Advanced Forex Trading Techniques

Advanced forex trading techniques offer experienced traders sophisticated methods and tools to navigate the volatile forex market effectively. This guide explores 11 of the best advanced forex trading techniques, providing detailed insights into each approach. These techniques are designed to cater to different trading styles and objectives, helping traders maximize their profits and manage risks efficiently.

Contents

What is Advanced Forex Trading?

Advanced forex trading refers to the use of complex strategies and analytical tools to trade in the foreign exchange market. Unlike basic trading methods, advanced techniques require a deep understanding of market mechanics, technical and fundamental analysis, and risk management.

These methods often involve intricate algorithms, a variety of technical indicators, and comprehensive economic data analysis. The goal is to predict market movements more accurately and execute trades with higher precision. Advanced traders utilize these techniques to gain an edge over the market, making more informed decisions based on a broader range of data and analytical tools.

Importance of Advanced Techniques

Advanced techniques are crucial for experienced traders looking to gain a competitive edge. These strategies help identify high-probability trading opportunities, manage risk more effectively, and enhance overall profitability. By employing advanced methods, traders can better navigate the complexities of the forex market, adapting to different market conditions and improving their trading performance.

These techniques also enable traders to respond more swiftly to market changes. With the ability to analyze multiple factors simultaneously, advanced traders can react to news events, economic shifts, and market trends more efficiently, capitalizing on opportunities that less sophisticated strategies might miss.

Who Should Use Advanced Techniques?

While beginners can benefit from understanding advanced forex trading concepts, these techniques are typically more suitable for experienced traders. Those with a solid foundation in basic trading principles and sufficient trading experience can leverage advanced techniques to improve their trading performance.

Experienced traders who have mastered basic trading strategies will find advanced techniques more beneficial. These methods require a deep understanding of market dynamics, the ability to interpret complex data, and the skill to execute trades with precision. Advanced techniques are best suited for traders who are committed to continuous learning and adapting their strategies to stay ahead in the fast-paced forex market.

Factors to Consider When Choosing Advanced Forex Trading Techniques

Trading Goals

Before selecting a technique, traders need to define their trading goals. Whether the objective is to achieve short-term gains, long-term wealth accumulation, or hedging against risk, understanding one’s goals will guide the choice of technique.

For instance, a trader looking for short-term gains might prefer high-frequency trading techniques like scalping, while someone focused on long-term growth might opt for position trading. Clear goals help in selecting the right strategy that aligns with the trader’s expectations and investment horizon.

Risk Tolerance

Different techniques come with varying levels of risk. Traders must assess their risk tolerance and choose techniques that align with their comfort level. High-frequency techniques like scalping may suit aggressive traders, while long-term techniques like position trading may be better for conservative traders.

Risk tolerance also influences how a trader manages their portfolio. Those with a higher risk tolerance might employ strategies that involve larger positions and more frequent trades, while risk-averse traders might focus on techniques that emphasize stability and lower volatility.

Market Conditions

Market conditions play a significant role in the effectiveness of a trading technique. For instance, breakout strategies work well in volatile markets, while carry trades are more effective in stable markets with significant interest rate differentials. Understanding the current market environment is essential for selecting the right technique.

Traders need to stay informed about market trends, economic events, and geopolitical developments that can influence currency movements. Adapting their strategies to the prevailing market conditions can help in maximizing returns and minimizing risks.

Time Commitment

The time a trader can dedicate to trading is another crucial factor. Techniques like scalping and day trading require constant monitoring and quick decision-making, while long-term techniques like position trading require less frequent attention.

Traders with limited time may prefer strategies that do not require constant oversight, allowing them to balance trading with other commitments. Conversely, those who can dedicate more time might find high-frequency trading more rewarding.

Technical and Fundamental Analysis Skills

Proficiency in technical and fundamental analysis is essential for advanced forex trading. Traders should choose techniques that match their analytical strengths. For example, technically inclined traders might prefer scalping or breakout strategies, while those adept at fundamental analysis might lean towards carry trades or position trading.

Understanding technical indicators and economic data allows traders to make more informed decisions. Advanced techniques often require a combination of both types of analysis to achieve the best results.

Access to Tools and Resources

Advanced trading often requires sophisticated tools and resources, such as high-speed internet, advanced trading platforms, real-time data feeds, and economic calendars. Ensuring access to these resources is vital for implementing advanced techniques successfully.

