Major vs. Minor Currency Pairs

Forex trading, the act of buying and selling fiat currencies on the global market, is a fascinating and potentially lucrative field. But it’s also complex and nuanced, especially when you’re starting out. One of the first things new traders must understand is the concept of currency pairs, and more specifically, the difference between major and minor pairs.

Have you ever wondered why some traders focus on certain pairs of currencies? Why is it that major pairs are so popular, and why do minor pairs offer unique opportunities despite being less commonly traded? Let’s dive deep into these questions and more.

Contents

- Understanding Forex and Currency Pairs

- Major Currency Pairs

- Minor Currency Pairs

- Key Differences Between Major and Minor Pairs

- Technical and Fundamental Analysis for Major and Minor Pairs

- Risk Management in Forex Trading

- Choosing the Right Pairs for Your Trading Strategy

- Practical Tips for Trading Major and Minor Pairs

- Common Mistakes and How to Avoid Them

- Conclusion: Finding Your Path in Forex Trading

- Additional Resources and Tools

- FAQs

Understanding Forex and Currency Pairs

What is Forex Trading?

Forex trading, also known as foreign exchange trading, is the world’s largest financial market. It’s where currencies are bought and sold against each other, making it a decentralized market that operates 24 hours a day, five days a week. Unlike other financial markets, forex has no central marketplace, and it involves a network of banks, brokers, institutions, and individual traders.

But what does that mean for you, the trader? Forex trading is like navigating a vast ocean. Sometimes the waters are calm, and other times they’re stormy. The key is knowing which waters (or currency pairs) to sail in.

What Are Currency Pairs?

In forex trading, currencies are always traded in pairs. One currency is bought while the other is sold. This pair represents the value of one currency relative to the other. For example, in the EUR/USD pair, you are comparing the Euro against the US Dollar.

Every currency pair has two parts: the base currency and the quote currency. The base currency is the first one listed in the pair, and the quote currency is the second. The price of a currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency.

Here’s a simple table to illustrate:

| Currency Pair | Base Currency | Quote Currency |

|---|---|---|

| EUR/USD | EUR (Euro) | USD (US Dollar) |

| GBP/JPY | GBP (British Pound) | JPY (Japanese Yen) |

So, if you see EUR/USD quoted at 1.20, that means it takes 1.20 US Dollars to buy one Euro.

Major vs. Minor Currency Pairs

Forex traders categorize currency pairs into major, minor, and exotic pairs. Major pairs always include the US Dollar and are the most traded pairs in the market. Minor pairs, on the other hand, do not include the US Dollar but involve other major global currencies.

Let’s break down these categories in more detail.

Major Currency Pairs

The Popularity of Major Currency Pairs

Why are major currency pairs so popular among traders? The answer lies in their liquidity, predictability, and the tight spreads they offer. Major pairs are heavily traded, meaning they have high liquidity. High liquidity makes it easier for traders to enter and exit positions, reducing the risk of slippage (when the market moves against you before your order is executed).

For instance, the EUR/USD pair is the most traded currency pair in the world. Its popularity stems from the economic might of the European Union and the United States, both of which have stable, liquid markets.

