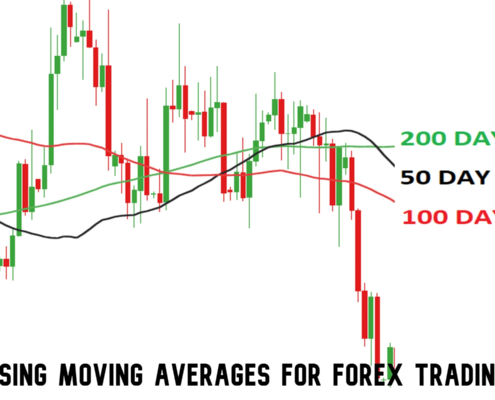

Using Moving Averages for Forex Trading

Moving averages are crucial tools in Forex trading, offering traders a way to smooth out price data and identify trends with greater clarity. This comprehensive guide delves into various moving average strategies, including the Simple Moving Average (SMA) and Exponential Moving Average (EMA). You'll discover how to implement these indicators to spot trading opportunities, manage risks, and refine your trading strategies.

The document covers practical applications such as the EMA crossover strategy, moving average envelopes, and the moving average ribbon, providing step-by-step instructions and real-world examples. Additionally, learn about the Moving Average Convergence Divergence (MACD) and the Guppy Multiple Moving Average (GMMA) to enhance your analysis and decision-making processes.

By understanding the nuances of these indicators and how they can be combined with other technical tools, traders can improve their market analysis and increase their chances of success. Whether you're a day trader or a long-term investor, this guide equips you with the knowledge to effectively use moving averages in various market conditions. Dive into the strategies, backtest them, and refine your approach to excel in the dynamic world of Forex trading.

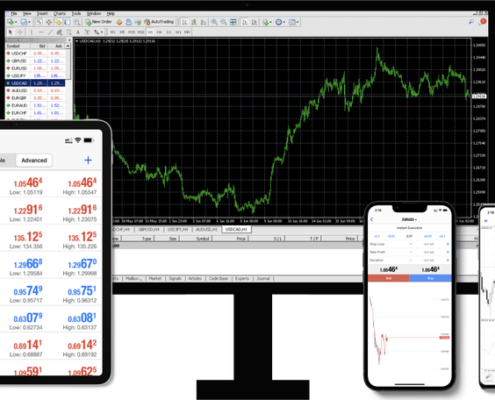

MetaTrader 5 (MT5)

MetaTrader 5 (MT5) is a premier trading platform renowned for its advanced features, speed, and flexibility. This guide delves into the numerous benefits of MT5, making it an essential resource for both novice and experienced traders.

MetaTrader 5 offers access to over 500 markets, including stocks, forex, cryptocurrencies, commodities, and indices. The platform boasts a 64-bit, multi-threaded system for faster trading, surpassing its predecessor, MT4, in efficiency and performance.

One of the standout features of MT5 is its range of tools designed to enhance trading strategies. With 15 custom indicators and advanced charting tools, traders can perform in-depth technical analysis. Additionally, the integrated Reuters news feed keeps users informed of global financial events, enabling timely and informed trading decisions.

MT5's versatility extends to multiple platforms, including desktop, web, and mobile. Each platform offers unique features, such as advanced charting on desktop, cross-platform compatibility on the web, and one-tap trading on mobile, ensuring you can trade anytime, anywhere.

Whether you are looking to diversify your portfolio, automate trading with Expert Advisors, or engage with a community of traders, MT5 provides the tools and support needed to succeed. Start your trading journey with MT5 and experience the power and flexibility of this exceptional platform.

Currency Pairs in Forex Trading

Currency pairs are fundamental to forex trading, representing the exchange rate between two currencies. Each pair consists of a base currency and a quote currency, with the base currency being the one bought or sold. For instance, in the EUR/USD pair, the euro (EUR) is the base currency and the US dollar (USD) is the quote currency. Understanding these pairs is crucial for effective trading. Major currency pairs like EUR/USD and USD/JPY are the most traded, known for their high liquidity and lower volatility. Minor pairs, such as EUR/GBP, exclude the US dollar but include other major currencies, while exotic pairs combine one major currency with one from an emerging economy, offering unique trading opportunities. Factors influencing currency pair values include economic indicators, central bank policies, geopolitical events, and market sentiment. Mastering currency pairs involves analyzing these factors and using them to inform trading strategies. This guide explores how currency pairs work, their classifications, and the key elements that impact their movements in the forex market.

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is a powerful trading platform that caters to traders of all levels, from beginners to seasoned professionals. In this comprehensive guide, you'll explore the ins and outs of MT4, including setup, navigation, and advanced features. Learn how to customize your charts, utilize technical indicators, and implement automated trading with Expert Advisors (EAs). Whether you're looking to enhance your trading strategies or simply get familiar with MT4's interface, this guide provides practical tips, personal insights, and step-by-step instructions to help you master the platform. Dive into the world of trading with confidence and leverage MT4's robust tools to optimize your trading experience and achieve your financial goals.

Forex Trading Education and Resources

To effectively navigate the complexities of the forex market, it's essential to arm yourself with the best educational resources available. This comprehensive guide is your gateway to mastering forex trading, offering an in-depth look at top books, online courses, and webinars designed to enhance your trading skills. You'll also discover invaluable forex trading forums and communities where you can engage with other traders, as well as insightful YouTube channels and podcasts for ongoing education. Whether you're a novice seeking foundational knowledge or an experienced trader aiming to refine your strategies, this guide provides a curated selection of resources to help you achieve your trading goals. With these tools at your disposal, you'll be well-equipped to make informed decisions and stay ahead in the fast-paced world of forex trading. Explore the best resources and take your trading skills to the next level.

