Risk Management in Forex Trading

Forex trading can be both thrilling and daunting, akin to riding a roller coaster through the peaks and valleys of financial markets. Success demands a firm grasp of risk management. This document delves deep into the world of forex risk management, guiding you on safeguarding your capital and crafting a strategy for sustainable trading.

Contents

Introduction to Forex Trading

What is Forex?

Forex, short for foreign exchange, is the world’s largest financial market, boasting an average daily trading volume exceeding $7 trillion. Unlike other financial markets, the forex market operates 24 hours a day, five days a week, with trading occurring over-the-counter (OTC) rather than through a centralized exchange. This means trades are conducted directly between participants, including banks, corporations, governments, and individual traders.

The forex market is a dynamic and ever-changing landscape where currencies from different countries are exchanged. Major currency pairs like EUR/USD and GBP/USD dominate trading volumes, but traders can also explore numerous minor and exotic pairs, each with its unique characteristics and risk profiles. Trading in forex involves speculating on currency pair price movements, buying one currency while simultaneously selling another.

Forex trading is accessible to both institutional and retail investors, with many brokers offering leveraged accounts to magnify profits. However, with great potential rewards come substantial risks, making effective risk management paramount for success.

The Importance of Risk Management

Risk management is the cornerstone of successful forex trading, acting as a safety net to protect your trading capital from unforeseen market events. It involves identifying, assessing, and prioritizing risks, followed by implementing strategies to minimize or mitigate them. A robust risk management plan ensures you remain in control of your trading activities, safeguarding your portfolio from catastrophic losses.

Without proper risk management, traders may fall into the trap of emotional decision-making, driven by fear or greed, which can lead to impulsive and irrational trading actions. Effective risk management provides a structured approach to trading, allowing you to make informed decisions based on predefined rules and criteria.

Risk management encompasses various techniques, including setting stop-loss orders, using leverage judiciously, diversifying your portfolio, and determining appropriate position sizes. By adopting these practices, you can maintain a balanced and disciplined approach to trading, minimizing the impact of adverse market movements.

Why Risk Management Matters

To illustrate the significance of risk management, consider the story of Tom, a novice forex trader eager to make quick profits. Excited by the prospect of substantial gains, Tom enters the market with high leverage, unaware of the potential consequences. Initially, luck is on his side, and he experiences a few profitable trades, boosting his confidence.

However, disaster strikes when an unexpected economic event sends currency prices plummeting, wiping out Tom’s account in a matter of minutes. The lack of a risk management plan, combined with excessive leverage, left him vulnerable to such a scenario. Tom’s story is a cautionary tale that emphasizes the importance of risk management as a fundamental aspect of trading success.

By implementing effective risk management strategies, traders can avoid similar pitfalls and navigate the forex market with confidence, knowing they are equipped to handle uncertainties and protect their capital from significant losses.