Having the right tools can significantly enhance a trader’s ability to analyze the market, execute trades efficiently, and monitor their positions. Investing in quality resources can make a substantial difference in trading performance.

11 Best Advanced Forex Trading Techniques

1. Forex Scalping

What is Forex Scalping?

Forex scalping is a high-frequency trading technique that involves making numerous trades within a single trading day to profit from small price movements. Traders using this technique aim to accumulate small, quick profits throughout the day, which can add up to significant returns over time.

Scalping requires traders to hold positions for very short periods, often just seconds or minutes. The key is to enter and exit trades rapidly, taking advantage of small price fluctuations. This approach demands a high level of discipline and the ability to make quick decisions.

How Does Scalping Work?

Scalpers typically hold their positions for a very short period, often just seconds or minutes. They rely on technical analysis and real-time charts to identify patterns and signals that indicate potential price movements. The goal is to enter and exit trades quickly, capturing small price differentials.

Tools such as moving averages, Bollinger Bands, and support and resistance levels are commonly used to identify trading opportunities. High-speed internet connections and advanced trading platforms are essential to execute trades swiftly and efficiently.

Tools and Techniques for Scalping

Successful scalping requires the use of various technical indicators, such as moving averages, Bollinger Bands, and support and resistance levels. These tools help traders make informed decisions about when to enter and exit trades. High-speed internet connections and advanced trading platforms are also essential for executing trades swiftly.

Scalpers must also stay informed about market news and events that can cause sudden price movements. They often use economic calendars to track important announcements and adjust their strategies accordingly.

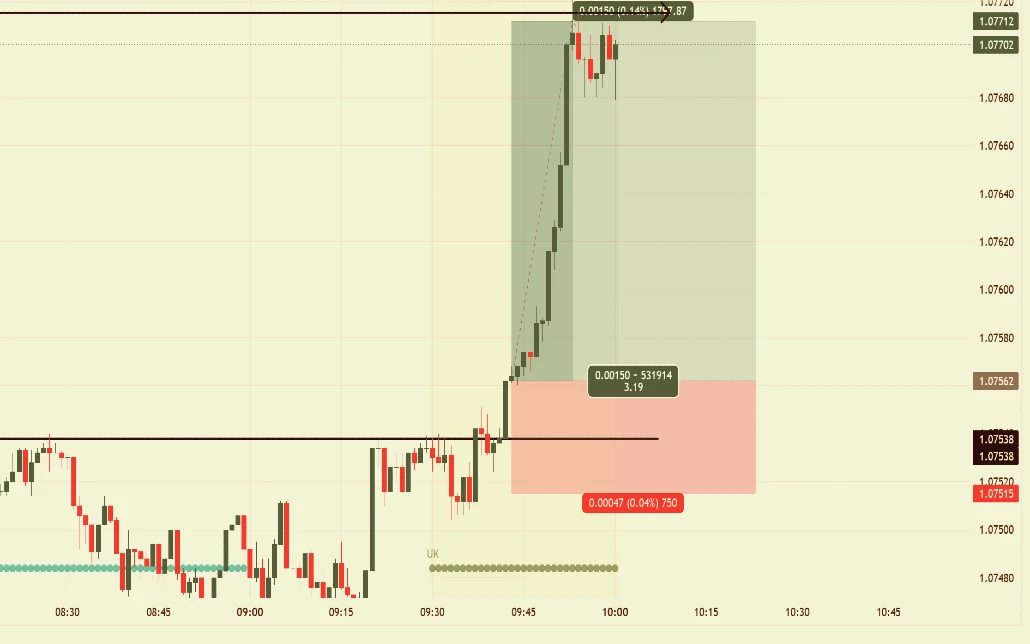

2. Breakout Trading

Breakout trading is a technique that involves entering a trade when the price breaks out from a defined range or pattern, such as a support and resistance level, trend line, or chart pattern. Breakouts often indicate the beginning of a significant price movement, offering an opportunity for substantial profits.

Identifying Breakouts

Traders use various tools to identify potential breakouts, including trend lines, support and resistance levels, and volume indicators. A breakout is confirmed when the price moves beyond these levels with increased volume, signaling a strong momentum shift.

Breakouts can occur in both directions, providing opportunities for both long and short trades. Identifying the right breakout points is crucial for maximizing profits and minimizing risks.

