Forex Market Hours and Trading Sessions

The Forex market operates 24 hours a day, five days a week, covering major financial centers around the world. Understanding the different trading sessions and their characteristics is crucial for traders to optimize their trading strategies and maximize profitability. The market hours are divided into four main trading sessions: Sydney, Tokyo, London, and New York.

Contents

- Why Forex Market Hours Matter

- The Four Major Forex Trading Sessions

- Overlapping Forex Trading Sessions

- Best Times to Trade Forex

- Impact of Time Zones on Forex Trading

- Forex Market Hours and Daylight Saving Time

- Forex Market Hours for Major Currency Pairs

- Forex Trading Strategies for Different Sessions

- Tools and Resources for Forex Trading

- FAQs

- Conclusion

Why Forex Market Hours Matter

Market Liquidity and Volatility

Market liquidity and volatility vary significantly across different trading sessions. Liquidity refers to the ease with which trades can be executed without causing significant price changes. Higher liquidity often leads to tighter spreads and better trading conditions. Volatility, on the other hand, measures the price fluctuations within a market. Knowing when these conditions are optimal can enhance a trader’s ability to make profitable trades.

Optimal Trading Times

The Forex market’s continuous operation means that traders can engage in trading activities at any time. However, the best trading times are when the market experiences the highest liquidity and volatility, typically during the overlap of major trading sessions. Understanding these optimal trading periods can help traders make more informed decisions and capitalize on market movements.

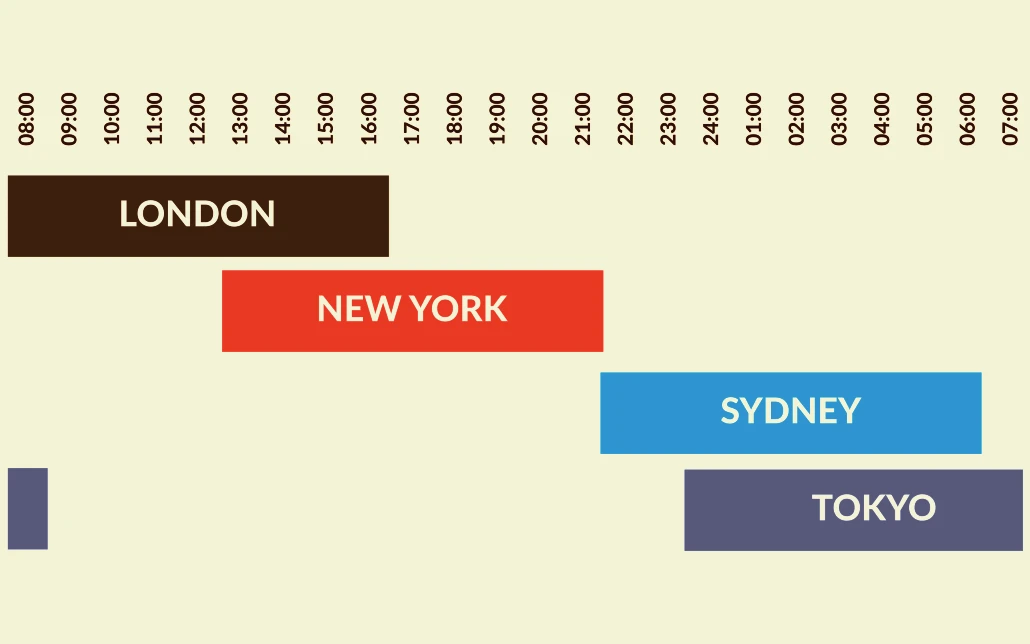

The Four Major Forex Trading Sessions

The Sydney Session

The Sydney trading session is the first to open each week. It starts at 10 PM GMT and closes at 7 AM GMT. This session is known for its lower volatility compared to other sessions, making it a quieter period for trading. However, it can still provide trading opportunities, especially for currencies from the Asia-Pacific region, such as the Australian dollar (AUD) and New Zealand dollar (NZD).

The Tokyo Session

The Tokyo session begins at 12 AM GMT and ends at 9 AM GMT. It is the second major trading session and overlaps with the Sydney session for the first hour. The Tokyo session is characterized by moderate volatility and liquidity, with significant activity in the Japanese yen (JPY) and other Asian currencies. Traders often look for trends that may continue into the London session.

The London Session

The London session opens at 8 AM GMT and closes at 5 PM GMT. It is the largest and most volatile trading session, accounting for a significant portion of daily Forex trading volume. The London session overlaps with both the Tokyo and New York sessions, leading to increased liquidity and trading opportunities. Major currency pairs, including EUR/USD, GBP/USD, and USD/CHF, are actively traded during this period.