Understanding Leverage

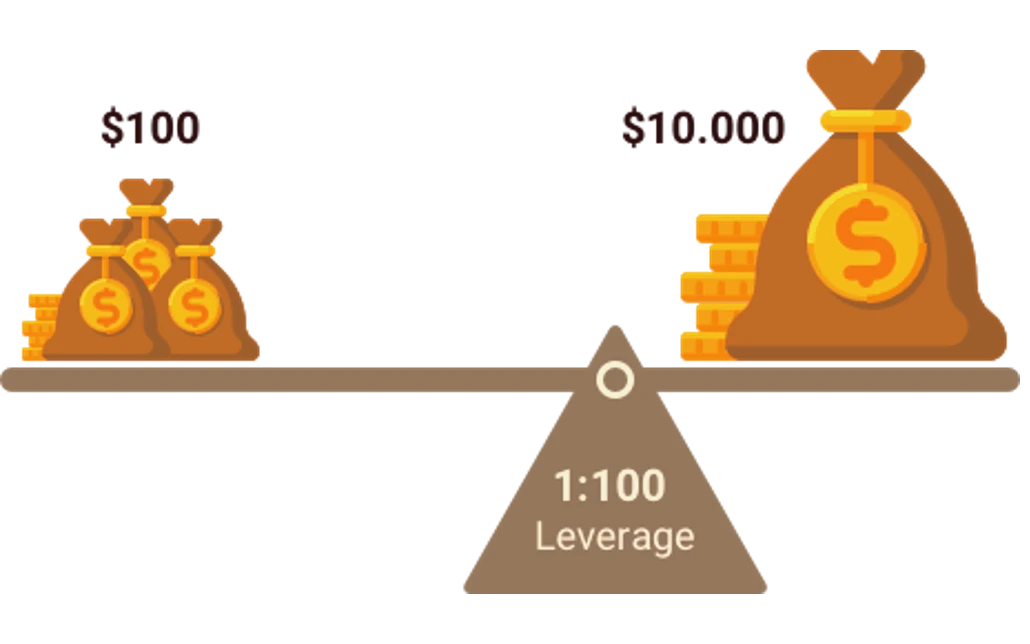

The Double-Edged Sword

Leverage is a powerful tool in forex trading, enabling traders to control larger positions with a relatively small amount of capital. It amplifies both potential profits and losses, making it a double-edged sword that requires careful consideration and management.

In essence, leverage allows traders to borrow money from their broker to open positions that exceed their account balance. For example, a leverage ratio of 100:1 means that for every $1 in your account, you can control a $100 position in the market. This magnification effect offers the potential for substantial returns, but it also exposes traders to increased risk.

It’s crucial to understand that leverage can quickly turn against you if not managed properly. A small price movement in the opposite direction of your trade can result in significant losses, potentially wiping out your entire account. This is why risk management is paramount when using leverage, ensuring that you set appropriate stop-loss orders and position sizes to protect your capital.

Calculating Leverage

Calculating leverage is a straightforward process that involves dividing the total value of your open positions by the actual amount of capital in your trading account. Here’s the formula:

Leverage Ratio=Total Position ValueAccount Equity\text{Leverage Ratio} = \frac{\text{Total Position Value}}{\text{Account Equity}}Leverage Ratio=Account EquityTotal Position Value

For example, if you have $1,000 in your account and control a $100,000 position, your leverage ratio is 100:1. Understanding your leverage ratio helps you gauge the level of risk you’re exposed to and make informed decisions about your trading strategy.

It’s essential to strike a balance between leverage and risk tolerance, as higher leverage increases the potential for both gains and losses. Novice traders should consider using lower leverage levels to limit their exposure and gain experience before increasing their risk.

| Account Equity ($) | Position Size ($) | Leverage Ratio |

|---|---|---|

| 1,000 | 50,000 | 50:1 |

| 1,000 | 100,000 | 100:1 |

| 1,000 | 200,000 | 200:1 |

Personal Experiences with Leverage

Leverage can be both exhilarating and daunting, as illustrated by Sarah’s experience as a forex trader. Sarah, a passionate and determined trader, initially embraced high leverage to maximize her profits. She was drawn to the potential for quick returns, feeling invincible with each successful trade.

However, Sarah soon learned that leverage is a double-edged sword when she encountered a sudden market reversal that caught her off guard. The rapid price movement triggered margin calls, forcing her to close positions at a significant loss. The experience served as a wake-up call, highlighting the need for caution and disciplined risk management.

With a renewed perspective, Sarah adjusted her trading strategy, opting for lower leverage and more conservative position sizes. She focused on managing her risk effectively, setting tighter stop-loss orders, and gradually building her account balance. Over time, Sarah’s approach paid off, allowing her to achieve consistent and sustainable profits.

Sarah’s journey underscores the importance of understanding leverage and using it judiciously. By acknowledging the risks and adopting a cautious approach, traders can harness the power of leverage while protecting their capital from unexpected market fluctuations.

Building a Solid Trading Plan

Elements of a Trading Plan

A trading plan is the foundation of successful forex trading, serving as a roadmap to guide your decisions and actions in the market. It outlines your trading goals, strategies, risk management techniques, and performance evaluation criteria. By adhering to a well-structured plan, you can maintain discipline, minimize emotional trading, and increase your chances of long-term success.

A comprehensive trading plan typically includes the following elements:

- Goals and Objectives: Define your short-term and long-term trading goals, such as generating consistent profits, increasing account size, or mastering specific trading strategies. Clear objectives provide direction and motivation, helping you stay focused on achieving your desired outcomes.

