Trading the USD/CAD Currency Pair

Trading the USD/CAD currency pair, often referred to as trading the “loonie,” offers investors a robust and highly liquid opportunity in the forex market. This pair is essential for understanding the relationship between two of the world’s most significant economies, the United States and Canada. In this comprehensive guide, we’ll delve into the intricacies of the USD/CAD currency pair, covering everything from its basic definition to advanced trading strategies.

Contents

- Understanding the USD/CAD Currency Pair

- Key Factors Influencing the USD/CAD

- Historical Context of the USD/CAD

- Trading Strategies for USD/CAD

- Analyzing Market Trends and Data

- Risk Management in USD/CAD Trading

- Tools and Resources for Trading USD/CAD

- Future Outlook for USD/CAD

- Summary of Key Points

- FAQs

- Conclusion

Understanding the USD/CAD Currency Pair

What is the USD/CAD?

The USD/CAD currency pair represents the exchange rate between the U.S. dollar (USD) and the Canadian dollar (CAD). It is a measure of how many Canadian dollars are needed to purchase one U.S. dollar. The term “loonie” is often used to describe trading this pair, named after the Canadian one-dollar coin that features a loon bird. This nickname reflects the cultural and economic significance of the currency in Canada.

The USD/CAD pair is a major currency pair in the forex market due to the economic size and stability of both the United States and Canada. The pair is highly traded by forex participants, including banks, corporations, hedge funds, and individual traders. Understanding the dynamics of this currency pair is crucial for anyone looking to engage in forex trading, as it can offer insights into broader economic trends and investment opportunities.

Significance of the USD/CAD Pair

The USD/CAD pair is one of the most actively traded currency pairs in the forex market. This is due to the substantial economic and trade relationships between the United States and Canada. The pair’s liquidity makes it an attractive option for traders, providing tight bid-ask spreads and ample trading opportunities. The high trading volume ensures that there are always buyers and sellers, making it easier to enter and exit positions without significant price slippage.

Moreover, the USD/CAD pair acts as a barometer for the economic health of both nations. Movements in the exchange rate can reflect changes in economic policies, market sentiment, and global economic conditions. For instance, shifts in commodity prices, especially oil, can have a direct impact on the Canadian dollar, while U.S. economic data can influence the U.S. dollar. This interplay makes the USD/CAD pair a focal point for traders and investors seeking to understand and capitalize on economic trends.