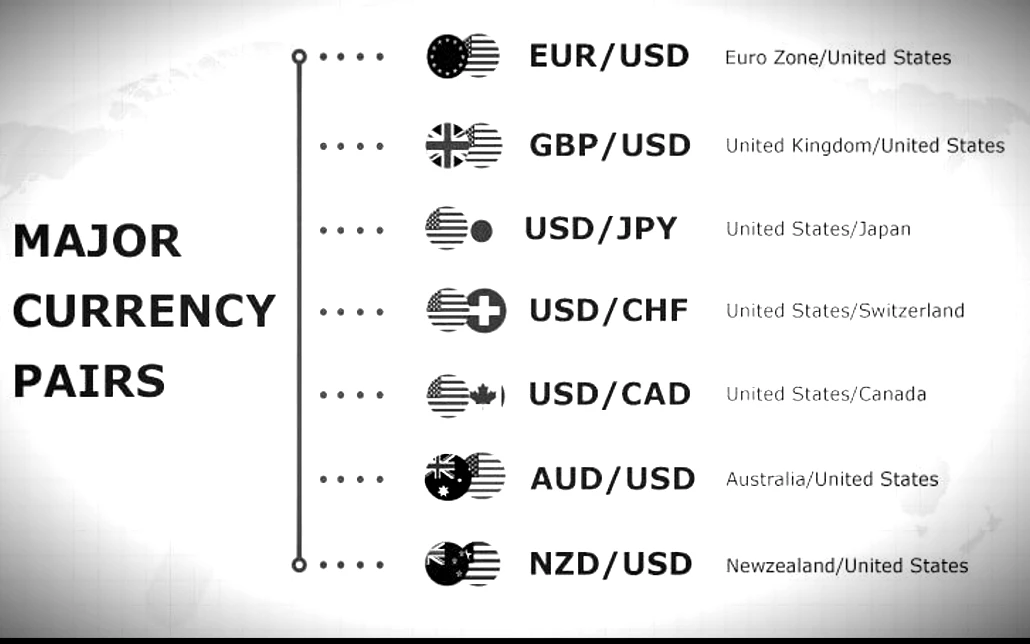

Examples of Major Currency Pairs

There are seven major currency pairs recognized in the forex market:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

- NZD/USD (New Zealand Dollar/US Dollar)

Each of these pairs has its own characteristics. For example, the USD/JPY pair often behaves differently than the GBP/USD pair, reflecting the different economic policies and market conditions of Japan and the UK.

Liquidity and Trading Volume

The major pairs dominate forex trading volumes. This high liquidity means that there is always a buyer and a seller ready to trade, which can lead to more stable price movements and less volatility. Liquidity also tends to lead to narrower spreads, making trading costs lower.

Consider this: when trading EUR/USD, you’re tapping into a market that sees billions of dollars in daily turnover. This high volume means you can enter and exit trades quickly without worrying about finding someone to take the other side of your trade.

Tighter Spreads and Lower Costs

Spreads, the difference between the buying and selling price, are narrower for major pairs. This is beneficial because it reduces the cost of trading. For a pair like EUR/USD, spreads can be as low as 0.2 pips, depending on your broker and market conditions.

Why does this matter? If you’re a day trader or scalper, even small differences in spreads can have a big impact on your profitability. Lower costs mean you can make more trades with the same capital, which can lead to more opportunities for profit.

Predictability and Market Sentiment

Major currency pairs are often considered more predictable than minor pairs. This predictability stems from the wealth of information and analysis available for these pairs. Economic indicators, news events, and technical analysis tools are more widely applied and understood for major pairs, making it easier to gauge market sentiment and predict price movements.

But here’s the thing—predictability doesn’t mean guaranteed profits. Markets can be fickle, and even the most seasoned traders can be caught off guard by unexpected news or shifts in sentiment. It’s all part of the thrill of forex trading.

Anecdote: A Beginner’s Journey with Major Pairs

When I first started trading forex, I gravitated toward the EUR/USD pair, largely because it was familiar. I could easily find news and analysis, and the spreads were low, which meant I didn’t feel like I was losing money to fees. Over time, I began to notice patterns and started to understand how different economic events impacted the pair. It was this familiarity and ease of access that helped build my confidence as a trader.

Minor Currency Pairs

The Intrigue of Minor Currency Pairs

Minor currency pairs, often referred to as “crosses,” don’t include the US Dollar. They involve two major currencies, and while they are less traded than the majors, they offer unique opportunities for traders willing to explore beyond the mainstream.

Why would someone choose to trade a minor pair? The reasons vary, but often it’s about seeking diversification, finding new trading opportunities, or simply exploring different market dynamics. The minor pairs can be like hidden gems in the forex market—overlooked by some but rich in potential for those who know where to look.