- Trading Strategies: Specify the strategies you will use to identify and execute trades, whether based on technical analysis, fundamental analysis, or a combination of both. Your strategies should align with your risk tolerance and trading style, allowing you to capitalize on market opportunities.

- Risk Management Rules: Establish guidelines for managing risk, including setting stop-loss and take-profit levels, determining position sizes, and using leverage responsibly. Risk management is crucial for protecting your capital and ensuring you can withstand adverse market conditions.

The Importance of Discipline

Discipline is the cornerstone of successful trading, allowing you to stick to your plan and make rational decisions in the face of market fluctuations. It’s easy to be swayed by emotions, such as fear or greed, which can lead to impulsive actions and costly mistakes. By cultivating discipline, you can maintain consistency and avoid deviating from your established rules.

Discipline involves following your trading plan diligently, executing trades according to predefined criteria, and resisting the urge to chase after losses or engage in revenge trading. It requires patience and self-control, as well as the ability to remain calm under pressure.

One of the most effective ways to cultivate discipline is by keeping a trading journal. By documenting your trades, decisions, and emotions, you can gain valuable insights into your trading behavior and identify areas for improvement. Regularly reviewing your journal allows you to learn from past experiences and reinforce positive habits.

Anecdotes on Trading Discipline

Consider the story of Jack, an ambitious forex trader eager to achieve quick profits. Initially, Jack was diligent in following his trading plan, adhering to his strategies and risk management rules. However, as his account balance grew, he became overconfident and began taking larger positions and risking more than his plan allowed.

Jack’s lack of discipline soon caught up with him when a series of unexpected market events led to significant losses. The experience served as a harsh reminder of the importance of sticking to his plan and maintaining discipline, regardless of past successes.

Determined to turn things around, Jack returned to his trading plan and rededicated himself to following it consistently. He focused on cultivating discipline by setting realistic goals, practicing patience, and documenting his trades meticulously. Over time, Jack’s commitment paid off, as he regained control of his trading and achieved consistent profits.

Jack’s journey highlights the critical role of discipline in trading success. By staying true to your plan and avoiding emotional decision-making, you can navigate the forex market with confidence and achieve your trading objectives.

Managing Emotions in Trading

Psychology of Trading

Emotions play a significant role in trading, influencing decision-making and often leading to irrational actions. The forex market can evoke a range of emotions, from excitement and euphoria to fear and anxiety. Understanding the psychology of trading is essential for managing these emotions and maintaining a clear and objective mindset.

Common emotional pitfalls in trading include:

- Fear: Fear of losing money can lead to hesitation and missed opportunities. It may also cause traders to exit positions prematurely, cutting profits short.

- Greed: The desire for larger profits can result in overtrading and excessive risk-taking. Greedy traders may hold onto losing positions, hoping for a reversal, rather than accepting a loss.

- Hope: Hope can cloud judgment, causing traders to ignore warning signs and hold onto losing positions in the hope of a turnaround.

- Regret: Dwelling on past mistakes can hinder future decision-making, leading to a lack of confidence and second-guessing.

To succeed in trading, it’s crucial to recognize these emotions and develop strategies to manage them effectively. By cultivating emotional awareness and resilience, you can make rational decisions and maintain discipline in the face of market volatility.

Techniques to Manage Emotions

Managing emotions in trading requires a combination of self-awareness, discipline, and practical techniques. Here are some strategies to help you stay calm and focused:

- Set Clear Goals: Establish specific, achievable trading goals that align with your overall strategy. Having clear objectives provides direction and motivation, reducing the influence of emotions on your decisions.

- Develop a Routine: Create a structured trading routine that includes regular analysis, preparation, and review. A consistent routine helps you stay disciplined and reduces impulsive actions.

- Use Risk Management Tools: Implement risk management techniques, such as stop-loss orders and position sizing, to protect your capital and minimize emotional decision-making. Knowing that your risk is controlled allows you to trade with confidence.

- Practice Mindfulness: Mindfulness techniques, such as meditation and deep breathing, can help you stay present and focused during trading. These practices promote emotional awareness and reduce stress, enabling you to make rational decisions.

- Take Breaks: Trading can be intense, and taking regular breaks allows you to recharge and maintain a clear mind. Stepping away from the screen helps prevent burnout and emotional fatigue.