Key Factors Influencing the USD/CAD

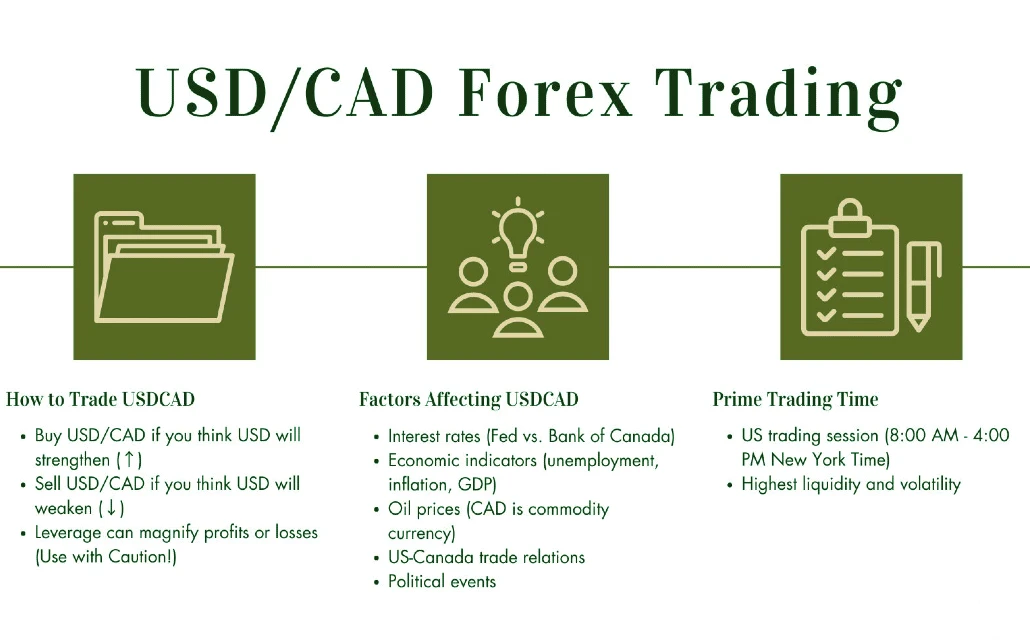

Interest Rate Differentials

One of the primary factors influencing the USD/CAD exchange rate is the interest rate differential between the Federal Reserve (Fed) and the Bank of Canada (BoC). When the Fed raises interest rates, the U.S. dollar typically strengthens against other currencies, including the CAD. Conversely, when the BoC raises rates, the CAD strengthens. Traders closely monitor these rates as they provide insights into future currency movements. Changes in interest rates can affect investor sentiment, capital flows, and ultimately, the exchange rate.

Interest rate differentials not only affect the USD/CAD pair directly but also influence the broader economic landscape. Higher interest rates in the U.S. can attract foreign capital, leading to an appreciation of the USD. Conversely, higher rates in Canada can bolster the CAD by attracting investment into Canadian assets. Understanding these dynamics is crucial for traders, as they can help predict potential movements in the currency pair and develop effective trading strategies.

Commodity Prices and Their Impact

Canada’s economy is heavily reliant on natural resources, particularly crude oil. As a result, the price of oil significantly impacts the CAD. Higher oil prices generally strengthen the CAD, while lower prices weaken it. This relationship is crucial for traders to understand, as it can provide predictive power over the USD/CAD exchange rate. For example, a surge in oil prices can lead to a stronger CAD, while a drop in oil prices can have the opposite effect.

The correlation between commodity prices and the CAD means that traders must stay informed about global commodity markets. Events such as geopolitical tensions, changes in production levels, and shifts in demand can all influence oil prices and, by extension, the USD/CAD pair. By monitoring these factors, traders can make more informed decisions and anticipate potential market movements. Additionally, understanding the broader economic implications of commodity price changes can help traders develop comprehensive trading strategies that account for multiple variables.

Historical Context of the USD/CAD

Parity and Economic Conditions

The USD/CAD has reached parity (1:1 exchange rate) at various points in history. Notably, after the Great Recession and the subsequent quantitative easing by the U.S. Federal Reserve, the CAD strengthened to trade below parity, at around 0.95 USD per CAD. These periods of parity are often associated with U.S. economic difficulties or high oil prices, sometimes both. Parity indicates a significant shift in the relative strength of the two currencies and can have wide-ranging economic implications.

Historical parity points provide valuable insights into the economic conditions that influence the USD/CAD pair. For instance, during periods of economic instability in the U.S., the CAD may strengthen as investors seek safer or higher-yielding assets. Conversely, strong economic performance in the U.S. can lead to a stronger USD. By studying these historical trends, traders can gain a deeper understanding of the factors that drive currency movements and apply this knowledge to their trading strategies.

Recent Trends and Developments

In recent years, the USD/CAD pair has experienced significant fluctuations. For instance, in 2016, oil prices slumped to decade-lows, trading below $30 a barrel. This caused the CAD to weaken substantially, trading at 1.46 CAD per USD. As of February 2024, the exchange rate hovers around 1.35, reflecting ongoing economic adjustments and market conditions. These fluctuations highlight the importance of staying informed about global economic trends and their impact on currency pairs.

Recent trends in the USD/CAD pair also underscore the need for traders to remain adaptable and responsive to market changes. Economic events such as changes in trade policies, shifts in commodity prices, and geopolitical developments can all influence the exchange rate. By staying informed and adjusting their trading strategies accordingly, traders can better navigate the complexities of the forex market and capitalize on emerging opportunities.

