What is Trading Psychology?

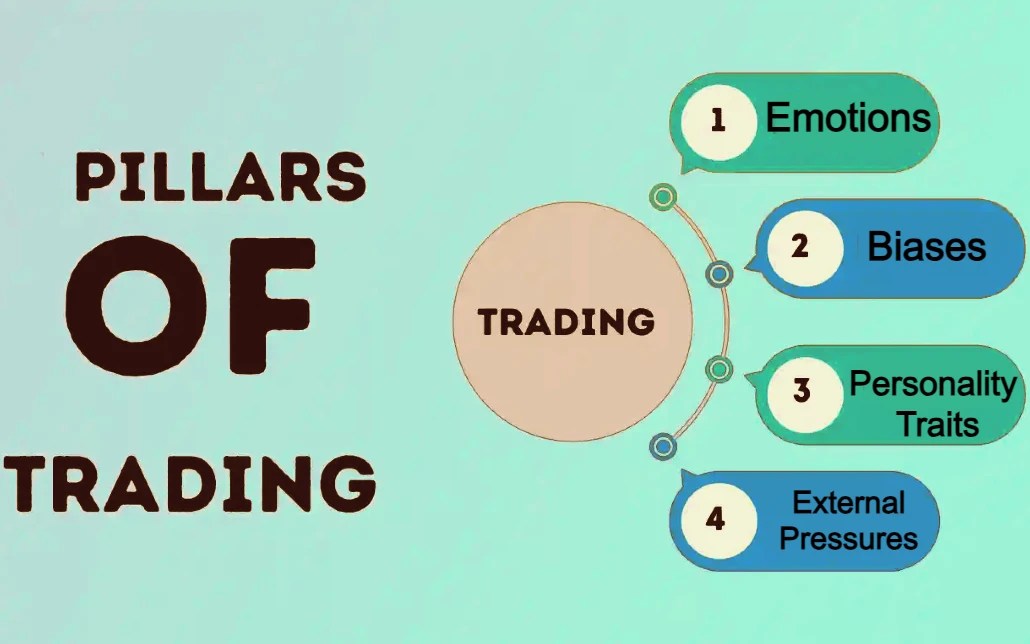

Trading psychology refers to the mental and emotional aspects of making trading decisions. It encompasses behaviors, characteristics, emotions, biases, personality traits, and external pressures that influence traders’ choices. Understanding and managing trading psychology is crucial for success, as it significantly impacts trade outcomes.

Contents

Importance of Trading Psychology

Why is trading psychology so critical? Simply put, it can make or break a trader. The ability to think quickly, exercise discipline, and control emotions can determine whether a trading strategy succeeds or fails. For instance, even the best trading strategy can be undermined by poor emotional control or irrational decision-making.

Personal Anecdote: The Initial Hurdles

When I first started trading, I thought that having a solid strategy was all I needed. I had done my homework, studied the charts, and set up my trading plan. However, it wasn’t long before I realized that my emotions were running the show. After a couple of significant losses, I began to understand the importance of trading psychology. It became clear that without mastering my emotions and biases, I would never achieve consistent success.

The Four Pillars of Trading Psychology

Emotions

Greed: The Double-Edged Sword

Greed is a powerful emotion that can lead to excessive risk-taking. Traders often enter high-risk positions or stay in trades too long, hoping for even greater profits. While the desire to earn money is natural, unchecked greed can be disastrous. Remember the saying, “Pigs get slaughtered.” Greedy investors often hang onto winning positions for too long, only to watch them turn into losses.

Case Study: The Bitcoin Boom

During the 2017 Bitcoin boom, many traders were driven by greed. As Bitcoin’s price soared, traders piled into the market, hoping to capitalize on the meteoric rise. However, many of these traders held onto their positions too long, driven by the belief that the price would keep climbing. When the market corrected, those who hadn’t managed their greed faced substantial losses.

Fear: The Great Paralyzer

Fear is the opposite of greed and can be equally damaging. It manifests as an irrational concern over potential losses, causing traders to avoid taking positions or exit trades prematurely. This emotion is prevalent in bear markets, where the fear of further losses leads to mass sell-offs. Fear can paralyze traders, preventing them from making rational decisions.

Personal Experience: Overcoming Fear

In the early days of my trading career, I was terrified of making losses. This fear led me to exit trades prematurely, even when all indicators suggested I should stay in. It took time and practice to learn how to manage this fear. I started using stop-loss orders to protect myself from significant losses and gradually built confidence in my trading plan.