Executing Breakout Trades

To execute a breakout trade, traders set entry points just above the resistance level for long positions or just below the support level for short positions. Stop-loss orders are placed near the breakout point to minimize potential losses if the breakout fails.

Traders must monitor the market closely and act quickly to capitalize on breakout opportunities. Using additional confirmation tools can help avoid false breakouts and improve the accuracy of trades.

Benefits and Challenges

Breakout trading can be highly profitable during periods of high market volatility. However, it also carries the risk of false breakouts, where the price briefly moves beyond the breakout point but then reverses direction. Traders must use additional confirmation tools and maintain strict risk management practices to mitigate these risks.

3. Carry Trade Strategy

Carry trading involves borrowing in a currency with a low interest rate and investing in a currency with a higher interest rate. The goal is to profit from the interest rate differential between the two currencies. This technique is typically used over a longer time horizon.

How to Implement Carry Trades

To implement a carry trade, traders need to identify currency pairs with significant interest rate differentials. They borrow in the lower-yielding currency and invest in the higher-yielding currency, earning the interest rate differential as profit.

Carry trades often involve holding positions for extended periods, allowing traders to accumulate interest payments over time. This strategy requires a thorough understanding of interest rate policies and economic conditions in the countries of the currencies involved.

Key Considerations

Successful carry trading requires a thorough understanding of interest rate policies and economic conditions in the countries of the currencies involved. Traders must also consider the potential impact of currency fluctuations, as adverse movements can offset the interest rate gains.

Monitoring central bank policies and economic indicators is essential for anticipating changes in interest rates that could affect the profitability of carry trades. Traders should also be aware of geopolitical events that might impact currency values.

Risks and Rewards

The main advantage of carry trading is the potential for steady income from interest rate differentials. However, it also carries significant risks, including currency risk and interest rate changes. Traders must monitor economic indicators and central bank policies closely to manage these risks effectively.

Carry trades can be particularly vulnerable to market volatility and sudden changes in interest rates. Implementing risk management techniques, such as setting stop-loss orders, can help mitigate potential losses.

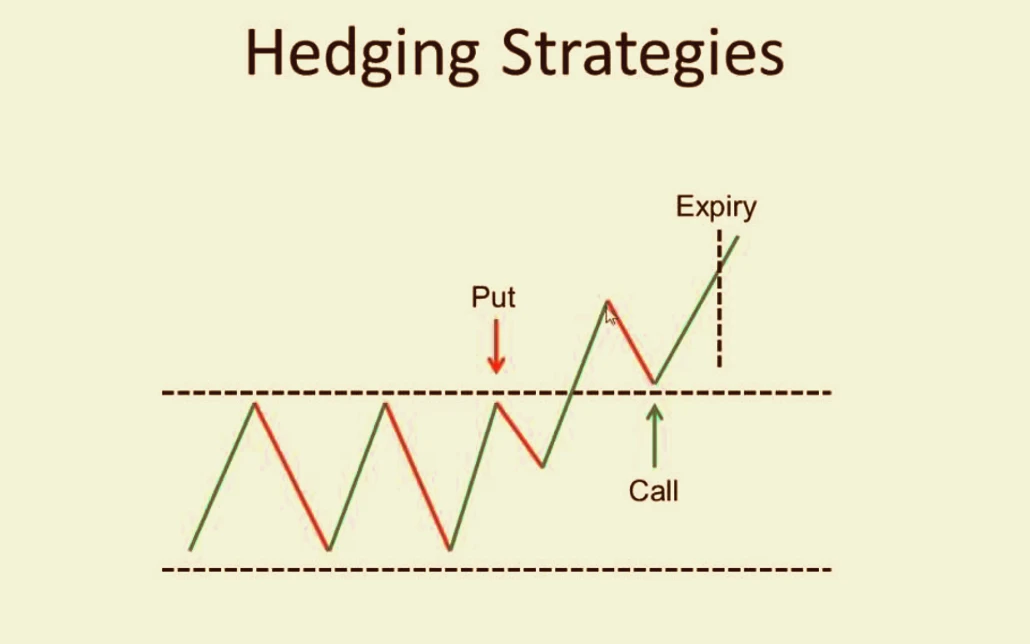

4. Hedging Forex

Forex hedging is a technique used to protect against potential losses in forex trading by taking offsetting positions in correlated currency pairs or using financial instruments like options and futures contracts. The goal is to reduce risk exposure and mitigate the impact of adverse market movements.