Trading Strategies for USD/CAD

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, interest rate changes, and geopolitical events to predict currency movements. For the USD/CAD pair, traders should focus on economic data releases from both the U.S. and Canada, such as GDP growth, employment figures, and trade balances. Understanding these fundamentals helps traders make informed decisions about potential market movements. By analyzing economic data, traders can gain insights into the health of the two economies and anticipate potential changes in the exchange rate.

In addition to economic data, traders should also consider geopolitical events that can influence the USD/CAD pair. For example, changes in trade policies, political stability, and international relations can all impact investor sentiment and currency values. By staying informed about these factors, traders can develop a comprehensive understanding of the market and make more informed trading decisions.

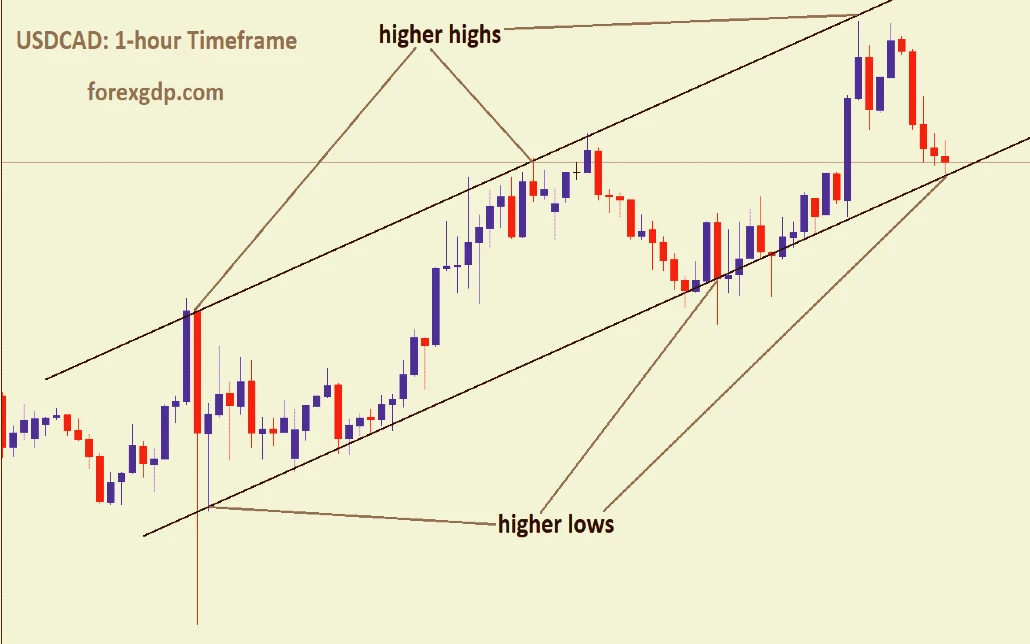

Technical Analysis

Technical analysis involves analyzing price charts and using various indicators to forecast future price movements. Commonly used technical tools for trading the USD/CAD pair include moving averages, relative strength index (RSI), and Bollinger Bands. These tools help traders identify trends, support and resistance levels, and potential entry and exit points. By studying price patterns and indicators, traders can develop strategies to capitalize on short-term market movements.

Technical analysis also involves the use of chart patterns, such as head and shoulders, double tops and bottoms, and trendlines. These patterns can provide valuable insights into potential market reversals and continuation patterns. By combining technical indicators with chart patterns, traders can enhance their ability to predict future price movements and develop more effective trading strategies.

Carry Trade Strategy

The carry trade strategy involves borrowing funds in a currency with a low-interest rate and investing in a currency with a higher interest rate. For the USD/CAD pair, this strategy can be employed depending on the interest rate differentials between the U.S. and Canada. Traders can profit from the interest rate differential while also taking advantage of potential currency appreciation. This strategy is particularly effective in stable economic environments where interest rate differentials are significant.