Biases

Negativity Bias

Negativity bias is the tendency to focus on negative aspects and overlook potential gains. For traders, this can lead to drastic strategy changes instead of minor adjustments. It’s essential to recognize this bias and strive for a balanced perspective.

| Scenario | Reaction Due to Negativity Bias | Optimal Reaction |

|---|---|---|

| Minor loss in a profitable week | Overhauling the entire trading strategy | Analyzing the loss, making minor adjustments |

| Market downturn | Exiting all positions prematurely | Reassessing strategy, considering long-term trends |

Hindsight Bias

Hindsight bias occurs when traders believe they “always knew” the outcome after it happens. This false sense of foresight can lead to overconfidence and misjudgment in future trades. Recognizing hindsight bias helps maintain humility and objectivity.

Anecdote: The Hindsight Trap

I once traded a tech stock that surged unexpectedly. After the fact, I convinced myself that I “knew it all along.” This hindsight bias led me to overestimate my predictive abilities, causing several poor decisions in subsequent trades. It was a humbling experience that taught me to respect the market’s unpredictability.

Gambler’s Fallacy

The gambler’s fallacy is the mistaken belief that past events affect the probability of future events. Traders might assume that a trade will be profitable simply because similar trades were successful in the past, even though the probability remains unchanged.

Loss Aversion

Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains. For example, a trader might avoid a £100 loss more intensely than they pursue a £100 gain. This bias can lead to overly cautious trading, potentially missing out on profitable opportunities.

Case Study: Loss Aversion in Action

During a volatile market period, I noticed that I was more focused on avoiding losses than pursuing gains. This cautious approach led to missed opportunities and minimal profits. By recognizing and addressing my loss aversion, I learned to take calculated risks and improve my trading performance.

Personality Traits

Discipline: A Double-Edged Sword

Discipline is vital for successful trading, but it must be balanced with flexibility. While sticking to a trading plan is essential, rigidly adhering to it without recognizing new opportunities can lead to missed gains. Practicing in a demo account can help develop a disciplined yet adaptable mindset.

Confidence vs. Overconfidence

Confidence in one’s abilities and knowledge is crucial. However, overconfidence can be dangerous, leading traders to take on excessive risks. The fine line between confidence and overconfidence must be navigated carefully.

| Trait | Description | Impact on Trading |

|---|---|---|

| Confidence | Trust in one’s abilities and knowledge | Informed decision-making, appropriate risk-taking |

| Overconfidence | Excessive trust, ignoring risks | High-risk positions, potential for significant losses |

External Pressures

Herd Behavior

Herd behavior refers to mimicking the actions of others without conducting proper research. This can be detrimental, as decisions based on fear of missing out (FOMO) often lead to poor outcomes. It’s important to stick to one’s own strategy and risk tolerance.

Peer Influence

The opinions and behaviors of peers can also exert significant pressure. While it’s beneficial to exchange ideas, traders must ensure that their decisions are guided by their own analysis and strategy rather than external influences.

Anecdote: The Pitfalls of Peer Pressure

A friend once convinced me to invest in a hot stock without doing my due diligence. Trusting his enthusiasm, I entered the trade only to watch it plummet. This experience underscored the importance of making independent, well-researched decisions.

Tips to Improve Trading Psychology

Set Clear Rules

Establishing and following specific trading rules is crucial. These rules should include risk tolerance levels, stop-loss orders, and profit targets. Clear rules help mitigate emotional decision-making.

Stick to Your Trading Plan

Adhering to a pre-set trading plan prevents impulsive decisions driven by emotions. Any changes to the plan should be tested in a demo environment first.

Example: The Benefits of a Trading Plan

By sticking to a detailed trading plan, I managed to navigate the 2020 market volatility with minimal losses. My plan included specific entry and exit points, risk management strategies, and a clear focus on long-term goals. This disciplined approach helped me stay calm and make rational decisions.

Conduct Thorough Research

Never rely solely on external opinions. Conduct comprehensive research and due diligence before opening positions. This practice builds confidence in one’s decisions.

Regularly Assess Performance

Periodically reviewing trading outcomes and strategies helps identify and correct bad habits. Use tools like performance analytics to automate this process.

| Assessment Frequency | Benefits |

|---|---|

| Weekly | Quick identification of emerging issues |

| Monthly | Broad overview of trading performance |

| Quarterly | In-depth analysis of trends and patterns |

Incorporate Personal Experiences

Reflecting on personal trading experiences can provide valuable insights. Documenting trades, emotions, and outcomes helps identify patterns and areas for improvement. Sharing these experiences with other traders can also foster a supportive learning environment.