Hedging Techniques

There are several techniques for hedging forex positions, including direct hedging, where a trader takes an opposite position in the same currency pair, and cross-hedging, where a trader takes a position in a correlated currency pair. Options and futures contracts can also be used to hedge against potential losses.

Direct hedging involves opening a trade that is opposite to an existing position, effectively neutralizing risk. Cross-hedging involves taking a position in a related currency pair that is expected to move in the opposite direction, offsetting potential losses.

Implementing a Hedging Strategy

To implement a hedging strategy, traders need to identify their risk exposure and choose appropriate hedging instruments. This may involve using technical and fundamental analysis to determine potential market movements and selecting the best hedging approach based on the trader’s risk tolerance and investment goals.

Hedging strategies should be regularly reviewed and adjusted based on changes in market conditions and risk exposure. Proper implementation requires a thorough understanding of the instruments being used and their potential impact on overall portfolio performance.

Advantages and Drawbacks

The main advantage of forex hedging is the ability to reduce risk and protect against potential losses. However, it can also limit potential profits, as offsetting positions can negate gains from favorable market movements. Additionally, hedging techniques can be complex and require careful planning and execution.

Hedging can also involve additional costs, such as transaction fees and premiums for options or futures contracts. Traders must weigh these costs against the benefits of risk reduction to determine the effectiveness of their hedging strategy.

5. News Trading

News trading involves making trading decisions based on news releases and economic data. This technique aims to capitalize on the volatility and price movements caused by significant news events, such as economic reports, geopolitical developments, and central bank announcements.

Identifying Key News Events

Traders use economic calendars and news feeds to identify key news events that are likely to impact the forex market. Important events include interest rate decisions, employment reports, GDP releases, and inflation data. Understanding the potential impact of these events is crucial for successful news trading.

News events can cause rapid and substantial price movements, creating opportunities for profit. Traders need to stay informed and react quickly to news releases to take advantage of these market opportunities.

Strategies for News Trading

There are several strategies for trading the news, including trading the initial reaction to the news, trading the retracement after the initial spike, and trading the trend following the news release. Each approach requires a different level of risk tolerance and market analysis.

Traders might enter positions immediately after a news release to capitalize on the initial volatility or wait for a retracement before entering a trade. Trend-following strategies involve assessing the longer-term impact of the news and positioning accordingly.

Risks and Opportunities

News trading can offer significant opportunities for profit due to the high volatility and large price movements that often accompany major news events. However, it also carries substantial risks, as markets can be unpredictable and react differently than expected. Traders must be prepared for rapid market movements and use strict risk management practices.

The unpredictability of news events can lead to unexpected price swings and increased market noise. Traders should use stop-loss orders and other risk management techniques to protect their capital and manage potential losses.

6. Day Trading Strategy

Day trading is a technique where all positions are opened and closed within the same trading day. The goal is to profit from intraday price movements without holding positions overnight, reducing exposure to overnight market risk.

Tools and Techniques for Day Trading

Successful day trading requires a combination of technical analysis, chart patterns, and intraday indicators. Common tools include moving averages, Bollinger Bands, and relative strength index (RSI). Traders also use advanced trading platforms and high-speed internet connections to execute trades quickly.

Day traders rely on real-time data and technical indicators to make quick decisions. They often use chart patterns and intraday volatility to identify trading opportunities and manage their positions throughout the trading day.

Day Trading Strategies

There are several day trading strategies, including trend following, where traders capitalize on the momentum of a trend; counter-trend trading, where traders take positions against the prevailing trend; and breakout trading, where traders enter positions when the price breaks out of a defined range.

Each strategy requires a different approach to market analysis and trade execution. Day traders need to adapt their strategies based on market conditions and their trading style.

Advantages and Challenges

The main advantage of day trading is the ability to capitalize on intraday price movements and avoid overnight risk. However, it also requires intense focus, quick decision-making, and strict risk management. The fast-paced nature of day trading can be stressful, and transaction costs can add up quickly.

Day trading demands a high level of discipline and time commitment. Traders must be prepared for the psychological pressures of rapid decision-making and manage their risk effectively to avoid significant losses.