However, the carry trade strategy also carries risks, particularly in volatile markets. Changes in interest rates, economic conditions, and geopolitical events can all impact the effectiveness of this strategy. To mitigate these risks, traders should conduct thorough research and stay informed about market developments. Additionally, employing risk management techniques, such as setting stop-loss levels, can help protect against potential losses.

Analyzing Market Trends and Data

Economic Indicators to Watch

Several economic indicators play a crucial role in determining the USD/CAD exchange rate. These include:

- Gross Domestic Product (GDP): Measures the economic performance of a country. Higher GDP growth in Canada or the U.S. can strengthen their respective currencies. For example, strong GDP growth in the U.S. can lead to a stronger USD, while robust growth in Canada can bolster the CAD.

- Employment Data: Employment reports, such as the U.S. Non-Farm Payrolls and Canadian Employment Change, provide insights into the labor market’s health and can influence currency values. High employment levels typically indicate a strong economy, which can strengthen the currency.

- Trade Balance: The difference between a country’s exports and imports. A positive trade balance typically strengthens the currency, while a negative balance can weaken it. For example, a trade surplus in Canada can lead to a stronger CAD, while a trade deficit can weaken it.

Impact of Geopolitical Events

Geopolitical events can significantly impact the USD/CAD exchange rate. For example, trade tensions between the U.S. and other countries can affect investor sentiment and currency values. Additionally, political stability in Canada and the U.S. influences market confidence and currency movements. For instance, political uncertainty in the U.S. can lead to a weaker USD, while stability in Canada can strengthen the CAD.

Traders must stay informed about geopolitical developments to anticipate potential market shifts. Events such as elections, trade negotiations, and international conflicts can all influence currency values. By understanding the potential impact of these events, traders can make more informed decisions and develop strategies to capitalize on market opportunities.

Risk Management in USD/CAD Trading

Setting Stop-Loss and Take-Profit Levels

Effective risk management is crucial for successful forex trading. Setting stop-loss and take-profit levels helps traders limit potential losses and secure profits. For the USD/CAD pair, these levels should be determined based on technical analysis and market conditions. Stop-loss orders help protect against adverse price movements, while take-profit orders enable traders to lock in gains when the market reaches a predetermined level.

Traders should regularly review and adjust their stop-loss and take-profit levels based on changing market conditions. For example, if the market becomes more volatile, traders may need to adjust their stop-loss levels to account for larger price fluctuations. By maintaining a flexible approach to risk management, traders can better navigate the complexities of the forex market and protect their investments.

Diversification and Portfolio Management

Diversifying a trading portfolio can reduce risk. Traders should consider trading other currency pairs and financial instruments to spread risk. For example, diversifying into other major currency pairs, such as EUR/USD or GBP/USD, can help balance risk and return. Additionally, investing in different asset classes, such as stocks or commodities, can further enhance portfolio diversification.

Proper portfolio management involves regularly reviewing and adjusting trading strategies based on market performance and changing economic conditions. Traders should assess their portfolio’s risk exposure and make adjustments as needed to align with their investment goals. By maintaining a diversified portfolio and employing effective risk management techniques, traders can better navigate market uncertainties and achieve their financial objectives.

Tools and Resources for Trading USD/CAD

Forex Trading Platforms

Several forex trading platforms offer tools and resources for trading the USD/CAD pair. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView. These platforms provide advanced charting tools, technical indicators, and real-time market data to aid in trading decisions. MT4 and MT5 are widely used for their user-friendly interfaces and comprehensive analytical capabilities, while TradingView offers robust charting features and social trading tools.

Traders should select a trading platform that aligns with their trading style and preferences. For example, those who prefer automated trading may benefit from platforms that support expert advisors (EAs), while those who focus on technical analysis may prefer platforms with advanced charting tools. By choosing the right platform, traders can enhance their trading experience and improve their ability to make informed decisions.