Stories of Emotional Trading

Emma, a passionate forex trader, initially struggled with managing her emotions in the fast-paced market. She found herself driven by fear and greed, often making impulsive decisions that led to losses. Frustrated by her inconsistent performance, Emma realized that she needed to address her emotional challenges to succeed.

Determined to improve, Emma embarked on a journey of self-discovery, learning about the psychology of trading and developing techniques to manage her emotions. She began practicing mindfulness and incorporating meditation into her daily routine, which helped her stay calm and focused during trading sessions.

Emma also established a disciplined trading routine, setting clear goals and using risk management tools to protect her capital. By documenting her trades and emotions in a journal, she gained valuable insights into her trading behavior and identified patterns that needed adjustment.

Over time, Emma’s efforts paid off, as she became more adept at managing her emotions and making rational decisions. Her story highlights the transformative power of emotional awareness and discipline in trading, demonstrating that success is within reach for those willing to confront and overcome their emotional challenges.

Setting a Risk-Reward Ratio

What is a Risk-Reward Ratio?

The risk-reward ratio is a critical concept in forex trading, representing the potential reward for every dollar risked. It’s a simple yet powerful tool that helps traders assess the viability of a trade and make informed decisions about entry and exit points.

A favorable risk-reward ratio ensures that potential profits outweigh potential losses, increasing the likelihood of long-term profitability. By consistently aiming for trades with a positive risk-reward ratio, traders can achieve a higher probability of success, even if their win rate is below 50%.

For example, a risk-reward ratio of 1:3 means that for every dollar risked, the trader aims to gain three dollars. This means that even if only one out of three trades is successful, the overall profitability remains intact.

Calculating Your Ratio

Calculating the risk-reward ratio involves determining the difference between the entry point, stop-loss, and take-profit levels. Here’s the formula:

To illustrate, consider a trade with the following parameters:

- Entry Price: $1.2000

- Stop-Loss Price: $1.1950

- Take-Profit Price: $1.2100

In this scenario, the potential risk is 50 pips ($1.2000 – $1.1950), and the potential reward is 100 pips ($1.2100 – $1.2000). Therefore, the risk-reward ratio is 1:2.

| Entry Price ($) | Stop-Loss Price ($) | Take-Profit Price ($) | Potential Risk (Pips) | Potential Reward (Pips) | Risk-Reward Ratio |

|---|---|---|---|---|---|

| 1.2000 | 1.1950 | 1.2100 | 50 | 100 | 1:2 |

It’s essential to set realistic stop-loss and take-profit levels based on market conditions and technical analysis. A well-defined risk-reward ratio helps you maintain discipline and avoid chasing after trades with unfavorable odds.

Examples and Implications

Consider the story of Alex, a cautious forex trader who learned the importance of the risk-reward ratio early in his trading journey. Initially, Alex struggled with consistency, often closing trades prematurely due to fear of losing profits. His win rate was relatively high, but his gains were frequently offset by significant losses.

Determined to improve his results, Alex focused on refining his risk-reward approach. He began setting specific targets for each trade, ensuring that potential rewards were at least twice the potential risks. By adhering to this strategy, Alex was able to achieve a positive risk-reward ratio and improve his overall profitability.

Over time, Alex’s disciplined approach paid off, as he became more confident in his trading decisions and less influenced by emotions. His story underscores the value of the risk-reward ratio as a guiding principle for consistent and sustainable trading success.

By consistently applying a favorable risk-reward ratio, traders like Alex can achieve long-term profitability, even if their win rate is modest. This approach emphasizes the importance of focusing on quality trades with positive expected outcomes, rather than chasing after every opportunity that arises.

Starting with a Demo Account

Benefits of Demo Trading

Demo trading is an invaluable tool for novice and experienced traders alike, offering a risk-free environment to practice strategies, test theories, and gain confidence. Most brokers offer demo accounts that simulate real market conditions, allowing traders to execute trades with virtual funds without risking their capital.

The primary benefits of demo trading include:

- Skill Development: Demo accounts provide an opportunity to learn the intricacies of trading platforms, charting tools, and order execution. Traders can experiment with different strategies and techniques, refining their skills and building a solid foundation for future success.

- Strategy Testing: A demo account allows traders to test and validate their trading strategies in real-time market conditions. This enables them to assess the effectiveness of their approach and make necessary adjustments before transitioning to live trading.