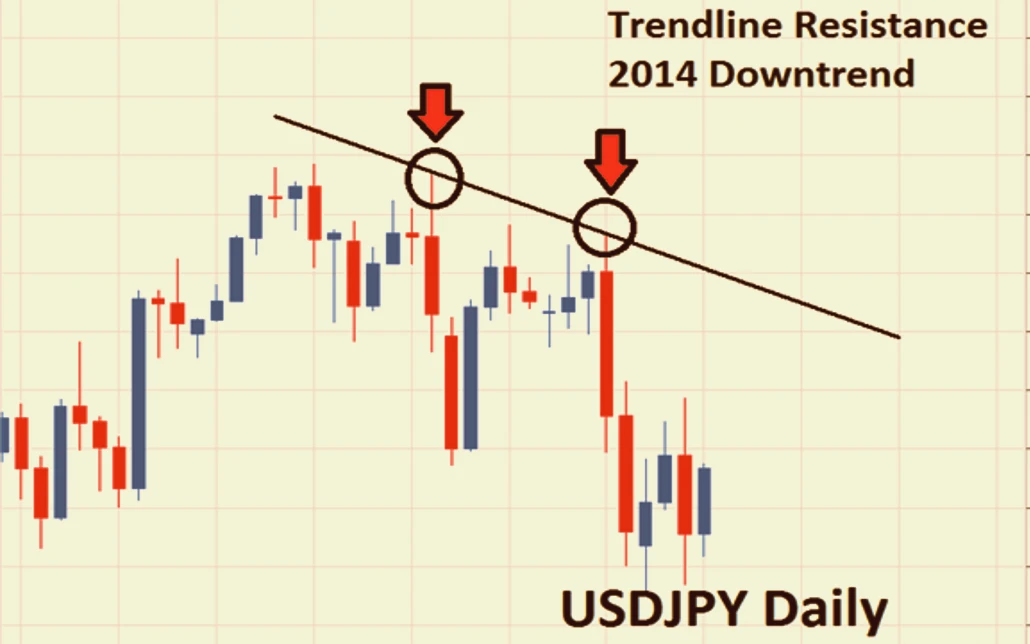

7. Retracement Trading

Retracement trading involves entering trades during a temporary price reversal within a larger trend. The goal is to take advantage of better entry prices within the context of the overall trend. Retracements are often identified using technical analysis tools.

Identifying Retracements

Common tools for identifying retracements include Fibonacci retracement levels, moving averages, and trend lines. These tools help traders determine potential levels where the price may reverse temporarily before continuing in the direction of the main trend.

Traders look for signs of a retracement within the overall trend to enter trades at favorable prices. Technical indicators and chart patterns can provide insights into potential retracement levels and price action.

Strategies for Retracement Trading

There are several strategies for retracement trading, including buying the dip in an uptrend and selling the rally in a downtrend. Traders use technical indicators to identify potential retracement levels and set entry and exit points based on these levels.

Retracement trading requires careful analysis of market trends and price movements. Traders must distinguish between temporary retracements and potential trend reversals to make informed trading decisions.

Risks and Rewards

Retracement trading can offer attractive entry points within a larger trend, potentially leading to higher profits. However, it also carries the risk of mistaking a retracement for a trend reversal. Traders must use additional confirmation tools and maintain strict risk management practices to mitigate this risk.

Successful retracement trading requires a clear understanding of the underlying trend and the ability to identify key support and resistance levels. Traders should be cautious of false signals and ensure their risk management strategies are in place.

8. Ichimoku Clouds

Ichimoku Clouds, also known as Ichimoku Kinko Hyo, is a comprehensive technical indicator that defines support and resistance levels, identifies trend direction, gauges momentum, and provides trading signals. It consists of five main components: the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span.

Components of Ichimoku Clouds

- Tenkan-sen (Conversion Line): A short-term moving average used to identify minor trends.

- Kijun-sen (Base Line): A medium-term moving average that serves as a reference for the overall trend.

- Senkou Span A and B (Leading Spans): These lines form the cloud, which represents support and resistance levels.

- Chikou Span (Lagging Span): A lagging indicator that shows the current price relative to past prices.

Ichimoku Clouds provide a comprehensive view of market conditions by combining multiple indicators into a single chart. Traders use these components to analyze trends, identify potential entry and exit points, and assess market momentum.

Using Ichimoku Clouds in Trading

Traders use Ichimoku Clouds to identify potential entry and exit points based on the interaction of the different components. For example, a buy signal is generated when the Tenkan-sen crosses above the Kijun-sen, while a sell signal is generated when the Tenkan-sen crosses below the Kijun-sen.