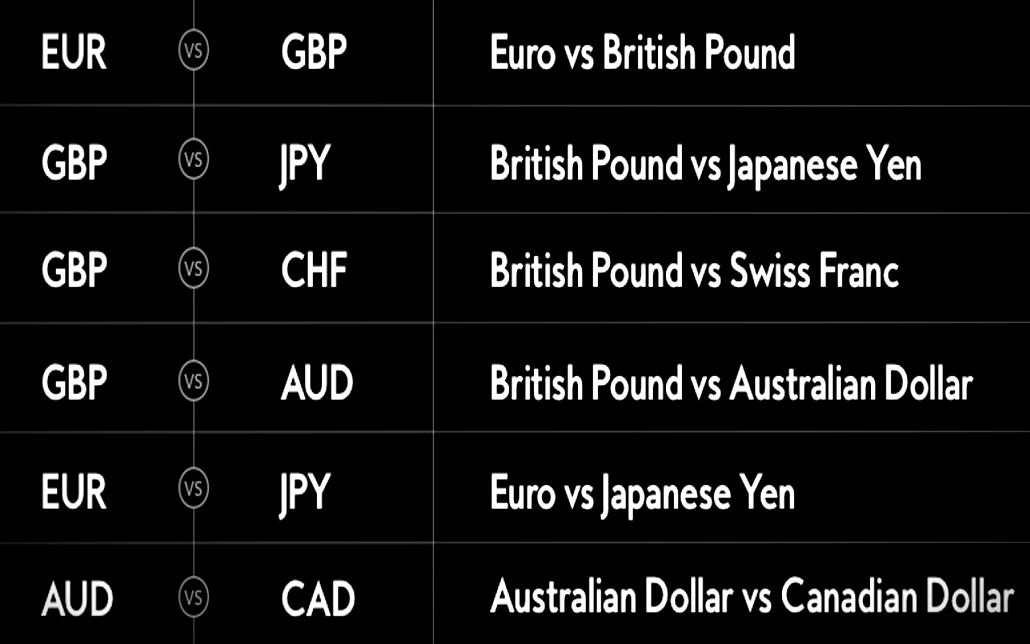

Examples of Minor Currency Pairs

Here are some commonly traded minor pairs:

- EUR/GBP (Euro/British Pound)

- AUD/JPY (Australian Dollar/Japanese Yen)

- GBP/JPY (British Pound/Japanese Yen)

- EUR/CHF (Euro/Swiss Franc)

Each of these pairs has its own set of drivers. For example, EUR/GBP is heavily influenced by economic data from the Eurozone and the UK, as well as political events like Brexit.

Lower Liquidity and Wider Spreads

Minor pairs typically have lower liquidity compared to major pairs. This lower liquidity can lead to wider spreads, which increases the cost of trading. Wider spreads can also mean more volatility and the potential for slippage.

But here’s an interesting twist—some traders are drawn to minor pairs precisely because of these characteristics. They see the wider spreads and lower liquidity as a challenge and an opportunity to capture larger price movements.

Volatility: A Double-Edged Sword

Volatility in minor pairs can be higher than in major pairs. This means prices can move more rapidly and unpredictably. While this volatility can increase risk, it also offers the potential for higher rewards. For traders who have a solid risk management strategy, trading minor pairs can be an exciting way to capitalize on these price movements.

Remember, though, that volatility is a double-edged sword. It can lead to significant profits, but it can also result in substantial losses if not managed properly.

Diversification and Market Opportunities

One of the advantages of trading minor pairs is the opportunity to diversify your trading portfolio. By including minor pairs, you can spread your risk across different currencies and markets, reducing your exposure to any single currency’s economic conditions.

For instance, while major pairs are often driven by US economic data, minor pairs like EUR/GBP are more influenced by European and UK factors. This diversification can help balance your trading strategy and provide opportunities when major pairs aren’t offering favorable conditions.