Mastering Trading Psychology

Experience and Knowledge

Mastering trading psychology requires experience and knowledge. Building and practicing a trading plan in a risk-free environment, such as a demo account, helps solidify a disciplined and unbiased approach.

Tailoring Strategies to Different Markets

Different markets require different mindsets. For instance, forex trading demands quick thinking and discipline due to its volatility, while stock trading benefits from patience and thorough research.

Continuous Learning

Trading is an ever-evolving field. Staying informed about market developments, new strategies, and psychological insights is essential. Engage with trading communities, read relevant literature, and attend webinars to enhance your knowledge continuously.

Example: Lifelong Learning in Trading

Throughout my trading journey, I’ve found that continuous learning is crucial. I regularly read books on trading psychology, attend webinars, and participate in trading forums. This ongoing education helps me stay adaptable and improve my trading skills.

Psychology in Different Markets

Forex Trading Psychology

Forex markets are highly volatile, requiring quick thinking and discipline. Traders often use technical analysis for its quantitative approach, helping them avoid impulsive decisions based on emotions.

Example: The 2008 Financial Crisis

During the 2008 financial crisis, forex traders faced extreme volatility. Those who stuck to their technical analysis and avoided panic selling managed to navigate the turbulent market better than those who reacted emotionally.

Case Study: Successful Forex Trader

Consider the story of Tom, a successful forex trader. Tom’s success is largely attributed to his disciplined approach and reliance on technical analysis. By sticking to his trading plan and managing his emotions, Tom consistently made profitable trades even in volatile markets.

Stock Trading Psychology

Stock markets attract patient individuals who conduct fundamental research. However, the allure of quick profits can also attract impulsive traders influenced by public attention stories.

Case Study: The Dot-Com Bubble

The dot-com bubble is a classic example of herd behavior and FOMO in the stock market. Many investors jumped on the bandwagon of internet stocks without proper research, leading to massive losses when the bubble burst.

Cryptocurrency Trading Psychology

Cryptocurrency markets are highly speculative and driven by news and sentiment. This environment requires traders to be exceptionally disciplined and resistant to emotional reactions.

Anecdote: The Rise and Fall of Crypto Prices

During the rapid rise of Bitcoin in 2017, many traders were swept up in the hype. I remember seeing friends and colleagues investing heavily based on the fear of missing out. When the market corrected, those who hadn’t managed their emotions faced significant losses.

Anecdotes and Personal Experiences

A Trader’s Journey: Learning from Mistakes

John, a novice trader, started with high hopes and a basic understanding of trading. Driven by greed, he took on high-risk positions without proper research, leading to significant losses. Reflecting on his experience, John realized the importance of controlling emotions and conducting thorough analysis. By shifting his focus to disciplined trading and continuous learning, John gradually improved his performance.

The Power of Patience: Sarah’s Story

Sarah, a seasoned trader, emphasized the importance of patience. During a bear market, she resisted the urge to sell off her positions in panic. Instead, she conducted a thorough analysis and adjusted her strategy accordingly. Her patience paid off when the market eventually recovered, resulting in substantial gains.

Table: Common Mistakes and Lessons Learned

| Mistake | Consequence | Lesson Learned |

|---|---|---|

| Ignoring Trading Plan | Significant financial losses | Stick to the trading plan |

| Emotional Decision-Making | Impulsive trades, erratic performance | Manage emotions, maintain discipline |

| Following Herd Behavior | Poorly researched decisions | Conduct independent research |

Tables and Data Interpretation

| Bias | Description | Impact on Trading |

|---|---|---|

| Negativity Bias | Focus on negative aspects, overlook potential gains | Unnecessary strategy changes |

| Hindsight Bias | Belief of “always knowing” the outcome after it occurs | Overconfidence, misjudgment |

| Gambler’s Fallacy | Belief that past events affect future probabilities | Misguided decisions based on past success |

| Loss Aversion | Preference for avoiding losses over equivalent gains | Overly cautious trading, missed opportunities |

Interpretation

Understanding these biases helps traders recognize and mitigate their impact. For instance, being aware of negativity bias can prompt traders to seek a balanced perspective, while acknowledging hindsight bias can help maintain humility and objectivity.