What is Trading Psychology?

Trading psychology is the mental and emotional framework that underpins the decision-making process in trading. It's crucial for traders to understand that their success or failure can be significantly influenced by their ability to manage emotions such as fear and greed, biases, personality traits, and external pressures.

Emotions like greed can drive traders to take excessive risks, while fear can cause them to exit positions prematurely. Biases, such as negativity bias and hindsight bias, distort objective decision-making, leading to potentially costly mistakes. Recognizing and mitigating these biases is essential for developing a balanced trading approach.

Personality traits, including discipline and confidence, play a significant role in trading. However, these traits must be balanced; too much discipline can lead to missed opportunities, while overconfidence can result in reckless trading.

External pressures, such as herd behavior, can also influence trading decisions. Traders must learn to stick to their strategies and not be swayed by the actions of others.

Improving trading psychology involves setting clear rules, adhering to a trading plan, conducting thorough research, and regularly assessing performance. By mastering these aspects, traders can enhance their decision-making process, leading to more rational and profitable trades. Engage with your trading journey by continuously learning and adapting to build a strong psychological foundation for success.

Fundamental Analysis in Forex

Fundamental analysis in forex trading is an essential skill for understanding the true value of currencies and making informed trading decisions. Unlike technical analysis, which focuses on price patterns and charts, fundamental analysis delves into the economic, political, and social factors that influence currency values. This approach considers key economic indicators such as Gross Domestic Product (GDP), inflation rates, and interest rates, as well as the actions of central banks and geopolitical events. For instance, a rising GDP typically signals a strong economy and can lead to a stronger currency, while high inflation may weaken it.

Central banks play a crucial role by adjusting interest rates and implementing monetary policies like quantitative easing, which directly impact currency values. Additionally, market sentiment, influenced by news and speculative positions, can drive significant price movements. By combining both fundamental and technical analysis, traders can achieve a more comprehensive understanding of the forex market.

Whether you're a beginner or an experienced trader, mastering fundamental analysis can enhance your trading strategy and improve your market predictions. Stay informed about global events, interpret economic data, and understand how different factors interact to become a successful forex trader. Join us as we explore the intricate world of fundamental analysis and its impact on forex trading.

Trading the USD/CAD Currency Pair

Trading the USD/CAD currency pair, known as trading the "loonie," offers investors an opportunity to engage with one of the most liquid and actively traded pairs in the forex market. This pair reflects the exchange rate between the U.S. dollar (USD) and the Canadian dollar (CAD), providing insights into the economic relationship between the two nations. Factors influencing this pair include interest rate differentials between the Federal Reserve (Fed) and the Bank of Canada (BoC), commodity prices, particularly crude oil, and various economic indicators.

In-depth analysis of the USD/CAD pair involves both fundamental and technical approaches. Fundamental analysis examines economic data, central bank policies, and geopolitical events affecting the currencies, while technical analysis focuses on price charts, trends, and indicators. Effective trading strategies often combine these analyses to predict currency movements and manage risk.

Risk management is crucial, encompassing strategies such as setting stop-loss and take-profit levels, diversifying portfolios, and leveraging advanced trading tools. Staying informed through market news, economic reports, and technological advancements is key to navigating the complexities of trading the USD/CAD pair and making informed investment decisions.

Forex Market Hours and Trading Sessions

Understanding Forex market hours and trading sessions is crucial for any successful trader. The Forex market operates 24 hours a day, five days a week, across major financial centers worldwide. This continuous operation is divided into four main trading sessions: Sydney, Tokyo, London, and New York. Each session has unique characteristics that impact market liquidity and volatility.

The Sydney session, the first to open each week, is known for its lower volatility, offering a more stable trading environment. The Tokyo session sees moderate volatility, especially in the Japanese yen (JPY) and other Asian currencies. The London session is the largest and most volatile, providing significant trading opportunities, particularly during its overlap with the New York session. This overlap is the most active period, offering high liquidity and tight spreads.

Traders must also consider the impact of economic events, such as central bank meetings and GDP releases, which can cause significant price movements. Adjusting to time zone differences and Daylight Saving Time changes is essential for effective trading. By aligning trading activities with the most active and volatile periods, traders can optimize their strategies and enhance profitability. Utilize tools like economic calendars and trading platforms to stay informed and make the most of the Forex market.

In-Depth Understanding of Global Forex Markets

The global Forex market, also known as the foreign exchange market or FX market, is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. It operates 24 hours a day, five days a week, across major financial centers like London, New York, Tokyo, and Sydney. Forex trading involves the exchange of one currency for another, with traders aiming to profit from fluctuations in currency prices.

Understanding the intricacies of the Forex market requires knowledge of various currency pairs, including major, minor, and exotic pairs. Major pairs, such as EUR/USD and USD/JPY, are highly liquid and widely traded, while minor and exotic pairs offer unique opportunities but come with higher risks.

Forex trading strategies can be broadly categorized into technical and fundamental analysis. Technical analysis focuses on historical price data and chart patterns to predict future movements, employing tools like moving averages and the Relative Strength Index (RSI). Fundamental analysis, on the other hand, examines economic indicators, central bank policies, and geopolitical events to assess currency values.

Risk management is crucial in Forex trading. Traders use tools like stop-loss and take-profit orders to mitigate potential losses and lock in profits. Additionally, maintaining a disciplined trading plan and staying updated with market news and trends are essential for long-term success.

By mastering these aspects, traders can navigate the complexities of the global Forex market and capitalize on its vast opportunities.