Educational Resources and Communities

There are numerous educational resources available for traders looking to enhance their knowledge of the USD/CAD pair. Online courses, webinars, and trading forums provide valuable insights and strategies. For instance, online courses can offer in-depth instruction on fundamental and technical analysis, while webinars provide opportunities to learn from industry experts. Trading forums and communities also allow traders to share experiences and discuss market trends.

Additionally, traders should consider participating in trading seminars and workshops to further their education. These events can provide hands-on training and networking opportunities, helping traders build valuable skills and connections. By leveraging educational resources and engaging with trading communities, traders can stay informed about market developments and improve their trading strategies.

Future Outlook for USD/CAD

Economic Projections and Forecasts

Economic projections and forecasts play a vital role in predicting the future movement of the USD/CAD pair. Analysts and economists use various models to estimate GDP growth, inflation rates, and other economic indicators for both the U.S. and Canada. These projections help traders anticipate potential market shifts and adjust their strategies accordingly. For example, forecasts of strong economic growth in the U.S. may indicate a potential appreciation of the USD.

Traders should regularly review economic reports and forecasts to stay updated on potential changes in market conditions. By understanding the factors that influence economic projections, traders can make more informed decisions and develop strategies that align with anticipated market trends. Additionally, keeping an eye on central bank announcements and policy changes can provide valuable insights into future currency movements.

Technological Advances in Forex Trading

Technological advancements are continuously shaping the forex trading landscape. Automated trading systems, artificial intelligence (AI), and machine learning are becoming increasingly popular among traders. These technologies can analyze vast amounts of data, identify patterns, and execute trades with minimal human intervention. For example, AI-powered trading algorithms can provide insights into market trends and automate trading decisions, offering a competitive edge in the forex market.

Traders should stay informed about technological developments and consider incorporating advanced tools into their trading strategies. By leveraging technology, traders can enhance their ability to analyze market data, execute trades efficiently, and manage risk. Additionally, staying updated on emerging technologies can help traders maintain a competitive edge and adapt to evolving market conditions.

Summary of Key Points

| Factor | Description |

|---|---|

| Interest Rate Differentials | Differences in interest rates set by the Federal Reserve and the Bank of Canada influence the strength of the USD and CAD. |

| Commodity Prices | The Canadian economy’s reliance on natural resources, particularly oil, means that commodity prices significantly impact the CAD. |

| Economic Indicators | Key economic indicators, such as GDP growth, employment data, and trade balances, provide insights into the health of the U.S. and Canadian economies. |

| Geopolitical Events | Political stability and international trade relations affect investor sentiment and currency values. |

| Historical Parity | The USD/CAD pair has reached parity at various points, often during U.S. economic difficulties or high oil prices. |

| Trading Strategies | Fundamental and technical analysis, as well as carry trade strategies, are commonly used to trade the USD/CAD pair. |

| Risk Management | Effective risk management involves setting stop-loss and take-profit levels, diversifying portfolios, and regularly reviewing trading strategies. |

| Technological Advances | Automated trading systems and AI are transforming forex trading, providing traders with advanced tools for data analysis and trade execution. |

| Future Outlook | Economic projections and technological advancements will continue to shape the future of the USD/CAD currency pair in the forex market. |

FAQs

The USD/CAD currency pair represents the exchange rate between the U.S. dollar (USD) and the Canadian dollar (CAD). It shows how many Canadian dollars are needed to purchase one U.S. dollar. For instance, if the USD/CAD exchange rate is 1.35, it means that 1 U.S. dollar is equivalent to 1.35 Canadian dollars.

The USD/CAD pair is often referred to as trading the “loonie” due to the Canadian one-dollar coin, which features a common loon on its reverse side. This nickname reflects the cultural and economic significance of the Canadian dollar.