- Risk-Free Environment: Trading in a demo account eliminates the financial risk associated with live trading. This allows traders to focus on developing their skills and gaining experience without the pressure of losing real money.

Transitioning to Real Accounts

Transitioning from a demo account to a live trading account is a significant step that requires careful consideration and preparation. While demo trading provides valuable experience, it doesn’t fully replicate the psychological aspects of trading with real money.

Here are some tips for making a smooth transition:

- Start Small: Begin with a small trading account to minimize risk and ease into live trading. Gradually increase your position sizes and leverage as you gain confidence and experience.

- Stick to Your Plan: Continue following your trading plan and risk management rules, just as you did with the demo account. Avoid deviating from your strategy due to the excitement or pressure of real trading.

- Manage Emotions: Recognize that trading with real money can evoke strong emotions, such as fear and greed. Be prepared to manage these emotions and maintain discipline, just as you did in the demo account.

- Review and Reflect: Regularly review your live trading performance and compare it to your demo trading experience. Identify areas for improvement and adjust your strategy as needed.

Common Pitfalls

Even experienced traders can encounter challenges when transitioning from a demo account to live trading. Common pitfalls include:

- Overconfidence: Success in a demo account can lead to overconfidence and reckless trading in a live account. It’s essential to maintain a disciplined approach and avoid taking unnecessary risks.

- Lack of Preparation: Failing to adequately prepare for live trading can result in poor performance and losses. Ensure you have a solid trading plan and risk management strategy in place before moving to a live account.

- Emotional Decision-Making: The emotional aspect of live trading can lead to impulsive decisions and deviation from your trading plan. Stay focused on your strategy and manage your emotions effectively.

Consider the experience of Lisa, a trader who initially excelled in her demo account. Confident in her abilities, Lisa transitioned to a live account with high expectations. However, she soon encountered unexpected challenges, including emotional stress and overconfidence, which led to losses.

Determined to succeed, Lisa reflected on her experiences and sought guidance from experienced traders. She revisited her trading plan, adjusted her risk management strategy, and worked on managing her emotions. By addressing these challenges and maintaining discipline, Lisa gradually improved her performance and achieved consistent results in her live trading account.

Lisa’s journey highlights the importance of preparation, discipline, and emotional management when transitioning from demo to live trading. With the right approach and mindset, traders can navigate the challenges and achieve long-term success in the forex market.

Understanding the Forex Market

Market Dynamics

The forex market is a complex and dynamic environment influenced by various factors, including economic data, geopolitical events, and market sentiment. Understanding these dynamics is crucial for making informed trading decisions and navigating the ever-changing landscape of forex trading.

Key factors that impact market dynamics include:

- Economic Indicators: Economic data, such as GDP growth, inflation, and employment figures, can significantly affect currency prices. Traders monitor these indicators to gauge the health of economies and predict potential market movements.

- Geopolitical Events: Political events, such as elections, trade agreements, and geopolitical tensions, can create volatility in the forex market. Staying informed about global events helps traders anticipate market reactions and adjust their strategies accordingly.

- Market Sentiment: Market sentiment refers to the overall attitude of traders and investors toward a particular currency or market. Sentiment analysis involves assessing factors such as news, rumors, and investor behavior to gauge market direction and trends.

Fundamental vs. Technical Analysis

Forex traders often use two primary methods of analysis: fundamental and technical. Both approaches offer valuable insights and can be used in combination to enhance trading decisions.

- Fundamental Analysis: Fundamental analysis involves evaluating economic, political, and social factors that influence currency prices. Traders analyze economic indicators, central bank policies, and geopolitical events to assess the underlying strength or weakness of a currency.

- Technical Analysis: Technical analysis focuses on historical price data and chart patterns to predict future price movements. Traders use tools such as trendlines, support and resistance levels, and technical indicators to identify potential entry and exit points.

Combining fundamental and technical analysis can provide a comprehensive view of the market and improve trading accuracy. For example, a trader may use fundamental analysis to identify a currency with strong economic prospects and technical analysis to pinpoint optimal entry and exit levels.

Real-World Examples

Consider the case of the EUR/USD currency pair, which is influenced by a range of factors, including economic data from the Eurozone and the United States. A positive economic report from the U.S. might lead to a strengthening of the USD, while a negative report could weaken it.

