How to Use Stop-Loss Orders Effectively

Investing in the stock market is often compared to navigating a stormy sea. Just as a sailor relies on navigational tools to avoid dangerous waters, investors use various strategies to manage their risk and protect their investments. One such crucial tool is the stop-loss order. While it may seem like a simple concept, understanding and implementing stop-loss orders effectively can make a significant difference in your investment outcomes. In this comprehensive guide, we’ll delve deep into stop-loss orders, exploring their advantages, potential pitfalls, and best practices for using them to safeguard your investments.

Contents

What is a Stop-Loss Order?

Definition and Purpose

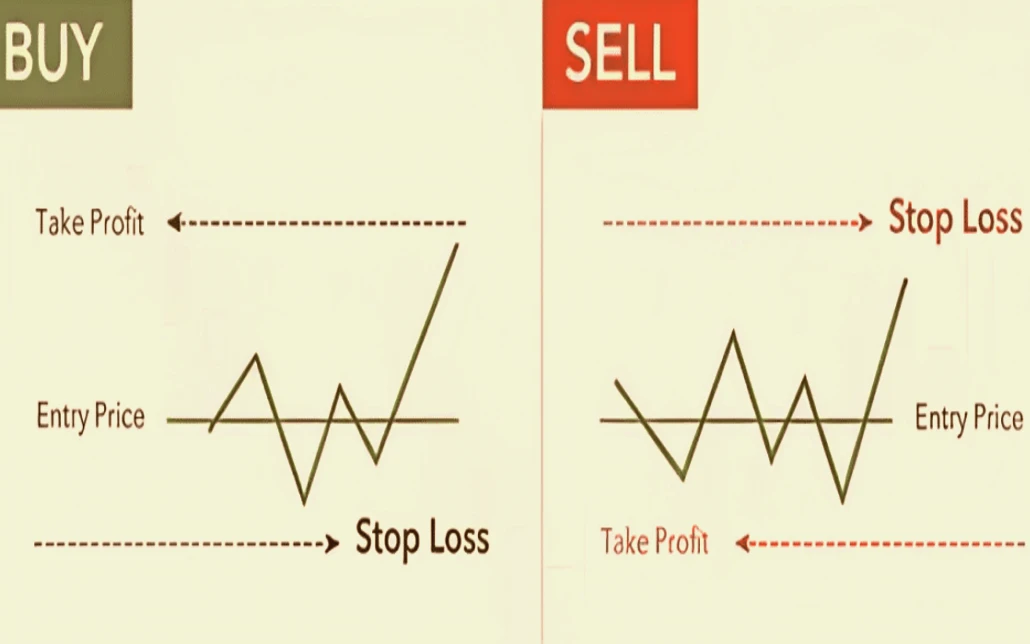

A stop-loss order is a directive given to a broker to sell a security when it reaches a specified price, known as the stop price. This price is set below the current market price for a sell stop-loss order and above the market price for a buy stop-loss order. The primary purpose of a stop-loss order is to limit potential losses on a position by automatically selling the security if its price declines to the stop price.

Imagine you’ve bought shares of a tech company at $100 each. You’re concerned about potential downturns, so you set a stop-loss order at $90. If the stock price drops to $90, your stop-loss order will trigger, selling your shares at the best available price. This ensures that your loss is capped at $10 per share, providing a safety net in a volatile market.

How Stop-Loss Orders Work

When the market price of the security reaches or falls below the stop price, the stop-loss order becomes a market order. This means that the order will be executed at the next available price, which might be slightly different from the stop price due to market fluctuations. This process is crucial in minimizing losses and avoiding emotional decision-making, especially in fast-moving markets.

For example, if the stock price drops suddenly to $89, the stop-loss order will trigger and sell your shares at or around that price. The execution price may not be exactly $90, but the order helps prevent further losses by automatically closing your position.

Types of Stop-Loss Orders

There are various types of stop-loss orders, each serving different needs and market conditions:

- Standard Stop-Loss Order: This converts into a market order once the stop price is reached.

- Stop-Limit Order: Becomes a limit order after the stop price is triggered, which may not be executed if the limit price is not reached.

- Trailing Stop-Loss Order: Adjusts with the market price and locks in profits as the price rises.

Understanding these types helps you choose the right stop-loss strategy for your trading style and investment goals.

Advantages of Using Stop-Loss Orders

Protection from Significant Losses

One of the most significant advantages of stop-loss orders is their ability to limit potential losses. By setting a predetermined exit point, you ensure that your losses are contained within acceptable limits. This is particularly valuable in volatile markets where prices can swing dramatically within short periods.

