Major vs. Minor Currency Pairs

In the world of forex trading, understanding the difference between major and minor currency pairs is crucial for traders of all levels. Major currency pairs, such as EUR/USD and USD/JPY, involve the US Dollar and are the most widely traded pairs in the market. These pairs are characterized by high liquidity, tighter spreads, and lower volatility, making them popular among beginners and experienced traders alike.

On the other hand, minor currency pairs, also known as "crosses," do not include the US Dollar and often involve other major currencies like the Euro, British Pound, or Japanese Yen. While these pairs offer unique trading opportunities, they typically come with lower liquidity, wider spreads, and higher volatility. This can lead to larger price swings and the potential for higher profits, but also greater risks.

Choosing between major and minor pairs depends on your trading goals, risk tolerance, and strategy. Major pairs are ideal for those looking for stability and predictability, while minor pairs can offer exciting opportunities for diversification and higher returns. By understanding these differences, traders can make more informed decisions and better navigate the dynamic forex market.

How to Choose the Right Forex Broker

Navigating the world of forex trading can be both exciting and overwhelming. The forex market is the largest and most liquid in the world, offering vast opportunities for profit. However, success in this dynamic environment largely depends on choosing the right forex broker to partner with. A forex broker serves as your gateway to the market, providing the platform, tools, and support needed to execute trades and manage your portfolio effectively.

When selecting a forex broker, it's crucial to consider several key factors to ensure that your trading experience is both secure and rewarding. Regulatory compliance should be at the top of your checklist, as it guarantees that your broker operates under strict guidelines designed to protect your investments. Equally important are the broker's fees and commissions, which can significantly impact your bottom line. Look for brokers with transparent pricing structures and competitive spreads to maximize your profitability.

Another critical aspect to evaluate is the trading platform offered by the broker. A user-friendly interface, advanced charting tools, and reliable execution speeds are essential for executing trades efficiently and effectively. Additionally, consider the variety of account types available, as well as the leverage and margin options that suit your trading style and risk tolerance.

Customer service is another factor that cannot be overlooked. Having access to responsive and knowledgeable support can make a significant difference, especially when dealing with technical issues or seeking guidance on complex trading strategies. Lastly, take advantage of educational resources and market analysis tools provided by brokers to enhance your trading knowledge and make informed decisions.

Ultimately, choosing the right forex broker involves thorough research and careful consideration of your trading goals and preferences. By selecting a broker that aligns with your needs and provides a robust platform for trading, you can set yourself up for success in the ever-evolving forex market.

How to Use Stop-Loss Orders Effectively

Stop-loss orders are a vital tool for managing investment risk, offering both protection against significant losses and a way to lock in profits. This comprehensive guide delves into the intricacies of stop-loss orders, explaining how they work, their various types, and their benefits and drawbacks. By setting a predetermined exit point, investors can mitigate potential losses and avoid emotional decision-making. We’ll explore how to determine the optimal stop-loss level, including percentage-based, support and resistance levels, and trailing stops. You'll also learn how to balance stop-loss orders with market conditions and individual stock volatility. Whether you’re a novice investor or a seasoned trader, understanding and implementing stop-loss orders can significantly enhance your investment strategy. Dive in to discover practical tips and best practices for using stop-loss orders to safeguard your investments and navigate market volatility with confidence.

How Political Events Affect Forex Markets

The Forex market, with a daily trading volume exceeding $5 trillion, is the largest and most liquid financial market globally. Political events significantly influence this market, creating volatility and impacting currency values. From changes in political leadership and government policies to geopolitical tensions and natural disasters, various political factors play a critical role in shaping Forex market dynamics.

For instance, the 2016 election of Donald Trump led to significant market fluctuations due to uncertainties surrounding his policies. Similarly, the Brexit referendum in 2016 caused the British pound to plummet as traders reacted to the uncertainty of the UK's future in the EU.

Monetary and fiscal policies, trade wars, and military conflicts are among the numerous factors that traders need to monitor. For example, the trade war between the U.S. and China, starting in 2018, led to increased Forex market volatility, affecting the values of both the Chinese yuan and the U.S. dollar.

Understanding these complex relationships between political events and Forex markets is crucial for traders. By staying informed, diversifying portfolios, using stop-loss orders, and focusing on long-term strategies, traders can navigate this volatile landscape more effectively. This guide provides insights, real-world examples, and strategies to help you understand and respond to political impacts on Forex markets.

Risk Management in Forex Trading

Forex trading can be both thrilling and daunting, akin to riding a roller coaster through the peaks and valleys of financial markets. Success demands a firm grasp of risk management. This document delves deep into the world of forex risk management,…

Central Banks' Role in Forex Markets forixo.trade

Central Banks' Role in Forex Markets forixo.trade Roles of Central Banks in Forex

Central banks play a pivotal role in the foreign exchange (forex) market and global economy. They are responsible for implementing monetary policy, regulating financial systems, and influencing currency values. The decisions and actions of central banks can significantly impact forex markets, affecting everything from exchange rates to international trade and investment flows. This summary explores the various roles central banks play in the forex market, their tools and strategies, and how traders can leverage central bank signals to inform their trading decisions.