Anecdote: A Risk-Taker’s Experience with Minor Pairs

I remember the first time I traded the GBP/JPY pair. The market was moving fast, and the spreads were wider than what I was used to with major pairs. It was a bit nerve-wracking, but the potential for profit was there. I quickly learned that trading minors required a different approach—one that was more cautious and calculated. It was a valuable lesson in understanding the nuances of different currency pairs.

Key Differences Between Major and Minor Pairs

Liquidity: The Lifeblood of Forex Trading

Liquidity is a crucial factor in forex trading, and it’s one of the main differences between major and minor pairs. As mentioned earlier, major pairs have higher liquidity, meaning they can be traded quickly without causing significant price changes.

For minor pairs, liquidity is lower, which can lead to price gaps and slippage, especially during volatile market conditions. This difference in liquidity can significantly impact your trading strategy and execution.

Spreads: Cost Considerations for Traders

Spreads are another area where major and minor pairs differ. Major pairs tend to have tighter spreads, making them less costly to trade. In contrast, minor pairs have wider spreads, which can increase the cost of entering and exiting trades.

Here’s a table to illustrate the typical spreads for major and minor pairs:

| Currency Pair | Typical Spread (Pips) |

|---|---|

| EUR/USD | 0.2 – 1.0 |

| USD/JPY | 0.3 – 1.0 |

| GBP/USD | 0.5 – 1.5 |

| EUR/GBP | 2.0 – 3.0 |

| GBP/JPY | 3.0 – 5.0 |

As you can see, trading minor pairs often involves paying a higher spread, which can impact your overall profitability.

Volatility can be both a friend and foe to forex traders. Major pairs generally have lower volatility, offering more predictable trading environments. In contrast, minor pairs can be more volatile, with prices fluctuating rapidly and unpredictably.

This volatility can create opportunities for quick profits, but it also requires a keen eye and a strong risk management strategy to avoid significant losses.

Risk and Reward: Balancing Your Portfolio

The trade-off between risk and reward is a key consideration when choosing between major and minor pairs. Major pairs are often seen as safer, more stable options, suitable for traders who prefer a more conservative approach.

On the other hand, minor pairs can offer higher potential rewards due to their volatility and wider spreads. However, they also come with increased risk, making them more suitable for experienced traders or those with a higher risk tolerance.

Anecdote: Balancing Major and Minor Pairs

As I gained more experience in forex trading, I began to appreciate the balance between trading major and minor pairs. I would often use major pairs for steady, reliable trades while dabbling in minor pairs when I wanted to take on more risk and potentially reap greater rewards. It’s all about finding the right balance that suits your trading style and risk appetite.

Technical and Fundamental Analysis for Major and Minor Pairs

Applying Technical Analysis

Technical analysis involves using historical price data and chart patterns to predict future price movements. This type of analysis is commonly used in forex trading, and it can be applied to both major and minor pairs.

For major pairs, technical analysis is often more straightforward due to the availability of extensive historical data and the generally smoother price movements. Traders often use tools like moving averages, Fibonacci retracements, and support and resistance levels to identify potential entry and exit points.

When applying technical analysis to minor pairs, traders might find that the charts are more erratic, with sharper price movements and less clear patterns. This is where the challenge—and opportunity—lies. The key is to adapt your analysis techniques to account for the increased volatility and unpredictability.

Fundamental Analysis and Economic Indicators

Fundamental analysis, on the other hand, focuses on economic data, news events, and other macroeconomic factors that influence currency values. For major pairs, this might include tracking US interest rates, European Central Bank decisions, or employment reports.

With minor pairs, fundamental analysis often involves a broader view, considering multiple economies and how they interact. For example, trading the EUR/GBP pair might require understanding not just European and UK economic data, but also how geopolitical events like Brexit could impact the pair.

Combining Technical and Fundamental Analysis

Successful forex traders often combine technical and fundamental analysis to create a more comprehensive trading strategy. For major pairs, this might involve using technical indicators to confirm a trade idea based on economic news.