For instance, suppose you invest in a biotech stock that’s prone to sudden price swings. Setting a stop-loss order helps you avoid catastrophic losses if the stock price plummets unexpectedly, thereby preserving your capital.

Reduction of Emotional Trading

Stop-loss orders can help mitigate emotional trading decisions. Investing can be an emotional rollercoaster, especially when faced with declining stock prices. A stop-loss order takes the emotion out of the equation by enforcing a pre-determined exit strategy, ensuring that you stick to your investment plan even during turbulent times.

Think of it this way: You’ve set a stop-loss at 15% below your purchase price. Even if the stock starts falling, you’re not making decisions based on fear or hope. Your stop-loss order is your safety net, preventing you from holding onto a losing position out of attachment or denial.

Convenience and Automation

Another advantage is the convenience of automation. Once a stop-loss order is set, it operates automatically without the need for constant monitoring. This is particularly beneficial for busy investors who may not have the time to track their investments closely.

Imagine you’re on vacation or dealing with a personal matter. You don’t need to worry about watching your portfolio daily; your stop-loss order will activate if needed, allowing you to focus on other aspects of your life.

Disadvantages of Stop-Loss Orders

Risk of Triggering from Short-Term Fluctuations

One notable disadvantage of stop-loss orders is the risk of being triggered by short-term price fluctuations. Stocks can experience temporary dips due to market noise or minor news events, which might trigger your stop-loss order unnecessarily. This can lead to selling your position at a loss when the stock might recover shortly after.

Consider a scenario where a stock drops briefly to hit your stop-loss price but then rebounds quickly. You could end up selling at a low price and missing out on potential gains. It’s essential to strike a balance when setting your stop-loss level to avoid premature exits.

Slippage and Execution Price Variability

Another drawback is slippage, where the execution price of the stop-loss order differs from the stop price. In fast-moving or illiquid markets, the price at which your order is executed may be lower than expected. This can result in larger losses than initially planned.

Imagine a stock you hold drops rapidly due to unexpected news. Your stop-loss order might be executed at a price significantly lower than your stop price, impacting your overall returns.

Incompatibility with Certain Securities

Some securities, such as penny stocks or those traded over-the-counter (OTC), may not be suitable for stop-loss orders. These stocks often have lower liquidity and higher volatility, making it challenging to execute stop-loss orders effectively.

If you’re trading low-volume stocks, your stop-loss order might not be executed at your desired price, potentially leading to more significant losses. It’s crucial to understand the liquidity and trading characteristics of the securities in your portfolio.

How to Set a Stop-Loss Order

Determining Your Risk Tolerance

The first step in setting a stop-loss order is to determine your risk tolerance. This involves deciding how much loss you’re willing to accept on a trade before exiting the position. Your risk tolerance should align with your overall investment strategy and financial goals.

For example, if you’re a conservative investor, you might set a tighter stop-loss to minimize potential losses. On the other hand, a more aggressive investor might opt for a wider stop-loss to accommodate larger price fluctuations.

Using Technical Analysis

Technical analysis can play a significant role in setting stop-loss levels. Analyzing charts and historical price data helps identify key support and resistance levels, which can inform your stop-loss placement. For instance, placing a stop-loss just below a significant support level can help protect against breakdowns while allowing some room for price fluctuations.

A technical trader might look at historical price charts to determine where the stock has previously found support. Setting a stop-loss slightly below this level provides a buffer while still protecting against potential losses.

Considering Market Conditions

Market conditions can influence how you set your stop-loss orders. In highly volatile markets, it might be wise to set a wider stop-loss to avoid being triggered by normal price swings. Conversely, in stable markets, a tighter stop-loss might be more appropriate to protect gains.

Consider the current market environment and adjust your stop-loss strategy accordingly. For example, during periods of high volatility, you might set a stop-loss at a wider distance to accommodate larger price fluctuations.

Common Stop-Loss Strategies

Percentage-Based Stop-Loss

A percentage-based stop-loss involves setting the stop price a specific percentage below the purchase price. This method is straightforward and allows you to manage risk based on a predefined loss percentage. For instance, setting a 10% stop-loss on a stock purchased at $50 means your stop price will be $45.

This strategy is easy to implement and understand but might not account for individual stock volatility. It’s important to choose a percentage that aligns with the stock’s historical price movements and your risk tolerance.

Support and Resistance Levels

Placing stop-loss orders based on support and resistance levels involves setting the stop price just below a support level or just above a resistance level. This method uses technical analysis to determine where the stock price might reverse, providing a strategic exit point.