On the technical side, a trader might analyze the EUR/USD chart and identify a key support level that has historically held strong. If the price approaches this level and shows signs of reversal, the trader might consider it a potential buying opportunity, supported by the fundamental outlook.

By integrating both fundamental and technical analysis, traders can make more informed decisions and develop a well-rounded trading strategy. This approach enhances their ability to navigate the complexities of the forex market and capitalize on opportunities.

Using Stops and Limits

Types of Orders

Stops and limits are essential tools for managing risk and controlling trade outcomes in the forex market. They help traders define their entry and exit points, ensuring that trades are executed according to predefined criteria.

- Stop-Loss Orders: A stop-loss order is designed to limit potential losses by automatically closing a position when the price reaches a specified level. It acts as a safety net, protecting traders from significant losses in case the market moves against their position.

- Take-Profit Orders: A take-profit order is used to lock in profits by automatically closing a position when the price reaches a predetermined target. It ensures that traders capture gains and avoid the risk of price reversals eroding their profits.

- Trailing Stops: A trailing stop is a dynamic stop-loss order that moves with the price as it moves in the trader’s favor. It allows traders to capture more significant gains while still protecting against potential reversals.

How to Set Stops and Limits

Setting appropriate stop-loss and take-profit levels is crucial for effective risk management. Traders should consider factors such as market volatility, support and resistance levels, and their risk tolerance when determining these levels.

Here are some guidelines for setting stops and limits:

- Risk-Reward Ratio: Align stop-loss and take-profit levels with your risk-reward ratio to ensure that potential rewards outweigh potential risks. This helps maintain a favorable balance and increase the likelihood of long-term profitability.

- Volatility: Adjust stop-loss levels based on market volatility. In highly volatile conditions, it may be necessary to set wider stop-loss levels to avoid premature stop-outs. Conversely, in low-volatility environments, tighter stops may be appropriate.

- Technical Levels: Use technical analysis to identify key support and resistance levels when setting stops and limits. Placing orders near these levels can enhance their effectiveness and improve the accuracy of your trade execution.

Tales of Stops and Limits

Mark, a seasoned forex trader, encountered a challenging market environment when he initially started trading. Early on, he faced difficulties with setting effective stop-loss and take-profit levels, resulting in inconsistent performance and frequent losses.

Determined to improve, Mark studied various techniques for setting stops and limits and sought advice from experienced traders. He learned to use technical analysis to identify critical levels and align his stop-loss and take-profit orders with his risk-reward ratio.

One memorable trade involved the GBP/USD currency pair, where Mark identified a significant support level and set a stop-loss just below it. As the price approached the support level and showed signs of reversal, Mark used a take-profit order to lock in his gains.

Mark’s improved approach to stops and limits led to more consistent results and enhanced his overall trading performance. His story illustrates the importance of setting well-defined stop-loss and take-profit levels and leveraging technical analysis to optimize trade execution.

Diversification of Portfolio

Importance of Diversification

Diversification is a key principle of risk management, aimed at reducing the impact of individual asset movements on your overall portfolio. In the context of forex trading, diversification involves spreading your investments across different currency pairs and trading strategies to mitigate risk and enhance potential returns.

The primary benefits of diversification include:

- Risk Reduction: By diversifying your portfolio, you can reduce the impact of adverse movements in any single currency pair. This helps to protect your capital and prevent large losses from negatively affecting your overall performance.

- Improved Risk-Reward Profile: Diversification allows you to balance your risk-reward profile by combining different trading strategies and currency pairs with varying characteristics. This enhances your ability to capture opportunities and achieve consistent returns.

- Market Exposure: Diversifying across multiple currency pairs and markets provides exposure to different economic and geopolitical factors, allowing you to benefit from a broader range of opportunities and reduce dependence on any single market.

Strategies for Diversification

Effective diversification strategies involve selecting a mix of currency pairs and trading approaches that complement each other and align with your overall trading goals. Here are some strategies to consider:

- Currency Pair Selection: Diversify your portfolio by trading a mix of major, minor, and exotic currency pairs. Each currency pair has unique characteristics, such as volatility and liquidity, that can influence your trading results.