Monetary Policy and Interest Rates

Monetary policy is the primary tool used by central banks to influence economic activity and control inflation. By adjusting interest rates and managing the money supply, central banks can stimulate or cool down an economy. Interest rates are a critical component of monetary policy, as they affect borrowing costs for consumers and businesses, influencing spending and investment decisions.

In the forex market, interest rates play a crucial role in determining currency values. When a central bank raises interest rates, it often leads to an appreciation of the country's currency. This is because higher interest rates attract foreign capital, as investors seek better returns on their investments. Conversely, when interest rates are lowered, it can result in currency depreciation, as investors may seek higher yields elsewhere.

The Impact of Central Bank Interventions

Central banks sometimes engage in currency interventions to influence exchange rates directly. This can involve buying or selling their own currency in the forex market to stabilize its value or achieve specific economic objectives. There are two primary types of currency interventions:

Direct Intervention: This involves the central bank actively buying or selling currency in the forex market to influence its value. This method is often used to stabilize volatile exchange rates or address imbalances in trade and investment flows.

Indirect Intervention: This involves using monetary policy tools, such as interest rates, to influence currency values indirectly. By changing interest rates or implementing unconventional measures like quantitative easing, central banks can affect currency values without directly intervening in the forex market.

Currency intervention can have significant implications for the forex market, affecting international trade, investment flows, and economic stability. Traders closely monitor central bank interventions for clues about future currency movements, as these actions can create opportunities or risks depending on the market context.

Forward Guidance and Market Expectations

Central banks use forward guidance as a communication tool to signal their future policy intentions to the market. Forward guidance provides explicit statements about the likely path of interest rates, helping manage market expectations and reduce uncertainty. By signaling their intentions, central banks can influence market behavior and achieve desired economic outcomes.

Traders analyze central bank communications for hawkish or dovish signals, which indicate the likelihood of rate hikes or cuts. Hawkish signals suggest tightening monetary policy and potentially higher interest rates, while dovish signals indicate the opposite. Understanding forward guidance helps traders anticipate market reactions and adjust their strategies accordingly.

The Role of Central Banks in Economic Stabilization

Central banks play a crucial role in stabilizing economies during periods of turbulence. During economic downturns or financial crises, central banks can use monetary policy tools to stimulate demand and support recovery. This includes cutting interest rates, purchasing assets through quantitative easing, and providing liquidity to financial institutions.

The global financial crisis of 2008 was a turning point for central banks, leading to unprecedented measures to stabilize economies and restore confidence in financial markets. The Federal Reserve, European Central Bank, and Bank of Japan implemented various policy measures, such as quantitative easing and interest rate cuts, to support economic recovery.

The COVID-19 pandemic posed unique challenges for central banks, requiring swift and coordinated responses to support economies and mitigate the crisis's impact. Central banks cut interest rates to near-zero levels, expanded asset purchase programs, and provided liquidity support to financial institutions, helping stabilize markets and support recovery.

Forex Traders and Central Bank Signals

Forex traders closely monitor central bank signals to anticipate future monetary policy changes and adjust their trading strategies accordingly. Economic calendars are essential tools for traders, providing a schedule of upcoming central bank meetings, economic data releases, and other events that can impact currency markets.

By analyzing central bank statements and speeches, traders can gain insights into forward guidance and develop informed trading strategies. Understanding central bank signals helps traders position themselves to profit from expected currency movements and manage risks effectively.

Case Studies: Central Bank Interventions

Swiss National Bank and the Swiss Franc: In 2011, the Swiss National Bank (SNB) implemented a policy to cap the Swiss franc's appreciation against the euro, stabilizing the franc and supporting Swiss exporters. This intervention involved massive purchases of foreign currency and was maintained until 2015 when the SNB unexpectedly abandoned the policy, leading to a sharp appreciation of the franc.

European Central Bank and Quantitative Easing: In 2015, the European Central Bank (ECB) launched a quantitative easing program to address low inflation and stimulate growth in the Eurozone. The program involved large-scale purchases of government and corporate bonds, reducing interest rates and supporting economic recovery.

Bank of Japan and Negative Interest Rates: In 2016, the Bank of Japan (BOJ) introduced negative interest rates to combat deflation and stimulate growth. This policy aimed to encourage lending and investment, but it also faced criticism for its impact on bank profitability and financial stability.

Future Trends in Central Banking

Central banks are continually evolving to address new economic challenges and opportunities. Emerging trends include the exploration of central bank digital currencies (CBDCs), incorporating climate change considerations into policy frameworks, and adapting to advances in financial technology (fintech).

As digital technologies reshape the global economy, central banks are exploring the development of CBDCs to improve payment systems and enhance financial inclusion. They are also adapting regulatory frameworks to address the risks and opportunities associated with digital technologies, ensuring financial stability and fostering innovation.

In conclusion, central banks play a vital role in shaping the forex market and influencing global economic dynamics. By understanding the roles and actions of central banks, forex traders can navigate the complexities of the market and make informed decisions. Staying informed and proactive is essential for success in the ever-changing landscape of the forex market.