For minor pairs, the combination of both analysis methods can help traders navigate the more volatile and less predictable market conditions. The key is to remain flexible and adapt your strategy as market conditions change.

Anecdote: The Power of Combined Analysis

I remember a time when I was trading the EUR/CHF pair. The charts showed a strong technical setup for a buy, but I hesitated because I knew there was an upcoming European Central Bank meeting. Sure enough, the ECB’s announcement caused the pair to spike in my favor. It was a reminder of the power of combining technical and fundamental analysis to make informed trading decisions.

Risk Management in Forex Trading

The Importance of Risk Management

Risk management is a cornerstone of successful forex trading, regardless of whether you’re trading major or minor pairs. Without a solid risk management strategy, even the most promising trades can lead to significant losses.

Risk management involves setting limits on how much you’re willing to lose on a single trade, using stop-loss orders, and managing your position sizes. It’s about being disciplined and not letting emotions drive your trading decisions.

Strategies for Managing Risk with Major Pairs

When trading major pairs, the lower volatility and tighter spreads can make risk management more straightforward. Traders often use smaller stop-losses and may employ strategies like scalping or day trading, where positions are held for very short periods.

One approach is to use a fixed percentage of your trading capital for each trade, ensuring that no single loss can wipe out a significant portion of your account. For example, you might decide never to risk more than 2% of your total capital on a single trade.

Risk Management for Minor Pairs

Minor pairs require a slightly different approach to risk management due to their higher volatility and wider spreads. Traders might use wider stop-losses to accommodate the larger price swings, but this also means they need to be more selective with their trades.

Another strategy is to trade smaller position sizes with minor pairs, reducing the overall risk exposure. Additionally, traders might avoid trading minor pairs during periods of low liquidity, such as during the Asian trading session, to minimize the risk of slippage.

Anecdote: Learning the Hard Way

Early in my trading journey, I neglected risk management, focusing only on potential profits. This approach worked—until it didn’t. A few losing trades in a row wiped out a significant portion of my account, and I learned a hard lesson about the importance of risk management. Now, I never enter a trade without a clear plan for managing risk, whether I’m trading major or minor pairs.

Choosing the Right Pairs for Your Trading Strategy

Aligning Your Strategy with Currency Pairs

Choosing the right currency pairs for your trading strategy is crucial. Different pairs have different characteristics, and matching these with your trading style can enhance your chances of success.

For example, if you’re a day trader who prefers quick, short-term trades, major pairs with their high liquidity and tight spreads might be ideal. On the other hand, if you’re more of a swing trader who holds positions for days or weeks, minor pairs could offer the volatility and price movements you’re looking for.

Long-Term vs. Short-Term Trading

Long-term traders often gravitate toward pairs that offer stable, predictable trends. Major pairs like EUR/USD or GBP/USD are popular for this reason. These pairs are influenced by well-known economic factors, and their trends can be easier to identify and follow.

Short-term traders, such as scalpers or day traders, might prefer pairs that are more volatile and can provide multiple trading opportunities throughout the day. Minor pairs, with their higher volatility, can be appealing, but they require a more hands-on approach and a willingness to adapt quickly to changing market conditions.

The Role of Time Zones in Pair Selection

Time zones also play a role in selecting currency pairs. For example, if you’re trading during the Asian session, you might focus on pairs like AUD/JPY or EUR/JPY, which are more active during those hours. Conversely, if you’re trading during the European or North American sessions, major pairs like EUR/USD or GBP/USD might offer more liquidity and better trading opportunities.

Anecdote: Finding My Niche

When I first started trading, I experimented with both major and minor pairs. I quickly realized that my personality and lifestyle were better suited to trading major pairs. The stability and predictability fit my preference for a more methodical approach. However, on occasion, I still trade minor pairs when I see a particularly compelling setup. It’s all about finding what works best for you.