Several factors influence the USD/CAD exchange rate, including:

Interest Rate Differentials: Differences between the interest rates set by the Federal Reserve (Fed) and the Bank of Canada (BoC).

Commodity Prices: The Canadian dollar is often correlated with oil prices due to Canada’s heavy reliance on oil exports.

Economic Indicators: Data such as GDP growth, employment figures, and trade balances impact currency values.

Geopolitical Events: Political stability and international relations can affect investor sentiment and currency values.

Interest rate policies set by the Fed and the BoC have a significant impact on the USD/CAD exchange rate. When the Fed raises interest rates, the U.S. dollar generally strengthens because higher rates attract foreign capital. Conversely, if the BoC raises rates, the Canadian dollar tends to strengthen. Traders monitor these rates to predict potential currency movements.

The Canadian dollar is often termed a “commodity currency” because Canada’s economy is heavily reliant on oil exports. When oil prices rise, the Canadian dollar usually strengthens as the economy benefits from increased revenue. Conversely, falling oil prices can weaken the CAD as the economic outlook becomes less favorable.

Traders use various methods to analyze the USD/CAD pair:

Fundamental Analysis: Evaluates economic indicators, interest rate changes, and geopolitical events to predict currency movements.

Technical Analysis: Uses price charts, technical indicators (e.g., moving averages, RSI), and chart patterns to forecast future price movements.

Carry Trade Strategy: Involves borrowing in a currency with a low interest rate and investing in one with a higher rate, depending on interest rate differentials.

Risks include:

Market Volatility: Prices can fluctuate significantly due to economic events and geopolitical developments.

Interest Rate Changes: Unexpected changes in interest rates can impact currency values and trading positions.

Commodity Price Shocks: Since the CAD is sensitive to oil prices, significant changes in oil prices can affect the exchange rate.

Geopolitical Risks: Political instability and international tensions can lead to sudden currency movements.

Effective risk management involves:

Setting Stop-Loss and Take-Profit Levels: Helps limit potential losses and secure profits.

Diversification: Trading other currency pairs or financial instruments to spread risk.

Regular Review: Continuously reviewing and adjusting trading strategies based on market conditions.

Using Technology: Employing automated trading systems and advanced tools to manage trades and analyze market data.

Useful tools and resources include:

Forex Trading Platforms: Platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView offer advanced charting tools and real-time data.

Educational Resources: Online courses, webinars, and trading forums provide valuable insights and strategies.

Economic Calendars: Track important economic data releases and events that could impact the USD/CAD exchange rate.

Traders can stay updated by:

Monitoring Economic News: Following economic data releases and central bank announcements from both the U.S. and Canada.

Reading Market Analysis: Consulting analysis reports and forecasts from financial institutions and experts.

Engaging with Trading Communities: Participating in forums and discussions with other traders to share insights and strategies.

Utilizing Technology: Using trading platforms and apps that provide real-time market updates and news.

Conclusion

Trading the USD/CAD currency pair offers a wealth of opportunities for forex traders. Understanding the fundamental and technical factors that influence this pair is crucial for making informed trading decisions. By leveraging effective risk management strategies, staying informed about economic indicators, and utilizing advanced trading tools, traders can navigate the complexities of the forex market and capitalize on the potential of the USD/CAD pair.

As the forex market continues to evolve, staying updated on economic projections and technological advancements will be essential for maintaining a competitive edge. Whether you are a novice trader or an experienced investor, the USD/CAD currency pair provides a dynamic and rewarding trading environment.

By mastering the concepts outlined in this guide and continuously honing your trading skills, you can enhance your ability to profit from the USD/CAD currency pair and achieve your financial goals in the forex market. With careful analysis, strategic planning, and effective risk management, you can successfully navigate the complexities of trading the USD/CAD pair and capitalize on its potential.

Leave a Reply

Want to join the discussion?Feel free to contribute!