The cloud itself provides visual support and resistance levels, helping traders gauge the strength of trends and potential reversal points. Understanding the interaction between the cloud components is crucial for effective trading decisions.

Benefits and Challenges

Ichimoku Clouds provide a comprehensive view of market conditions and potential trading signals. However, it can be complex to interpret, especially for beginners. Traders must understand the different components and how they interact to use this indicator effectively.

While Ichimoku Clouds offer valuable insights, they may not be suitable for all trading styles. Traders need to be familiar with the nuances of the indicator and how it fits into their overall trading strategy.

9. Fundamental Analysis

Fundamental analysis involves evaluating a currency’s value by analyzing economic indicators, interest rates, GDP, employment rates, and other economic data. This method aims to predict currency movements based on economic fundamentals and long-term trends.

Key Economic Indicators

Important economic indicators for fundamental analysis include interest rates, inflation rates, GDP growth, employment data, and trade balances. Central bank policies and geopolitical events also play a crucial role in determining currency values.

Fundamental analysis provides a long-term perspective on currency movements by examining economic conditions and policy decisions. Traders use this information to forecast future trends and make informed trading decisions.

Applying Fundamental Analysis

To apply fundamental analysis, traders need to stay informed about economic data releases and central bank announcements. They use this information to assess the overall economic health of a country and predict future currency movements. Long-term trends and macroeconomic factors are crucial for making informed trading decisions.

Fundamental analysis requires continuous monitoring of economic news and data, as well as an understanding of how various factors interact to influence currency values. Traders should be able to interpret economic reports and assess their potential impact on the forex market.

Advantages and Drawbacks

The main advantage of fundamental analysis is its ability to provide a long-term perspective on currency movements. However, it can be time-consuming and requires a deep understanding of economic principles. Additionally, fundamental analysis may not be as effective for short-term trading, where technical analysis is often more useful.

Fundamental analysis can offer valuable insights for long-term traders but may not always capture short-term market fluctuations. Combining fundamental analysis with technical analysis can provide a more comprehensive trading approach.

10. Grid Trading

Grid trading is a technique that involves placing buy and sell orders at set intervals above and below a set price, creating a grid of orders. This strategy aims to profit from market volatility within a defined range, regardless of the market’s direction.

How to Implement Grid Trading

To implement a grid trading strategy, traders set a central price and define intervals for placing buy and sell orders. As the market moves, orders are executed, and new orders are placed at predefined levels. This creates a grid of positions that can generate profits as the market fluctuates.

Grid trading can be automated using trading software, allowing traders to execute orders and manage positions more efficiently. The strategy relies on market volatility and requires careful planning to set appropriate grid levels and manage risk.

Advantages and Disadvantages

The main advantage of grid trading is its ability to profit from both upward and downward market movements. It also reduces the need for precise market timing. However, grid trading can be risky if the market trends strongly in one direction, leading to significant losses. Traders must use risk management techniques, such as setting stop-loss orders, to mitigate these risks.

Grid trading can involve substantial capital and requires careful monitoring of market conditions. Traders must be prepared for potential drawdowns and ensure their risk management strategies are effective.

11. Position Trading

Position trading is a long-term technique that involves holding positions for weeks, months, or even years. The goal is to benefit from major shifts in the market by following long-term trends and economic developments.

How to Implement Position Trading

To implement a position trading strategy, traders use a combination of fundamental and technical analysis to identify long-term trends and potential entry points. They set their positions and hold them for extended periods, aiming to capture significant market movements.

Position traders focus on broader economic trends and long-term market dynamics. They use fundamental analysis to assess the economic outlook and technical analysis to identify key entry and exit points.

Advantages and Risks

The main advantage of position trading is the potential for substantial profits from major market shifts. It also requires less frequent trading, reducing transaction costs. However, position trading also carries the risk of significant drawdowns during adverse market conditions. Traders must have a strong understanding of market fundamentals and use risk management techniques to protect their positions.

Position trading requires patience and a long-term perspective. Traders must be prepared for potential volatility and market fluctuations while maintaining a disciplined approach to trading.