Practical Tips for Trading Major and Minor Pairs

Stay Informed with Economic Calendars

Whether you’re trading major or minor pairs, staying informed about economic news and events is essential. Economic calendars provide information about upcoming data releases, central bank meetings, and other events that can impact currency prices.

For major pairs, pay attention to key indicators like US Non-Farm Payrolls, Federal Reserve meetings, and European Central Bank announcements. For minor pairs, you might focus on country-specific events, like Australian employment data or Japanese GDP figures.

Use Technical Indicators Wisely

Technical indicators can be valuable tools for identifying trading opportunities. Popular indicators include moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

When trading major pairs, you might use these indicators to identify trends and potential reversals. For minor pairs, technical indicators can help you navigate the more volatile price movements and identify entry and exit points.

Develop a Trading Plan

A well-defined trading plan is essential for success in forex trading. Your plan should outline your trading goals, risk management rules, and the criteria you use to enter and exit trades.

For major pairs, your plan might focus on taking advantage of stable trends and low spreads. For minor pairs, you might include strategies for managing volatility and wider spreads. The key is to stick to your plan and not deviate based on emotions or market noise.

Anecdote: The Power of a Trading Plan

I can’t stress enough the importance of having a trading plan. Early in my trading career, I often traded on gut feeling rather than a structured plan. This approach led to inconsistent results and unnecessary stress. Once I developed a solid trading plan, I found that my trading became more disciplined, and my results improved significantly. It’s a simple concept, but one that’s easy to overlook in the heat of the moment.

Common Mistakes and How to Avoid Them

Overtrading: The Pitfall of Greed

One of the most common mistakes in forex trading is overtrading—taking too many positions at once or trading too frequently. Overtrading often stems from a desire to make quick profits or recoup losses, but it can lead to poor decision-making and increased risk.

To avoid overtrading, focus on quality over quantity. Stick to your trading plan and only enter trades that meet your criteria. Remember, in forex trading, sometimes less is more.

Ignoring Risk Management

Another common mistake is ignoring risk management. It’s easy to get caught up in the excitement of potential profits and overlook the importance of protecting your capital. This can lead to significant losses, especially when trading volatile minor pairs.

To avoid this mistake, always use stop-loss orders, manage your position sizes, and never risk more than you can afford to lose. Risk management should be at the core of every trade you make.

Failing to Adapt to Market Conditions

Markets are constantly changing, and what worked yesterday might not work today. Failing to adapt to changing market conditions is another common mistake that can lead to losses. This is particularly true when trading minor pairs, where market dynamics can shift rapidly.

To avoid this pitfall, stay flexible and be willing to adjust your strategy as needed. Keep an eye on market trends, news events, and other factors that could impact your trades.

Anecdote: Learning from Mistakes

I’ve made my fair share of mistakes in forex trading, from overtrading to neglecting risk management. Each mistake was a valuable lesson that helped me improve as a trader. The key takeaway? Don’t be afraid to make mistakes, but learn from them and use them to refine your trading approach.

Conclusion: Finding Your Path in Forex Trading

Embrace the Journey

Forex trading is a journey, not a destination. It’s a journey filled with learning, growth, and yes, sometimes mistakes. Whether you choose to focus on major pairs, minor pairs, or a combination of both, the most important thing is to keep learning and adapting.

Stay Disciplined and Patient

Success in forex trading requires discipline, patience, and a willingness to put in the work. Stay disciplined in your trading approach, manage your risk carefully, and don’t rush the process. The forex market will always be there, but opportunities will only come to those who are prepared.

Keep Exploring and Experimenting

Finally, don’t be afraid to explore and experiment. The forex market is vast and filled with opportunities. Try different pairs, strategies, and approaches to find what works best for you. And most importantly, enjoy the process.

