation in check.

Changes in inflation rates can also influence central bank policies, leading to adjustments in interest rates that can further affect exchange rates. For instance, if inflation rises significantly, a central bank may increase interest rates to combat inflation, leading to an appreciation of the currency.

Trade Balance and Economic Growth

Exchange rates play a vital role in determining a country’s trade balance. A weaker currency can enhance export competitiveness, as domestic goods become cheaper for foreign buyers. This can lead to an increase in exports, positively impacting economic growth.

Conversely, a stronger currency can make imports cheaper, potentially leading to increased consumption of foreign goods. While this may benefit consumers, it can negatively impact domestic producers who struggle to compete with cheaper imports. A persistent trade deficit can also lead to currency depreciation over time.

Foreign Investment

Exchange rates also influence foreign direct investment (FDI). Countries with stable currencies and positive economic prospects attract more foreign investment, leading to currency appreciation. In contrast, countries with volatile currencies may deter investment, leading to depreciation.

Investors often analyze exchange rate trends alongside economic indicators when making investment decisions. A stable and appreciating currency can signal a healthy economy, encouraging more foreign investment and fostering economic growth.

Managing Exchange Rate Risks

Businesses engaged in international trade often face risks associated with fluctuating exchange rates. To mitigate these risks, companies can employ various hedging strategies, including:

- Forward Contracts: A forward contract allows a business to lock in an exchange rate for a future date. This strategy helps companies budget effectively by eliminating uncertainty regarding future currency costs.

- Options: Currency options provide businesses with the right, but not the obligation, to buy or sell a currency at a predetermined exchange rate. This strategy offers flexibility while protecting against unfavorable movements.

- Natural Hedging: Some businesses can reduce currency risk by diversifying their operations across multiple countries. By balancing revenues and expenses in different currencies, companies can minimize the impact of exchange rate fluctuations.

Monitoring Exchange Rates

Regularly monitoring exchange rates is essential for businesses engaged in international trade. Companies can use various tools and resources to track currency movements, including forex market data, economic indicators, and financial news.

Establishing a currency risk management policy can help businesses navigate the complexities of exchange rate fluctuations. This policy should outline procedures for monitoring rates, evaluating risks, and implementing hedging strategies to protect against unfavorable currency movements.

Central Bank Interventions

Central banks can intervene in the forex market to stabilize their currencies and manage exchange rate fluctuations. These interventions can take various forms, including:

- Open Market Operations: Central banks may buy or sell currencies to influence exchange rates. For instance, buying foreign currency can increase demand for a domestic currency, leading to appreciation.

- Interest Rate Adjustments: By changing interest rates, central banks can influence capital flows and currency values. Higher interest rates typically attract foreign investment, leading to currency appreciation.

- Currency Pegs: Some central banks maintain fixed exchange rates by pegging their currency to another currency. This approach can provide stability but requires significant reserves and intervention capabilities.

FAQs

An exchange rate is the value of one currency expressed in terms of another currency. It determines how much of one currency you can obtain in exchange for another. For instance, if the exchange rate between the U.S. dollar (USD) and the euro (EUR) is 1.07, it means that one euro can be exchanged for $1.07.

Exchange rates are determined by several factors, including interest rates, inflation, economic performance, political stability, and market sentiment. They can either float freely based on market supply and demand or be fixed to another currency.

Floating exchange rates fluctuate based on market forces without direct government intervention, reflecting real-time economic conditions. In contrast, fixed exchange rates are pegged to another currency and maintained by the government or central bank to provide stability.

Interest rates play a crucial role in determining exchange rates. When a country’s central bank raises interest rates, it generally leads to currency appreciation, as higher rates attract foreign investment. Conversely, lower interest rates can result in depreciation as investors seek better returns elsewhere.

Political stability is a key factor for investor confidence. Countries with stable governments and sound economic policies attract foreign investment, which strengthens their currency. Political uncertainty or turmoil can lead to currency depreciation as investors seek safer investments.

Yes, exchange rates significantly impact international trade. A weaker currency can boost exports by making goods cheaper for foreign buyers, while a stronger currency can make imports less expensive, influencing domestic consumption patterns.

Exchange rates can be monitored through various financial news platforms, banking institutions, and dedicated currency conversion websites. Many financial apps also provide real-time exchange rate updates to help users make informed decisions.

Conclusion

Exchange rates are a fundamental aspect of the global economy, influencing trade dynamics, investment decisions, and consumer behavior. Understanding how exchange rates are determined, the factors that influence them, and the mechanisms at play can help individuals and businesses navigate the complexities of international finance.

By staying informed about economic indicators, market trends, and hedging strategies, businesses can effectively manage exchange rate risks and optimize their operations in the global marketplace. The interplay between currencies, economies, and market sentiment underscores the importance of exchange rates in shaping the economic landscape, making it essential for all stakeholders to remain vigilant and informed in this ever-changing environment.

Leave a Reply

Want to join the discussion?Feel free to contribute!