The New York Session

The New York session starts at 1 PM GMT and ends at 10 PM GMT. It is the second-largest trading session and overlaps with the London session for four hours, creating a high liquidity environment. The New York session sees substantial activity in the U.S. dollar (USD) and Canadian dollar (CAD). Economic news releases from the United States, such as GDP reports and Federal Reserve announcements, can cause significant market movements during this session.

| Trading Session | Opening Time (GMT) | Closing Time (GMT) |

|---|---|---|

| Sydney | 10 PM | 7 AM |

| Tokyo | 12 AM | 9 AM |

| London | 8 AM | 5 PM |

| New York | 1 PM | 10 PM |

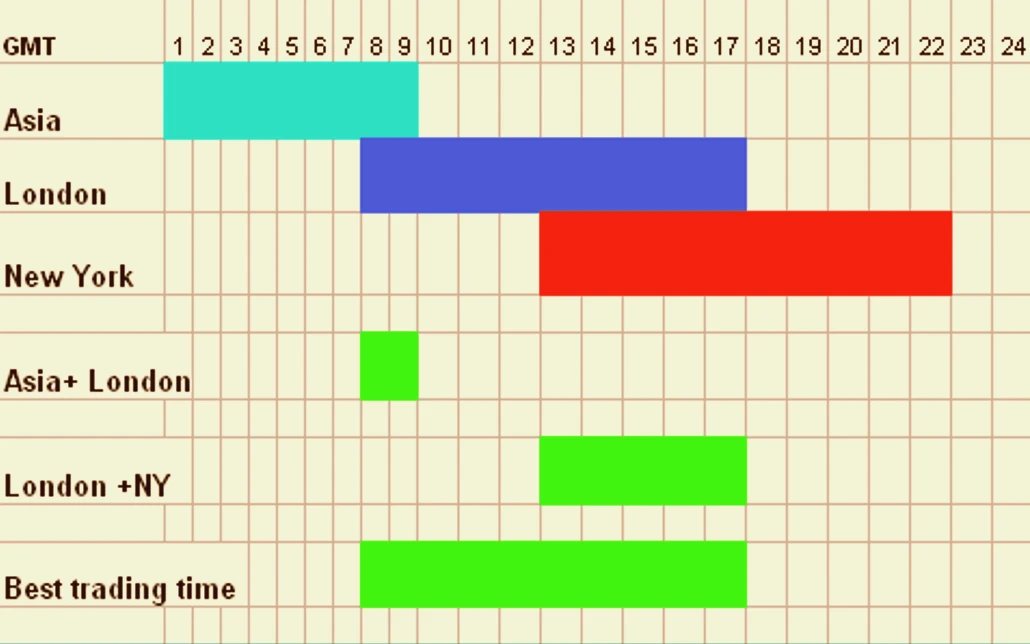

Overlapping Forex Trading Sessions

Importance of Overlaps

Overlaps between trading sessions represent the times when two markets are open simultaneously. These periods are characterized by high liquidity and volatility, offering excellent trading opportunities. The most significant overlaps are between the London/New York sessions and the Tokyo/London sessions.

London/New York Overlap

The London/New York overlap occurs from 1 PM to 5 PM GMT. This is the most active and liquid period in the Forex market, with substantial trading volumes and tight spreads. Major economic data releases from the U.S. and Europe often occur during this time, leading to increased market volatility and trading opportunities.

Tokyo/London Overlap

The Tokyo/London overlap happens from 8 AM to 9 AM GMT. Although it is a shorter overlap compared to the London/New York overlap, it still provides valuable trading opportunities. The transition from the Asian to European trading sessions can lead to significant market movements, especially in currency pairs involving the yen (JPY) and the euro (EUR).

Best Times to Trade Forex

High-Impact Economic Events

Economic events, such as central bank meetings, employment reports, and GDP releases, can cause significant price movements in the Forex market. Traders often monitor economic calendars to anticipate these events and adjust their trading strategies accordingly. Trading during these events can be highly profitable, but it also carries increased risk due to potential market volatility.

Day Trading vs. Swing Trading

Day traders prefer to trade during the most volatile times of the day, typically focusing on the London and New York sessions. They aim to capitalize on short-term price movements and often close their positions by the end of the trading day. Swing traders, on the other hand, hold positions for several days or weeks, focusing on broader market trends and often trading during less volatile periods.

Impact of Time Zones on Forex Trading

Understanding Global Time Zones

The Forex market operates across multiple time zones, making it essential for traders to understand how these time zones affect market activity. Each trading session has unique characteristics influenced by the geographical location and economic activities of the respective regions.

Adjusting to Time Zone Differences

Forex traders must adjust their trading schedules to align with the most active market periods. This may involve trading during early mornings or late evenings, depending on the trader’s location. Effective time management and understanding of global market hours can enhance a trader’s ability to capitalize on trading opportunities.

Forex Market Hours and Daylight Saving Time

Effect of Daylight Saving Time

Daylight Saving Time (DST) can affect Forex market hours, as countries adjust their clocks forward or backward. This can lead to changes in trading session overlaps and market activity. Traders must stay informed about DST changes to ensure they are trading during the correct market hours.

Adapting to DST Changes

Adapting to DST changes involves adjusting trading schedules and being aware of the new session timings. Many trading platforms automatically adjust for DST, but it is essential for traders to verify the session times and plan their trading activities accordingly.