Final Anecdote: The Evolution of a Trader

Looking back on my own journey, I realize how much I’ve evolved as a trader. From the early days of focusing solely on major pairs to exploring the opportunities in minor pairs, every step has been a learning experience. The beauty of forex trading is that there’s always something new to discover, and that’s what keeps me coming back to the markets day after day.

Additional Resources and Tools

Recommended Reading

- “Currency Trading For Dummies” by Brian Dolan

- “Forex Trading: The Basics Explained in Simple Terms” by Jim Brown

- “Day Trading and Swing Trading the Currency Market” by Kathy Lien

Useful Tools

- Economic Calendars: Stay updated on economic events and data releases that could impact your trades.

- Forex Trading Platforms: MetaTrader 4/5, cTrader, and TradingView are popular platforms with robust tools for analysis and trading.

- Risk Management Calculators: Use online calculators to determine position sizes, stop-loss levels, and risk-reward ratios.

FAQs

Major currency pairs involve the US Dollar and are the most traded pairs in the forex market. They offer high liquidity, tighter spreads, and generally lower volatility, making them popular among traders. Minor currency pairs, also known as crosses, do not include the US Dollar. These pairs typically have lower liquidity, wider spreads, and higher volatility, offering unique opportunities but also higher risk.

Major currency pairs are more popular because they involve the world’s most stable and widely traded currencies, including the US Dollar. The high liquidity of these pairs makes them easier to trade, with lower costs and less slippage. Additionally, the large amount of information and analysis available for these pairs helps traders make more informed decisions.

Yes, minor currency pairs can be profitable to trade. While they have lower liquidity and wider spreads, they also tend to be more volatile, providing opportunities for larger price movements. This volatility can result in significant profits, but it also comes with increased risk, so careful risk management is essential when trading these pairs.

Generally, yes. Minor currency pairs tend to be more volatile than major pairs due to lower liquidity and less market participation. This increased volatility can lead to larger price swings, offering potential for higher returns but also greater risk.

When choosing between major and minor currency pairs, consider your trading goals, risk tolerance, and strategy. Major pairs might be better suited for short-term, high-frequency trading due to their liquidity and lower spreads. Minor pairs might be more appropriate for longer-term trades or for traders seeking diversification and the potential for larger price movements.

As a beginner, it’s generally advisable to start with major currency pairs. They offer more predictable price movements, lower trading costs due to tighter spreads, and a wealth of information and analysis to guide your trading decisions. Once you gain more experience, you can explore trading minor pairs to diversify your trading strategy.

Liquidity affects how easily you can enter and exit trades. Major currency pairs have high liquidity, meaning large volumes can be traded without significantly affecting the price, which leads to smoother price movements and tighter spreads. Minor pairs have lower liquidity, which can result in wider spreads, slippage, and more erratic price movements, making them more challenging to trade.

While some trading strategies can be applied to both major and minor pairs, adjustments are often necessary. For example, due to higher volatility, trading minor pairs may require wider stop-losses and different risk management techniques compared to major pairs. It’s important to adapt your strategies to the specific characteristics of the pair you’re trading.

Economic events have a significant impact on both major and minor currency pairs. Major pairs are influenced by economic data and policy decisions from the US and other major economies, which are closely followed and widely analyzed. Minor pairs, while also affected by economic events, might react more sharply due to their lower liquidity and the less predictable nature of the economies involved. Traders need to be aware of the economic calendar and how specific events might impact the pairs they are trading.

Yes, hedging is a strategy that involves taking opposite positions in different currency pairs to manage risk. By trading both major and minor pairs, traders can diversify their exposure and potentially offset losses in one position with gains in another. However, effective hedging requires a good understanding of how different pairs are correlated and how they might react to the same market events.

Final Thoughts

Trading forex is not just about making money; it’s about understanding markets, mastering your emotions, and constantly improving your skills. Whether you’re drawn to the stability of major pairs or the excitement of minor pairs, there’s a place for you in the forex market. Embrace the journey, stay curious, and keep striving for excellence.

Leave a Reply

Want to join the discussion?Feel free to contribute!