Position Trading in Forex

Position trading in forex offers a unique and strategic approach for those willing to embrace the long haul. Imagine holding a trade for months, riding out the ups and downs, and finally seeing the market move in your favor. It’s not for the faint-hearted, but the rewards can be substantial. Picture this: you identify a long-term trend, stick with it through thick and thin, and reap the benefits of major market shifts. The key to successful position trading lies in a deep understanding of fundamental analysis and a robust trading plan. It’s not just about picking a currency pair and waiting—it's about carefully analyzing economic indicators, central bank policies, and market trends. Tools like moving averages and RSI help pinpoint the right moments to enter and exit. But remember, this isn’t a get-rich-quick scheme. It demands patience, discipline, and a strong emotional backbone. Have you ever wondered how some traders seem to have the patience of saints? They’re likely position traders, focused on long-term gains rather than short-term thrills. If you’re ready to take a measured approach to forex trading, position trading might be your path to substantial profits and a deeper understanding of the market. Dive in, and discover the strategy that could transform your trading journey.

Swing Trading Basics

Swing trading might sound like financial jargon to some, but it’s a strategy that can offer significant rewards when approached with the right mindset and tools. Imagine catching the wave of a stock’s price movement, riding it for a few days or weeks, and then moving on to the next opportunity. That's the essence of swing trading. It’s about making the most of short- to medium-term price swings, without the need to monitor the market minute by minute like a day trader.

From my own experience, I recall a period when I was drawn to swing trading because it allowed me to balance my trading activity with a busy schedule. I would scan charts, spot potential setups, and place trades with a clear strategy in mind, all while managing other responsibilities. The key was to stay disciplined and avoid the urge to overtrade, a common pitfall for many.

In this guide, we’ll dive into the core strategies that define swing trading, including how to use technical analysis to your advantage and manage risk effectively. We’ll also touch on tools that can enhance your trading experience, from stock screeners to educational resources. Whether you’re new to swing trading or looking to refine your approach, this guide will provide you with practical insights and actionable tips to help you navigate the markets more confidently. So, are you ready to catch your next big swing? Let’s get started!

Day Trading Strategies for Forex

Day trading in the Forex market can be both exhilarating and daunting. The constant fluctuations in currency pairs offer endless opportunities—and challenges. So, how can traders navigate this dynamic landscape effectively?

In this comprehensive guide, we explore a variety of Forex day trading strategies that cater to different trading styles and risk appetites. From scalping, where quick, small trades are the name of the game, to swing trading, which captures short-to-medium-term gains over several sessions, there's a method for every trader. We delve into the intricacies of trend trading, mean reversion, and the breakout strategy, providing real-life anecdotes to illustrate key points.

Consider the time I executed a swing trade on the GBP/USD pair. By leveraging Fibonacci retracement levels, I identified optimal entry and exit points, resulting in a substantial profit. These personal experiences highlight the importance of using technical analysis tools and maintaining discipline.

Risk management is another critical aspect we cover, including setting stop-loss and take-profit levels, calculating position sizes, and diversifying trades. Emotional control and maintaining a trading mindset are essential for staying objective and resilient in the face of market volatility.

Technology also plays a pivotal role in modern trading. We discuss the benefits of automated trading systems and the features of popular trading platforms like MetaTrader 4 and TradingView. Utilizing data and analytics for backtesting and strategy optimization ensures your trading approach remains robust.

Join us as we share practical tips, personal insights, and detailed strategies to help you succeed in Forex day trading. Whether you're a novice or an experienced trader, this guide is designed to enhance your trading journey.

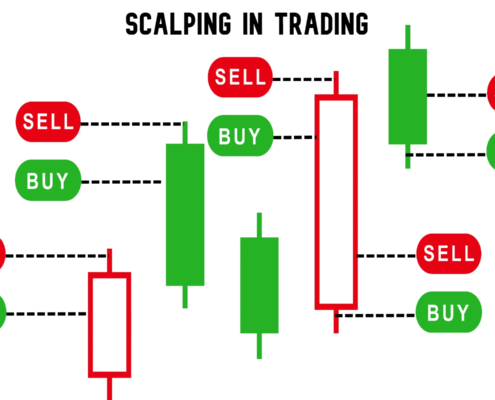

Scalping in Trading

Scalping in trading is a high-frequency strategy that aims to profit from small price movements by executing numerous trades within a single day. Unlike other trading styles that might hold positions for days or weeks, scalping involves quick in-and-out trades to capture minimal price changes. This method requires precise timing, a thorough understanding of market dynamics, and the ability to manage risks effectively.

In this comprehensive guide, we delve into the fundamentals of scalping, including its definition, key characteristics, and various strategies such as market making and trend following. We also cover essential technical analysis tools like candlestick charts and moving averages that scalpers use to make informed decisions. Additionally, the guide explores the risks associated with scalping, including high transaction costs and leverage risks, and provides best practices for effective risk management.

Whether you’re an experienced trader or new to scalping, this guide offers valuable insights and practical tips to enhance your trading performance. Discover how to navigate the fast-paced world of scalping and make the most of short-term market opportunities.