- Trading Styles: Incorporate a variety of trading styles, such as scalping, day trading, and swing trading, to diversify your approach. Different trading styles can offer varying levels of risk and reward, helping to balance your overall portfolio.

- Correlation Analysis: Analyze the correlation between currency pairs to avoid overexposure to similar market movements. Low or negative correlations between pairs can help reduce risk and enhance diversification.

Personal Insights

Jessica, an experienced forex trader, initially struggled with diversification, focusing primarily on a few major currency pairs. As she gained experience, she realized that her lack of diversification exposed her portfolio to higher risk and limited her opportunities.

Determined to improve, Jessica researched various diversification strategies and began incorporating different currency pairs and trading styles into her portfolio. She paid attention to correlation analysis, ensuring that her trades were not overly dependent on the same market movements.

By diversifying her portfolio, Jessica was able to achieve a more balanced risk-reward profile and improve her overall performance. Her story underscores the importance of diversification in managing risk and enhancing potential returns in forex trading.

FAQs

Risk management in forex trading involves strategies and techniques to minimize potential losses and protect your trading capital. It includes setting stop-loss orders, managing leverage, diversifying your portfolio, and adhering to a trading plan to control the risks associated with trading currency pairs.

Risk management is crucial in forex trading because the market is highly leveraged and volatile, which can magnify both potential gains and losses. Without proper risk management, traders can experience significant losses that may wipe out their trading accounts. Effective risk management helps to preserve capital, reduce the impact of negative trades, and maintain a disciplined trading approach.

Leverage amplifies both potential gains and potential losses. For example, with 100:1 leverage, a trader can control $100,000 with just $1,000 of their own capital. While this can enhance profit opportunities, it also increases the risk of significant losses if the market moves against the trader’s position. Managing leverage involves using lower leverage ratios and ensuring trades align with your risk tolerance and trading strategy.

Stop-loss orders automatically close a position when the price reaches a predetermined level, limiting potential losses. Take-profit orders close a position when the price reaches a specified target, securing profits. Both types of orders are essential tools in risk management, helping traders to control their risk-reward ratio and execute trades according to their predefined criteria.

When setting stop-loss and take-profit levels, consider factors such as market volatility, support and resistance levels, and your risk-reward ratio. A common approach is to set the stop-loss at a level where the trade’s risk is acceptable, typically based on a percentage of your trading capital. The take-profit level should align with your profit target while ensuring the trade remains favorable in terms of risk-reward ratio.

The risk-reward ratio is a measure that compares the potential profit of a trade to its potential loss. For example, a 1:2 risk-reward ratio means you aim to gain twice as much as you risk losing. This ratio helps traders assess whether a trade is worth taking and ensures that potential rewards justify the risks involved. Maintaining a favorable risk-reward ratio is crucial for long-term trading success.

A demo account allows you to practice trading without risking real money. Use it to test your risk management strategies, such as setting stop-loss and take-profit orders, and experimenting with different leverage levels. This practice helps you build confidence, refine your trading plan, and identify any adjustments needed before transitioning to live trading.

Diversification involves spreading your trading capital across multiple currency pairs and trading strategies. This approach reduces the impact of adverse movements in any single currency pair on your overall portfolio. By diversifying, you can balance risks, capture opportunities in different markets, and improve the stability of your trading performance.

Emotions can significantly impact trading decisions, leading to impulsive actions and deviations from your trading plan. Fear, greed, and overconfidence can cloud judgment and result in poor risk management. Effective risk management requires emotional discipline, adherence to a trading plan, and the ability to manage stress and maintain objectivity during trades.

Conclusion

Mastering forex trading involves a combination of strategic planning, discipline, and emotional management. By developing a solid trading plan, understanding market dynamics, and applying effective risk management techniques, you can navigate the complexities of the forex market with confidence.

Remember that trading is a journey that requires continuous learning and adaptation. Keep refining your strategies, managing your emotions, and diversifying your portfolio to achieve long-term success.

As you embark on your forex trading journey, stay committed to your goals and remain disciplined in your approach. With dedication and perseverance, you can overcome challenges and unlock the potential of the forex market.

Central Banks' Role in Forex Markets forixo.trade

Central Banks' Role in Forex Markets forixo.trade

Leave a Reply

Want to join the discussion?Feel free to contribute!