For example, if a stock has consistently bounced off a support level, placing a stop-loss slightly below this level helps protect against a potential breakdown. Similarly, setting a stop-loss above a resistance level can be effective if the stock is facing strong selling pressure.

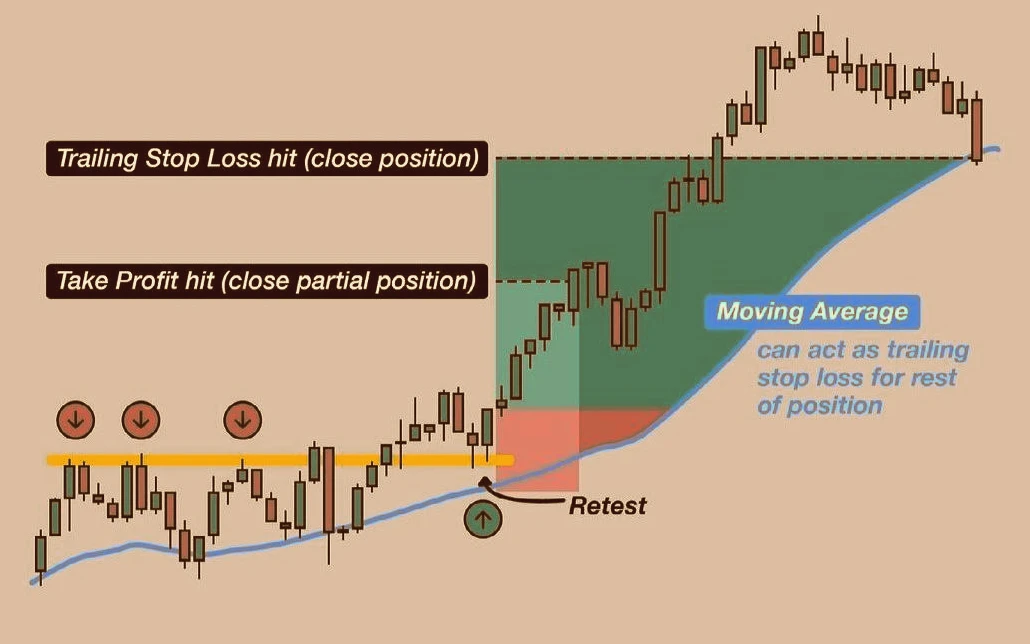

Trailing Stop-Loss

A trailing stop-loss adjusts with the stock’s price movement, locking in profits as the price rises and protecting gains. This method is particularly useful for capturing profits in a rising market while providing downside protection.

If you buy a stock at $100 and set a trailing stop-loss at 10%, the stop price will trail the stock price as it increases. If the stock rises to $120, the stop price adjusts to $108. If the stock then falls to $108, the stop-loss order is triggered, locking in your gains.

Example Scenarios

Scenario 1: Using a Percentage-Based Stop-Loss

Imagine you buy shares of a company at $200 each. You set a stop-loss order at 15% below the purchase price, which is $170. If the stock price drops to $170, your stop-loss order triggers and sells the shares at the best available price. This strategy helps limit your losses to 15% in case of a downturn.

Scenario 2: Setting a Stop-Loss Based on Support Levels

Suppose a stock has consistently found support at $80. You purchase the stock at $85 and set a stop-loss order at $78, just below the support level. If the stock price falls below $78, the stop-loss order activates, selling your shares to protect against a potential breakdown below the support level.

Scenario 3: Implementing a Trailing Stop-Loss

You buy a stock at $50 and set a trailing stop-loss at 10%. As the stock price rises to $60, the trailing stop price adjusts to $54. If the stock then falls to $54, your stop-loss order triggers, selling your shares and locking in profits while still providing downside protection.

Best Practices for Using Stop-Loss Orders

Regular Review and Adjustment

Regularly reviewing and adjusting your stop-loss orders is essential to ensure they remain aligned with your investment strategy and market conditions. As the stock price fluctuates, you may need to modify your stop-loss levels to reflect new support and resistance levels or changes in your risk tolerance.

For example, if you’ve set a stop-loss at a fixed percentage and the stock’s volatility increases, you might need to widen your stop-loss to accommodate larger price swings. Conversely, if the stock price stabilizes, a tighter stop-loss might be appropriate to protect gains.

Avoiding Overuse

While stop-loss orders are valuable, overusing them can lead to frequent triggering and potential losses. It’s important to strike a balance between protecting your capital and allowing for normal price fluctuations. Using stop-loss orders judiciously helps avoid unnecessary sales and maintains your investment strategy’s effectiveness.