Forex Market Hours for Major Currency Pairs

EUR/USD Trading Hours

The EUR/USD pair is the most traded currency pair in the Forex market. It experiences the highest liquidity and volatility during the London and New York sessions, particularly during their overlap. Economic events from both the Eurozone and the U.S. significantly impact this pair.

USD/JPY Trading Hours

The USD/JPY pair is highly active during the Tokyo session and sees increased activity during the London and New York sessions. The overlap between the Tokyo and London sessions can also provide trading opportunities for this pair, influenced by economic data from Japan and the U.S.

GBP/USD Trading Hours

The GBP/USD pair is most active during the London session and continues to see significant activity during the New York session. Economic news from the U.K. and the U.S. can lead to substantial price movements, making these periods ideal for trading the GBP/USD pair.

| Currency Pair | Most Active Sessions | Best Trading Hours (GMT) |

|---|---|---|

| EUR/USD | London/New York Overlap | 1 PM – 5 PM |

| USD/JPY | Tokyo/London/New York | 12 AM – 9 AM, 1 PM – 10 PM |

| GBP/USD | London/New York | 8 AM – 5 PM |

| AUD/USD | Sydney/Tokyo | 10 PM – 9 AM |

| USD/CAD | New York | 1 PM – 10 PM |

Forex Trading Strategies for Different Sessions

Strategies for the Sydney Session

The Sydney session is typically less volatile, making it suitable for traders who prefer a more stable trading environment. Traders may focus on range trading strategies, where they identify key support and resistance levels and trade within these boundaries. Currency pairs involving the Australian dollar (AUD) and New Zealand dollar (NZD) are popular during this session.

Strategies for the Tokyo Session

The Tokyo session provides opportunities for trading currency pairs like USD/JPY and EUR/JPY. Traders can use breakout strategies, where they identify key levels and trade the breakout when the price moves beyond these levels. The moderate volatility of the Tokyo session allows traders to capitalize on these breakouts.

Strategies for the London Session

The London session is the most volatile, providing numerous trading opportunities. Traders often use trend-following strategies, where they identify the market direction and trade in the direction of the trend. Currency pairs like EUR/USD and GBP/USD are highly active, and traders can take advantage of the significant price movements.

Strategies for the New York Session

During the New York session, traders can use news trading strategies to capitalize on economic data releases from the U.S. This session overlaps with the London session, creating high liquidity and volatility. Traders may also use reversal strategies, where they identify potential reversal points and trade the price retracement.

Tools and Resources for Forex Trading

Economic Calendars

Economic calendars are essential tools for Forex traders, providing information on upcoming economic events and data releases. These calendars help traders anticipate market movements and adjust their strategies accordingly. Key economic indicators include GDP reports, employment data, and central bank meetings.

Trading Platforms

Choosing the right trading platform is crucial for successful Forex trading. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer advanced charting tools, technical indicators, and automated trading capabilities. These platforms provide traders with the necessary tools to analyze the market and execute trades efficiently.

Forex Indicators

Forex indicators are used to analyze price movements and identify trading opportunities. Common indicators include moving averages, relative strength index (RSI), and Bollinger Bands. These tools help traders make informed decisions and improve their trading strategies.

FAQs

The main Forex trading sessions are the Sydney, Tokyo, London, and New York sessions. These sessions correspond to the major financial centers around the world and have distinct trading characteristics.

The Forex market is most volatile during the overlaps of major trading sessions, particularly the London/New York overlap from 1 PM to 5 PM GMT. This period sees the highest trading volume and liquidity.

Daylight Saving Time (DST) can shift the opening and closing times of trading sessions. Traders need to adjust their schedules accordingly to ensure they are trading during the correct market hours.

The best currency pairs to trade during the London session include EUR/USD, GBP/USD, and USD/CHF. These pairs experience high liquidity and significant price movements during this session.

Economic calendars provide information on upcoming economic events and data releases. Traders use these calendars to anticipate market movements and adjust their trading strategies based on the expected impact of these events.

Popular Forex trading strategies include trend-following, breakout, range trading, news trading, and reversal strategies. Each strategy is suited to different market conditions and trading sessions.

Popular trading platforms for Forex trading include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer advanced charting tools, technical indicators, and automated trading capabilities, making them suitable for traders of all experience levels.

Risk management in Forex trading involves setting stop-loss orders, using proper position sizing, and diversifying trades. Traders should also have a well-defined trading plan and stick to it to minimize potential losses.

The Forex market is closed during weekends. Trading resumes on Sunday at 10 PM GMT with the opening of the Sydney session and closes on Friday at 10 PM GMT with the close of the New York session.

Conclusion

Understanding Forex market hours and trading sessions is essential for any successful trader. By knowing when the market is most active and liquid, traders can optimize their trading strategies and maximize profitability. Whether you are a day trader or a swing trader, aligning your trading activities with the most volatile periods can significantly enhance your trading performance. Utilize the tools and resources available, such as economic calendars and trading platforms, to stay informed and make the most of the Forex market.

Leave a Reply

Want to join the discussion?Feel free to contribute!