| Emotion | Trigger | Typical Response | Optimal Response |

|---|---|---|---|

| Greed | Rapid price increase | Enter high-risk positions, stay too long | Stick to the trading plan, set profit targets |

| Fear | Sudden market downturn | Exit positions prematurely | Conduct thorough analysis, adjust strategy calmly |

Interpretation

Recognizing emotional triggers and typical responses allows traders to develop strategies to counteract impulsive decisions. For instance, setting profit targets can help manage greed, while conducting thorough analysis can mitigate fear-driven decisions.

| Trait | Description | Impact on Trading |

|---|---|---|

| Discipline | Ability to stick to a plan | Consistent performance, reduced impulsive decisions |

| Flexibility | Ability to adapt to changing markets | Identifying new opportunities, adjusting strategies |

| Confidence | Trust in one’s abilities | Informed decision-making, taking calculated risks |

| Overconfidence | Excessive trust, ignoring risks | High-risk positions, potential for significant losses |

Interpretation

Balancing discipline and flexibility is crucial for successful trading. Confidence should be cultivated through knowledge and experience, while overconfidence should be tempered by acknowledging market unpredictability.

| Market | Psychological Trait | Required Approach |

|---|---|---|

| Forex | Quick thinking, discipline | Use technical analysis, avoid impulsive decisions |

| Stocks | Patience, thorough research | Focus on long-term trends, conduct fundamental analysis |

| Cryptocurrencies | Discipline, resistance to hype | Manage emotions, stay informed about news and sentiment |

Interpretation

Different markets require different psychological traits and approaches. Forex trading demands quick decision-making and discipline, while stock trading benefits from patience and thorough research. Cryptocurrency trading requires a high level of discipline and resistance to market hype.

Conclusion

Trading psychology is a critical component of successful trading. By understanding and managing emotions, biases, personality traits, and external pressures, traders can enhance their decision-making process. Establishing clear rules, adhering to a trading plan, conducting thorough research, and regularly assessing performance are essential steps toward mastering trading psychology.

Engage with this content, reflect on your experiences, and apply these insights to your trading journey. Whether you’re navigating the volatile forex market or the patient world of stock trading, a solid grasp of trading psychology will guide you toward more rational and profitable decisions.

Final Thoughts

Remember, mastering trading psychology is an ongoing process. Continuous learning, self-reflection, and adaptation are key to becoming a successful trader. Stay disciplined, manage your emotions, and keep improving your strategies. The market may be unpredictable, but with a strong psychological foundation, you can navigate its challenges and opportunities with confidence.

FAQs

Trading psychology is crucial because emotional and cognitive factors can significantly impact trading decisions. Poor management of these factors can lead to impulsive trades, excessive risk-taking, or missed opportunities, ultimately affecting trading performance and profitability.

Emotions like greed can lead traders to take on excessive risks, while fear can cause them to exit positions too early or avoid taking necessary risks. Both emotions can disrupt a well-thought-out trading plan and lead to suboptimal decisions.

Personality traits like discipline, patience, and confidence are essential for successful trading. However, traits like overconfidence can lead to excessive risk-taking, while a lack of flexibility can prevent traders from adapting to changing market conditions.

External pressures include influences from other traders, market trends, and media reports. Herd behavior, or following the majority without independent analysis, is a common external pressure that can lead to poor trading decisions.

Managing fear and greed involves creating and adhering to a structured trading plan with predefined risk management strategies. Using tools like stop-loss orders and setting profit targets can help mitigate these emotions.

Identifying trading biases requires self-reflection and regular review of trading decisions and outcomes. Keeping a trading journal to document the rationale behind each trade can help highlight patterns of biased thinking.

Yes, trading psychology can be improved through consistent practice and experience. Simulated trading environments, like demo accounts, allow traders to build confidence and refine their psychological approach without risking real capital.

Traders may follow herd behavior due to a fear of missing out (FOMO) on perceived profitable opportunities. This behavior can lead to entering trades without proper research and analysis, often resulting in losses when the trend reverses.

Different markets require different psychological approaches. For example, forex trading demands quick decision-making and discipline due to its volatility, while stock trading benefits from patience and thorough fundamental analysis. Cryptocurrency trading requires a high level of discipline and resistance to market hype due to its speculative nature.

Self-assessment is crucial for identifying and correcting psychological weaknesses in trading. Regularly reviewing trades, understanding the emotions and biases involved, and making necessary adjustments can lead to improved trading performance.

Leave a Reply

Want to join the discussion?Feel free to contribute!