Consider the stock’s volatility and trading volume when setting stop-loss orders. Overly tight stop-loss levels might result in premature exits, while excessively wide levels could expose you to larger losses. Finding the right balance is key to effective risk management.

Monitoring Market Trends

Keeping an eye on market trends and economic indicators can provide valuable context for setting and adjusting stop-loss orders. Changes in market conditions, economic reports, or company news can impact stock prices and influence your stop-loss strategy.

For example, if you’re investing in a sector experiencing significant changes, such as new regulations or technological advancements, it might affect stock volatility and necessitate adjustments to your stop-loss levels. Staying informed helps you make more informed decisions and adapt your strategy as needed.

FAQs

A stop-loss order is a trade order placed with a broker to sell a security when it reaches a specified price. It’s designed to limit an investor’s potential loss on a position. For example, if you buy a stock at $50 and set a stop-loss order at $45, the stock will automatically be sold if its price falls to $45, limiting your loss to $5 per share.

When you place a stop-loss order, you set a price at which you want to sell your stock to prevent further losses. Once the stock’s price hits this stop price, the stop-loss order converts into a market order, triggering a sale of the stock at the best available price. This process helps manage risk by automatically executing a sale if the price falls below your set threshold.

A stop-loss order becomes a market order once the stop price is reached, meaning the stock is sold at the best available price. A stop-limit order, however, becomes a limit order when the stop price is reached, which means the stock will only be sold at a specified price or better. This can result in the order not being executed if the market price falls below the limit price.

Determining the stop-loss price depends on your risk tolerance and the stock’s volatility. Common methods include setting a percentage-based stop-loss (e.g., 10% below the purchase price), placing it just below significant support levels, or using a moving average. Assess the stock’s historical price fluctuations and your investment goals to find an appropriate level.

Yes, stop-loss orders can also be used to lock in profits through a “trailing stop.” A trailing stop moves with the stock price, allowing you to set a stop-loss percentage below the highest price reached. For example, if a stock rises to $100 and you set a trailing stop at 10%, your stop price will adjust to $90. If the stock then falls to $90, the trailing stop order triggers, helping you secure profits while providing downside protection.

Stop-loss orders can sometimes lead to unwanted sales due to short-term price fluctuations. If the stock price dips briefly but recovers, your stop-loss order might trigger a sale at a lower price than you anticipated. Additionally, in fast-moving markets, the execution price may differ from the stop price due to slippage. It’s important to balance the stop-loss level with the stock’s volatility and market conditions to mitigate these risks.

Effective stop-loss strategies include setting a stop-loss based on a percentage of the purchase price, placing it just below key technical levels like support, or using a trailing stop to lock in gains. Regularly review and adjust your stop-loss levels based on market conditions and the stock’s performance. Avoid setting stop-loss orders too close to the current price to prevent premature triggering due to normal price volatility.

Adjusting your stop-loss orders should be done periodically or when significant changes occur in market conditions or stock performance. Regularly review your stop-loss levels to ensure they align with your current risk tolerance and investment strategy. Major news events, earnings reports, or changes in market trends may also necessitate adjustments to your stop-loss orders to reflect new information or updated risk assessments.

Stop-loss orders are commonly used for stocks, but their application can vary for other types of investments. For example, they can be used with ETFs and mutual funds, but they might not be suitable for certain securities like penny stocks or over-the-counter (OTC) stocks due to lower liquidity. Always check with your broker to understand the specific rules and limitations for stop-loss orders on different types of investments.

Conclusion

Stop-loss orders are a powerful tool for managing investment risk and protecting your portfolio. By understanding the different types of stop-loss orders, their advantages and disadvantages, and best practices for implementation, you can effectively safeguard your investments and navigate the market with greater confidence.

Remember, investing is not just about avoiding losses but also about making informed decisions based on your risk tolerance, market conditions, and investment goals. Stop-loss orders are just one part of a comprehensive risk management strategy. Regularly reviewing and adjusting your approach, staying informed about market trends, and avoiding overuse are key to leveraging stop-loss orders effectively.

In the end, investing is a journey with its ups and downs. Stop-loss orders can serve as your safety net, helping you stay on course and manage risks along the way. Whether you’re a seasoned investor or just starting, incorporating stop-loss orders into your strategy can enhance your ability to protect your investments and achieve your financial goals.

Leave a Reply

Want to join the discussion?Feel free to contribute!