Comparing Advanced Forex Trading Techniques

To help traders choose the best technique for their needs, the following table compares the key features of each advanced forex trading technique:

| TECHNIQUE | TIMEFRAME | KEY TOOLS AND INDICATORS | RISK LEVEL | PROFIT POTENTIAL |

|---|---|---|---|---|

| Forex Scalping | Seconds-Minutes | Moving Averages, Bollinger Bands | High | Moderate |

| Breakout Technique | Various | Trend Lines, Volume Indicators | Moderate | High |

| Carry Trade | Long-term | Interest Rate Differentials | Moderate | Moderate |

| Hedging Forex | Various | Options, Futures Contracts | Low-Moderate | Low-Moderate |

| News Trading | Short-term | Economic Calendars, News Feeds | High | High |

| Day Trading | Intraday | Technical Indicators, Chart Patterns | High | Moderate-High |

| Retracement Trading | Various | Fibonacci Retracement Levels | Moderate | Moderate |

| Ichimoku Clouds | Various | Ichimoku Kinko Hyo Indicator | Moderate | Moderate |

| Fundamental Analysis | Long-term | Economic Data, Central Bank Policies | Low-Moderate | Moderate-High |

| Grid Trading | Various | Grid Trading Software | Moderate-High | High |

| Position Trading | Long-term | Fundamental and Technical Analysis | Low-Moderate | High |

Conclusion

Advanced forex trading techniques offer traders a diverse range of methods to navigate the complex and volatile forex market. Each technique has its own advantages, risks, and requirements, making it essential for traders to choose the one that best fits their trading style, risk tolerance, and investment goals. By understanding and applying these techniques effectively, traders can enhance their potential for success in the forex market.

FAQs

Forex scalping is a trading strategy that involves making a large number of trades within a very short period to profit from small price movements. Scalpers aim to capture tiny price changes and typically hold positions for seconds to minutes.

Key Tools: Moving averages, Bollinger Bands, and other short-term indicators.

Risk Level: High, due to frequent trading and the need for precise timing.

Profit Potential: Moderate, as profits per trade are small but accumulated over many trades.

The breakout technique involves entering trades when the price breaks out of a defined range or technical level, such as support or resistance. Traders anticipate that the price will continue to move in the direction of the breakout.

Key Tools: Trend lines, volume indicators, and price patterns.

Risk Level: Moderate, as false breakouts can occur.

Profit Potential: High, especially if the breakout leads to a strong trend.

A carry trade involves borrowing money in a currency with a low interest rate and investing it in a currency with a higher interest rate. The trader profits from the interest rate differential, also known as the “carry.”

Key Tools: Interest rate differentials, central bank policies.

Risk Level: Moderate, as changes in interest rates and currency movements can affect profitability.

Profit Potential: Moderate, depending on the interest rate differential and currency fluctuations.

Hedging is a strategy used to reduce or eliminate risk by taking an opposite position in the forex market or using financial instruments like options and futures.

Key Tools: Options, futures contracts, and correlated currency pairs.

Risk Level: Low to moderate, as it aims to reduce exposure but can limit potential gains.

Profit Potential: Low to moderate, as hedging often results in smaller net gains due to the offsetting positions.

News trading involves making trading decisions based on economic news and data releases that can cause significant market volatility. Traders aim to capitalize on price movements triggered by news events.

Key Tools: Economic calendars, news feeds, and volatility indicators.

Risk Level: High, due to the unpredictable nature of news impacts.

Profit Potential: High, as significant news events can lead to substantial price movements.

Day trading involves buying and selling currency pairs within the same trading day to profit from short-term price movements. Positions are closed before the end of the trading day to avoid overnight risk.

Key Tools: Technical indicators, chart patterns, and real-time data.

Risk Level: High, due to the fast-paced nature and frequent trading.

Profit Potential: Moderate to high, depending on market volatility and trading skills.

Retracement trading involves entering trades during a temporary reversal within a larger trend. Traders aim to buy at lower prices during an uptrend or sell at higher prices during a downtrend.

Key Tools: Fibonacci retracement levels, moving averages, and trend lines.

Risk Level: Moderate, as traders must distinguish between temporary retracements and trend reversals.

Profit Potential: Moderate, as it provides opportunities to enter trades at better prices within a trend.

Ichimoku Clouds is a technical indicator that provides a comprehensive view of market conditions by defining support and resistance levels, trend direction, and momentum. It consists of five components: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span.

Key Tools: Ichimoku Kinko Hyo components.

Risk Level: Moderate, due to the complexity of interpreting multiple components.

Profit Potential: Moderate, depending on the accuracy of trend and signal interpretation.

Leave a Reply

Want to join the discussion?Feel free to contribute!